Effective cash flow management ensures Your business maintains sufficient liquidity to meet daily expenses and invest in growth opportunities. Understanding the timing of cash inflows and outflows helps prevent shortfalls and supports long-term financial stability. Explore the rest of the article to learn strategies for optimizing Your cash flow and boosting profitability.

Table of Comparison

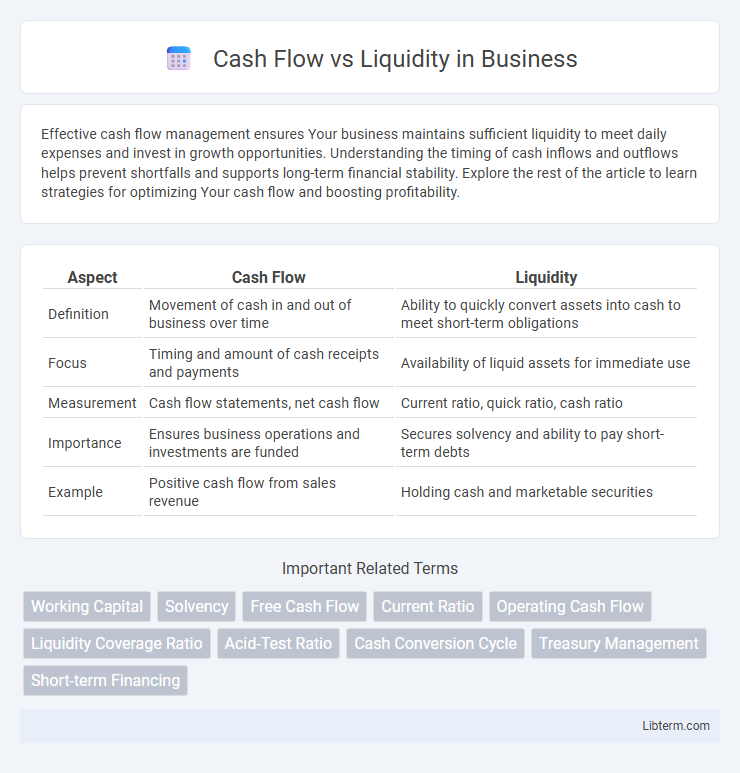

| Aspect | Cash Flow | Liquidity |

|---|---|---|

| Definition | Movement of cash in and out of business over time | Ability to quickly convert assets into cash to meet short-term obligations |

| Focus | Timing and amount of cash receipts and payments | Availability of liquid assets for immediate use |

| Measurement | Cash flow statements, net cash flow | Current ratio, quick ratio, cash ratio |

| Importance | Ensures business operations and investments are funded | Secures solvency and ability to pay short-term debts |

| Example | Positive cash flow from sales revenue | Holding cash and marketable securities |

Introduction to Cash Flow and Liquidity

Cash flow represents the actual inflow and outflow of cash within a business over a specific period, highlighting the company's ability to generate cash from operations, investments, and financing activities. Liquidity refers to the ease with which a business can convert assets into cash to meet short-term obligations without significant loss of value. Understanding the distinction between cash flow and liquidity is essential for assessing a company's financial health and operational efficiency.

Defining Cash Flow

Cash flow refers to the movement of money into and out of a business during a specific period, reflecting its operational income and expenses. It includes cash generated from operating activities, investing activities, and financing activities, providing a snapshot of a company's financial health. Positive cash flow indicates the firm can cover its short-term liabilities, distinguishing it from liquidity, which measures the availability of liquid assets to meet immediate obligations.

Understanding Liquidity

Liquidity represents a company's ability to meet short-term obligations by quickly converting assets into cash without significant loss of value. It is a critical measure of financial health, reflecting operational efficiency and the capacity to manage unexpected expenses. Unlike cash flow, which tracks the actual inflow and outflow of cash over a period, liquidity emphasizes the immediate availability of assets to cover liabilities.

Key Differences Between Cash Flow and Liquidity

Cash flow measures the actual inflow and outflow of cash within a specific period, reflecting a company's operational efficiency and financial health. Liquidity indicates the ability to meet short-term obligations by converting assets into cash quickly without significant loss in value. While cash flow assesses timing and magnitude of cash movement, liquidity emphasizes the availability and accessibility of liquid resources to cover immediate liabilities.

Importance of Cash Flow Management

Effective cash flow management ensures a business maintains sufficient operational liquidity to cover expenses and invest in growth opportunities, directly impacting financial stability. Monitoring inflows and outflows helps prevent cash shortages that can disrupt operations, even if the company is profitable on paper. Strategic cash flow forecasting and control reduce risks of insolvency and enhance the ability to meet short-term liabilities efficiently.

The Role of Liquidity in Financial Health

Liquidity plays a critical role in maintaining a company's financial health by ensuring it can meet short-term obligations without disrupting operations. Adequate liquidity provides a buffer against unexpected expenses and helps manage cash flow fluctuations effectively. Companies with strong liquidity are better positioned to capitalize on opportunities and avoid solvency risks.

Common Cash Flow Challenges

Cash flow challenges frequently arise from delayed customer payments, unpredictable sales cycles, and insufficient cash reserves, impacting a business's ability to meet short-term obligations. Liquidity issues often occur when cash inflows do not align with immediate expenses, causing operational disruptions and increased reliance on credit lines. Effective cash flow management and accurate forecasting are essential to maintaining adequate liquidity and ensuring financial stability.

Measuring and Analyzing Liquidity

Measuring liquidity involves assessing a company's ability to meet its short-term obligations using ratios such as the current ratio, quick ratio, and cash ratio, which provide insights into asset convertibility to cash. Analyzing liquidity requires examining cash flow statements alongside balance sheets to determine the timing and sufficiency of cash inflows and outflows. This approach ensures a comprehensive evaluation of financial health beyond cash flow alone, highlighting potential liquidity risks and operational flexibility.

Strategies to Improve Both Cash Flow and Liquidity

Effective strategies to improve both cash flow and liquidity include accelerating accounts receivable through prompt invoicing and offering early payment discounts. Managing inventory efficiently reduces holding costs and frees up cash, while negotiating better payment terms with suppliers delays cash outflows. Maintaining a cash reserve or access to a line of credit provides a financial cushion to address unexpected expenses and stabilize liquidity.

Conclusion: Balancing Cash Flow and Liquidity

Balancing cash flow and liquidity is essential for maintaining a company's financial health and operational stability. Effective cash flow management ensures timely payment of obligations and investment in growth opportunities, while strong liquidity provides a buffer against unforeseen expenses and market volatility. Businesses that optimize both cash flow and liquidity achieve sustainable profitability and resilience in fluctuating economic conditions.

Cash Flow Infographic

libterm.com

libterm.com