A comfort letter provides assurance from a third party, often a parent company or auditor, confirming financial stability or commitments without legally binding obligations. This document supports Your confidence in a business transaction or financial arrangement by clarifying the extent of support or guarantees. Explore the rest of the article to understand the key elements and practical uses of comfort letters.

Table of Comparison

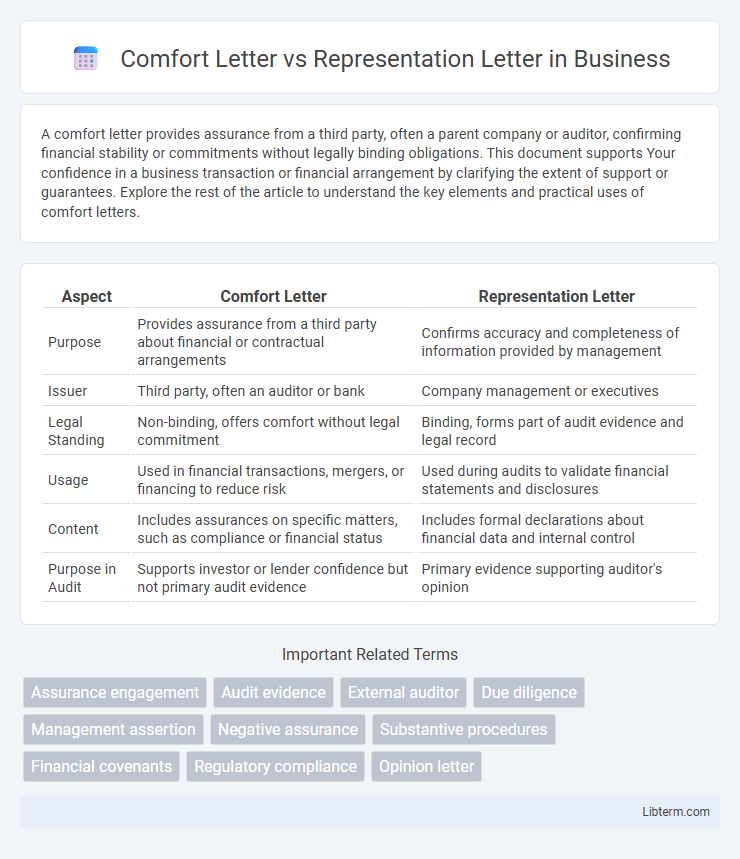

| Aspect | Comfort Letter | Representation Letter |

|---|---|---|

| Purpose | Provides assurance from a third party about financial or contractual arrangements | Confirms accuracy and completeness of information provided by management |

| Issuer | Third party, often an auditor or bank | Company management or executives |

| Legal Standing | Non-binding, offers comfort without legal commitment | Binding, forms part of audit evidence and legal record |

| Usage | Used in financial transactions, mergers, or financing to reduce risk | Used during audits to validate financial statements and disclosures |

| Content | Includes assurances on specific matters, such as compliance or financial status | Includes formal declarations about financial data and internal control |

| Purpose in Audit | Supports investor or lender confidence but not primary audit evidence | Primary evidence supporting auditor's opinion |

Introduction to Comfort Letters and Representation Letters

Comfort letters provide third parties with assurance from an auditor or a financial institution regarding financial information, often used in securities offerings to confirm data reliability without offering a formal opinion. Representation letters are formal written statements from a company's management confirming the accuracy and completeness of financial statements and disclosures, typically required by auditors during the audit process. Both letters serve distinct purposes in financial reporting and auditing, with comfort letters focusing on external assurance and representation letters on internal management assertions.

Key Definitions: Comfort Letter vs Representation Letter

A Comfort Letter is a document issued by an auditor or accountant to provide assurance about financial information, often used during mergers and acquisitions without offering an audit opinion. A Representation Letter is a formal written statement from management to auditors, confirming the accuracy and completeness of financial records and disclosures during an audit. The key distinction lies in the Comfort Letter being an external assurance tool, while the Representation Letter serves as internal confirmation supporting the audit process.

