Business-to-investor communication requires clear, concise, and persuasive messaging that highlights the company's value proposition and growth potential. Emphasizing financial performance, market opportunity, and competitive advantages can attract and retain investor interest. Explore the full article to discover strategies that will help you effectively engage with your investors.

Table of Comparison

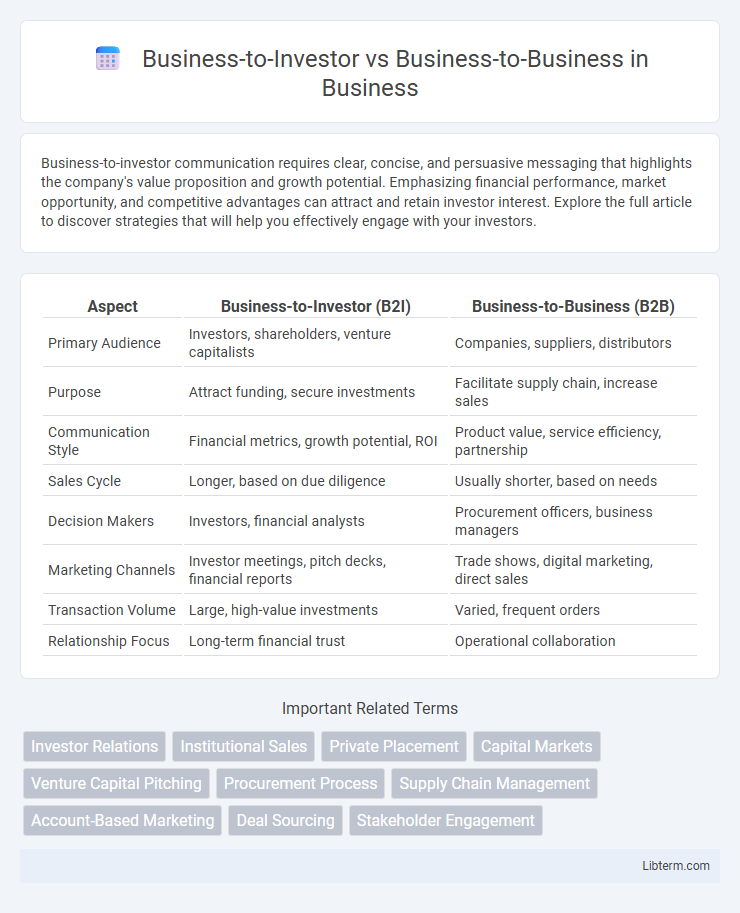

| Aspect | Business-to-Investor (B2I) | Business-to-Business (B2B) |

|---|---|---|

| Primary Audience | Investors, shareholders, venture capitalists | Companies, suppliers, distributors |

| Purpose | Attract funding, secure investments | Facilitate supply chain, increase sales |

| Communication Style | Financial metrics, growth potential, ROI | Product value, service efficiency, partnership |

| Sales Cycle | Longer, based on due diligence | Usually shorter, based on needs |

| Decision Makers | Investors, financial analysts | Procurement officers, business managers |

| Marketing Channels | Investor meetings, pitch decks, financial reports | Trade shows, digital marketing, direct sales |

| Transaction Volume | Large, high-value investments | Varied, frequent orders |

| Relationship Focus | Long-term financial trust | Operational collaboration |

Understanding Business-to-Investor (B2I) and Business-to-Business (B2B)

Business-to-Investor (B2I) focuses on interactions where companies engage directly with investors, emphasizing financial transparency, shareholder relations, and capital fundraising strategies. Business-to-Business (B2B) involves transactions between companies, prioritizing supply chain management, product integration, and long-term partnerships for mutual growth. Understanding the key differences highlights B2I's role in securing investment capital versus B2B's focus on operational collaborations and commercial exchanges.

Key Differences Between B2I and B2B Strategies

Business-to-Investor (B2I) strategies prioritize building strong relationships with financial stakeholders, emphasizing transparent communication, detailed financial reporting, and investment potential. Business-to-Business (B2B) strategies focus on delivering value through product innovation, supply chain efficiency, and tailored solutions to meet client operational needs. The key difference lies in B2I targeting capital attraction and long-term investor confidence, while B2B targets transactional partnerships and operational collaboration between companies.

