Commission structures vary widely across industries, often based on a percentage of sales or fixed fees per transaction to incentivize performance. Understanding how commissions work can help you maximize your earnings and negotiate better deals. Explore the rest of the article to learn how commissions impact your income and strategies to optimize them.

Table of Comparison

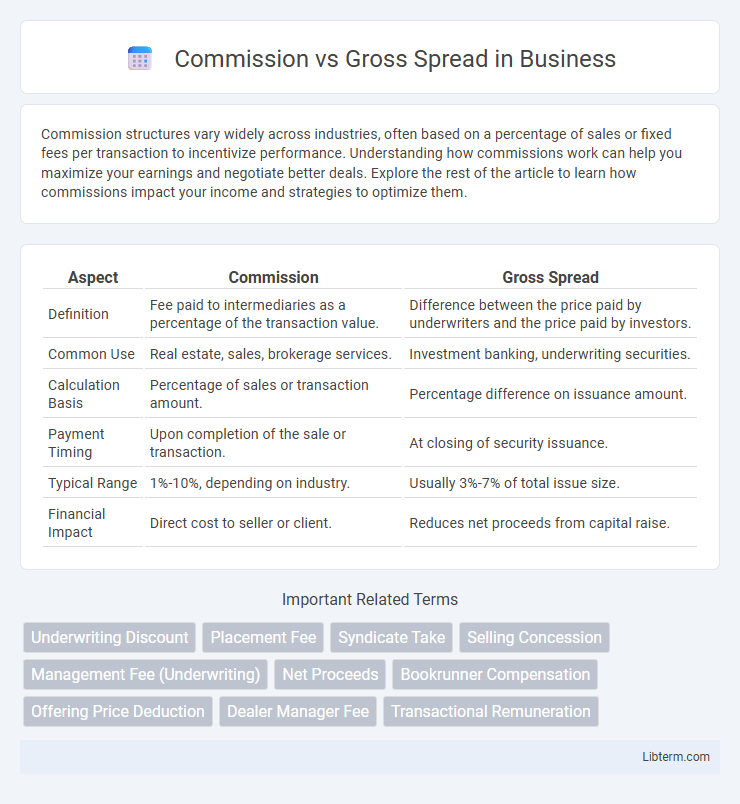

| Aspect | Commission | Gross Spread |

|---|---|---|

| Definition | Fee paid to intermediaries as a percentage of the transaction value. | Difference between the price paid by underwriters and the price paid by investors. |

| Common Use | Real estate, sales, brokerage services. | Investment banking, underwriting securities. |

| Calculation Basis | Percentage of sales or transaction amount. | Percentage difference on issuance amount. |

| Payment Timing | Upon completion of the sale or transaction. | At closing of security issuance. |

| Typical Range | 1%-10%, depending on industry. | Usually 3%-7% of total issue size. |

| Financial Impact | Direct cost to seller or client. | Reduces net proceeds from capital raise. |

Introduction to Commission and Gross Spread

Commission refers to the fee paid to financial intermediaries or brokers for facilitating transactions, often expressed as a percentage of the total deal value. Gross spread is the difference between the price at which securities are purchased from the issuer and the price at which they are sold to the public during an underwriting process, representing the underwriters' compensation. Understanding the distinction between commission and gross spread is essential for evaluating costs and profits in financial transactions such as stock offerings and bond underwriting.

Understanding the Basics: Commission Explained

Commission represents a fee charged by brokers or agents as a percentage of the transaction value, serving as compensation for services rendered. Gross spread includes the total underwriting discount and expenses deducted from the gross proceeds of a securities offering, encompassing commissions and additional fees. Understanding that commission is a component of the broader gross spread helps clarify the costs involved in financial transactions.

What is Gross Spread in Financial Transactions?

Gross spread in financial transactions represents the total fees earned by underwriters or intermediaries during the issuance of securities, typically expressed as a percentage of the total offering amount. It encompasses underwriting fees, management fees, and selling concessions, reflecting the combined compensation for services rendered. Understanding gross spread helps investors gauge the cost impact of underwriting on the overall capital raised through public or private offerings.

Key Differences Between Commission and Gross Spread

Commission refers to the fee paid to brokers or agents as a percentage of the transaction value for facilitating a deal, while gross spread represents the difference between the price at which underwriters buy securities from the issuer and the price at which they sell to investors. Commissions are typically earned in various types of sales, including real estate and securities trading, whereas gross spread is primarily associated with investment banking underwriting processes. The key difference lies in their application: commissions compensate intermediaries for brokerage services, whereas gross spread reflects underwriting profitability and risk distribution in securities offerings.

How Commission Works in Various Industries

Commission structures vary significantly across industries, often based on a percentage of sales or revenue generated by the salesperson. In real estate, commissions typically range from 5% to 6% of the property's sale price, while in financial services, brokers receive commissions on trades or managed assets as a part of the gross spread between buying and selling prices. Insurance agents earn commissions as a portion of the premiums collected, and in retail or direct sales, commission rates depend on product type and sales volume, highlighting the adaptability of commission models to different market dynamics.

Gross Spread: Application in Investment Banking

Gross Spread represents the total underwriting fee in an investment banking transaction, typically expressed as a percentage of the offering amount. It encompasses the issuer's compensation to underwriters, including the manager's fee, underwriting fee, and selling concession, directly impacting the bank's revenue from securities offerings. Understanding Gross Spread is crucial for structuring deals, pricing securities, and negotiating terms between issuers and underwriters in initial public offerings (IPOs) and bond issuances.

Advantages and Disadvantages of Commission Models

Commission models offer clear advantages such as straightforward cost structures and alignment of interests between agents and clients, which can boost motivation and performance. However, these models may encourage agents to prioritize higher commissions over client needs, potentially leading to conflicts of interest and reduced transparency. Unlike gross spread models, commissions lack built-in coverage for ancillary expenses, which can result in less predictable overall costs for clients.

Pros and Cons of Gross Spread Structures

Gross spread structures provide a fixed percentage of the total offering amount as compensation, ensuring clear expectations for underwriters and simplifying fee calculations. This arrangement can incentivize underwriters to maximize the offering size but may reduce flexibility in tailoring fees to the transaction's complexity. However, the fixed nature of gross spreads may lead to higher costs for smaller or less complex deals and limit negotiation opportunities between issuers and financiers.

Choosing Between Commission and Gross Spread: Factors to Consider

Choosing between commission and gross spread depends on transaction size, complexity, and industry norms. Commissions often suit smaller, less complex deals, offering a flat or percentage-based fee, while gross spreads are typical in underwriting large securities offerings, covering underwriting risk and expenses. Consider factors such as transparency, cost predictability, and alignment of incentives with the service provider to optimize financial outcomes.

Conclusion: Which Structure Suits Your Business Best?

Choosing between commission and gross spread structures depends on your business model and transaction volume. Commission works well for businesses aiming for transparent, fixed-cost fees tied directly to sales or deals. Gross spread suits companies handling large, complex transactions where multiple parties are compensated from the deal's total proceeds, optimizing incentives for all stakeholders.

Commission Infographic

libterm.com

libterm.com