Customer Lifetime Value (CLV) measures the total revenue a business can expect from a single customer over the duration of their relationship. Understanding CLV helps you prioritize marketing efforts, optimize customer retention strategies, and increase profitability. Explore the rest of the article to learn how to effectively calculate and maximize your customer lifetime value.

Table of Comparison

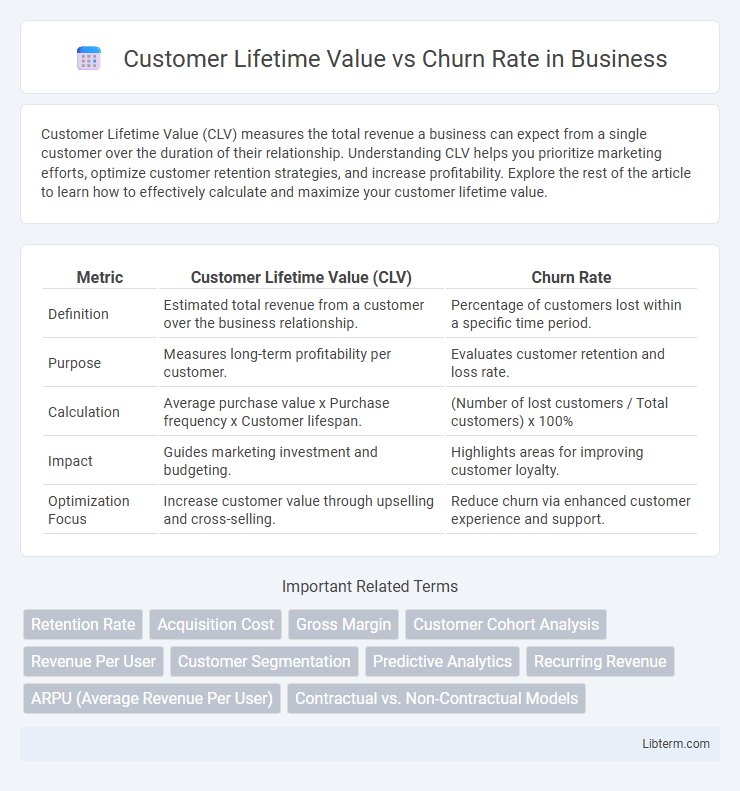

| Metric | Customer Lifetime Value (CLV) | Churn Rate |

|---|---|---|

| Definition | Estimated total revenue from a customer over the business relationship. | Percentage of customers lost within a specific time period. |

| Purpose | Measures long-term profitability per customer. | Evaluates customer retention and loss rate. |

| Calculation | Average purchase value x Purchase frequency x Customer lifespan. | (Number of lost customers / Total customers) x 100% |

| Impact | Guides marketing investment and budgeting. | Highlights areas for improving customer loyalty. |

| Optimization Focus | Increase customer value through upselling and cross-selling. | Reduce churn via enhanced customer experience and support. |

Understanding Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) measures the total revenue a business expects from a single customer throughout their relationship, guiding strategic decisions in marketing and customer retention. Calculating CLV involves analyzing purchase frequency, average order value, and customer lifespan to predict future profitability. Understanding CLV helps businesses allocate resources effectively, reducing churn rate by targeting high-value customers with personalized experiences and retention efforts.

Defining Churn Rate in Business

Churn rate in business measures the percentage of customers who stop using a company's products or services during a specific time period. It is a critical metric for understanding customer retention and directly impacts Customer Lifetime Value (CLV) by indicating the rate at which revenue-generating customers are lost. Lowering churn rate increases CLV, leading to sustained revenue growth and long-term business success.

Importance of CLV and Churn Rate Metrics

Customer Lifetime Value (CLV) quantifies the total revenue a business expects from a single customer over the entire relationship, serving as a critical indicator for long-term profitability and marketing strategies. Churn Rate measures the percentage of customers who discontinue their subscription or stop purchasing, highlighting retention challenges and the health of customer loyalty. Analyzing both CLV and Churn Rate together enables businesses to optimize customer acquisition costs, improve retention efforts, and maximize sustainable revenue growth.

Key Differences Between CLV and Churn Rate

Customer Lifetime Value (CLV) measures the total revenue a business expects from a single customer over the entire relationship, while Churn Rate quantifies the percentage of customers who stop doing business with the company during a specific period. CLV focuses on the long-term profitability and value derived from customers, whereas Churn Rate emphasizes customer retention and loss. Understanding both metrics enables businesses to optimize marketing strategies for sustained revenue growth and reduced customer attrition.

How Churn Rate Impacts Customer Lifetime Value

Churn rate directly reduces customer lifetime value (CLV) by shortening the duration of customer relationships, limiting the revenue generated per customer. High churn rates increase acquisition costs needed to replace lost customers, thereby decreasing overall profitability. Reducing churn enhances CLV by extending customer retention, maximizing revenue, and improving long-term business growth.

Calculating Customer Lifetime Value: Methods & Formulas

Calculating Customer Lifetime Value (CLV) involves estimating the total revenue a business can expect from a single customer over the duration of their relationship. Common methods include the Historical CLV, which sums past revenues, and Predictive CLV, using statistical models to forecast future value based on purchase patterns, retention rates, and average purchase value. Key formulas often involve multiplying the average purchase value by purchase frequency and average customer lifespan, adjusted by the churn rate to reflect customer attrition accurately.

Measuring and Analyzing Churn Rate

Measuring and analyzing churn rate involves tracking the percentage of customers who discontinue their subscriptions or stop purchasing within a specific period, providing critical insights into customer retention challenges. Accurate churn calculation requires segmenting customers by behavior, demographics, and tenure to identify patterns that contribute to attrition. Leveraging tools like cohort analysis and predictive analytics helps businesses pinpoint high-risk segments and implement targeted interventions to reduce churn and improve Customer Lifetime Value (CLV).

Strategies to Increase CLV and Reduce Churn

Implement targeted upselling and cross-selling campaigns based on customer purchase history and behavior analysis to increase Customer Lifetime Value (CLV). Implement personalized customer engagement tactics such as loyalty programs and consistent post-purchase support to enhance retention and reduce churn rate. Utilize predictive analytics to identify at-risk customers early and deploy tailored retention strategies, including exclusive offers and proactive communication, to minimize churn and maximize long-term revenue.

Leveraging Data: Tools for Tracking CLV and Churn

Leveraging data to track Customer Lifetime Value (CLV) and churn rate involves using advanced analytics tools such as CRM software, predictive modeling, and customer segmentation platforms to gain actionable insights. Tools like Salesforce, HubSpot, and Tableau integrate customer transaction data and behavior patterns to accurately forecast CLV and identify early signs of churn. Real-time dashboards and machine learning algorithms enable businesses to optimize retention strategies and maximize long-term profitability.

Maximizing Profitability: Integrating CLV and Churn Insights

Maximizing profitability requires integrating Customer Lifetime Value (CLV) with churn rate analysis to prioritize high-value customers and reduce attrition. By identifying segments with high CLV and elevated churn risk, businesses can tailor retention strategies that prolong engagement and boost revenue. Leveraging predictive analytics on CLV and churn data enables optimized marketing spend and customer experience initiatives, ultimately enhancing long-term profitability.

Customer Lifetime Value Infographic

libterm.com

libterm.com