Purpose and Importance in Financial Reporting

A Comfort Letter provides assurance from auditors or third parties about specific financial information, helping underwriters and investors verify data accuracy during securities offerings. A Representation Letter is a formal statement from management confirming the completeness and truthfulness of financial statements, ensuring accountability and transparency in financial reporting. Both letters play crucial roles in enhancing trust and reliability in financial disclosures.

Main Differences Between Comfort and Representation Letters

Comfort letters provide assurances from auditors or third parties regarding financial statements or other data without offering formal opinions, primarily used in transactions like mergers or securities offerings. Representation letters are formal written statements from a company's management affirming the accuracy and completeness of information provided to auditors during an audit. The main difference lies in their purpose and authority: comfort letters offer limited, non-binding assurances to external parties, while representation letters are binding declarations made by management to auditors to support the audit process.

Who Issues Comfort Letters and Representation Letters?

Comfort letters are typically issued by auditors, underwriters, or legal counsel to provide assurance to third parties during securities offerings or financial transactions. Representation letters are usually issued by management to auditors, confirming the accuracy and completeness of financial statements and other relevant information. Both documents serve distinct purposes in the audit and financial reporting processes, with comfort letters aimed at external stakeholders and representation letters directed internally toward auditors.

Legal Implications and Responsibilities

A Comfort Letter provides limited assurance from an auditor or third party regarding financial information, often used in securities offerings, and generally avoids legal liability by disclosing its scope and limitations. A Representation Letter, issued by company management to auditors, contains explicit assertions about financial statements and internal controls, creating a legal obligation for accuracy and completeness under audit standards. The legal implications of a Representation Letter are more direct, as false or misleading representations can lead to liability for fraud or misstatement, while Comfort Letters typically mitigate risk through disclaimers.

Common Scenarios and Use Cases

Comfort letters are typically issued by auditors to underwriters in securities offerings, providing assurance about financial information without binding responsibility, commonly used in IPOs and bond issuances. Representation letters are signed by management to auditors, confirming the accuracy and completeness of financial statements during audits or reviews, crucial in financial reporting and regulatory compliance. Both documents serve distinct roles in the financial disclosure process, with comfort letters ensuring third-party assurance and representation letters securing internal accountability.

Impact on Auditing and Assurance Processes

Comfort letters provide auditors with limited assurance regarding financial information, often issued by third parties during underwriting processes, thereby influencing the scope of audit procedures by reducing the need for additional verification. Representation letters, issued by management to auditors, affirm the accuracy and completeness of financial statements, directly impacting auditors' risk assessment and reliance on internal controls. The distinction between these letters critically shapes the depth of audit evidence gathered and the level of assurance that can be reasonably obtained in assurance engagements.

Regulatory Requirements and Standards

Comfort letters primarily address regulatory requirements by providing assurance on financial information for securities offerings under standards such as the SEC's Regulation S-K and S-X, focusing on compliance with reporting obligations. Representation letters, governed by auditing standards like PCAOB AS 2105 or ISA 580, serve as formal written statements from management confirming the accuracy and completeness of information used during an audit. Both letters ensure adherence to regulatory frameworks but differ in purpose: comfort letters support investor confidence in financial disclosures, while representation letters underpin auditor reliance on management's assertions.

Choosing the Right Letter for Your Needs

Choosing the right letter between a Comfort Letter and a Representation Letter depends on the level of assurance required and the context of the transaction. A Comfort Letter provides limited assurance from an auditor or third party, often used in financing or investment scenarios to confirm certain facts without full audit opinion. In contrast, a Representation Letter is a formal declaration from management to auditors, confirming the accuracy of financial statements, making it essential for internal audit processes and regulatory compliance.

Comfort Letter Infographic

libterm.com

libterm.com