Target Audience Analysis: Investors vs Businesses

Target audience analysis in Business-to-Investor (B2I) focuses on understanding the financial goals, risk tolerance, and investment preferences of individual and institutional investors to tailor communications and investment opportunities effectively. In contrast, Business-to-Business (B2B) analysis centers on identifying the operational needs, decision-making processes, and procurement criteria of companies to build strong partnerships and provide relevant products or services. Precise segmentation and profiling enable both B2I and B2B models to deliver targeted value propositions aligned with their distinct audiences.

Decision-Making Processes in B2I and B2B Markets

Decision-making processes in Business-to-Investor (B2I) markets emphasize financial performance, risk assessment, and long-term return on investment, requiring detailed financial reports and strategic forecasting. In contrast, Business-to-Business (B2B) decisions prioritize operational efficiency, product compatibility, and vendor reliability, demanding thorough evaluations of supply chain benefits and service agreements. Both markets rely heavily on data-driven analysis, but B2I focuses on investment potential while B2B centers on transactional and relational dynamics.

Communication Channels and Engagement Tactics

Business-to-Investor (B2I) communication channels prioritize transparency and trust, often utilizing investor relations websites, earnings calls, and regulatory filings to convey financial performance and strategic vision. Engagement tactics in B2I focus on timely disclosures, detailed reports, and personalized meetings to address investor concerns and foster confidence. In contrast, Business-to-Business (B2B) communication channels emphasize relationship-building through trade shows, targeted email campaigns, and professional networking platforms, with engagement tactics centered on solution-based consultations, long-term partnerships, and collaborative content marketing.

Lead Generation and Conversion in B2I vs B2B

Business-to-Investor (B2I) lead generation targets financial stakeholders using personalized outreach, investor relations content, and performance data to build trust and credibility. In contrast, Business-to-Business (B2B) lead generation emphasizes relationship building through targeted marketing campaigns, webinars, and case studies focused on solving enterprise challenges. Conversion rates in B2I rely heavily on demonstrating strong ROI and financial projections, while B2B conversion benefits from nurturing long-term partnerships and addressing operational needs.

Sales Cycle Length: Comparing B2I and B2B

Business-to-Investor (B2I) sales cycles are typically shorter than Business-to-Business (B2B) cycles due to decision-making processes focused on investment potential rather than operational integration. B2B sales often involve multiple stakeholders, extensive product evaluations, and longer contract negotiations, extending the sales timeline significantly. Understanding these differences helps companies tailor their sales strategies to meet specific investor or business client expectations efficiently.

Risk Factors and Due Diligence Considerations

Business-to-Investor (B2I) models require comprehensive due diligence focused on financial risk, market volatility, and investor compliance to safeguard capital and ensure regulatory adherence. Business-to-Business (B2B) transactions demand rigorous evaluation of partner stability, supply chain reliability, and contractual obligations to mitigate operational and credit risks. Both models necessitate tailored risk management strategies aligned with sector-specific challenges and stakeholder expectations.

Impact on Branding and Market Positioning

Business-to-Investor (B2I) strategies emphasize transparency, financial performance, and growth potential to strengthen investor confidence and enhance corporate reputation, directly influencing market valuation and brand credibility. Business-to-Business (B2B) marketing prioritizes building long-term partnerships, demonstrating product reliability, and delivering tailored solutions, which solidify brand authority and competitive positioning within industry niches. Both approaches shape market positioning distinctly; B2I drives brand perception through investor relations and public trust, while B2B relies on operational excellence and client satisfaction to secure industry leadership.

Choosing the Right Model for Your Organization

Business-to-Investor (B2I) models prioritize attracting and maintaining investor interest through transparent financial reporting and growth potential, essential for startups and publicly traded companies seeking capital infusion. Business-to-Business (B2B) models emphasize establishing long-term partnerships, streamlined supply chains, and customized solutions to meet the specific needs of other organizations, which benefits companies focused on operational efficiency and scalability. Selecting the right model depends on your company's primary goals, whether that's securing funding or building sustainable business partnerships.

Business-to-Investor Infographic

libterm.com

libterm.com