A Shareholders Agreement outlines the rights, responsibilities, and obligations of shareholders within a company, ensuring clear governance and dispute resolution mechanisms. It protects your interests by defining voting rights, share transfers, and exit strategies, fostering a stable business environment. Explore the full article to understand how a Shareholders Agreement can safeguard your investment and promote corporate harmony.

Table of Comparison

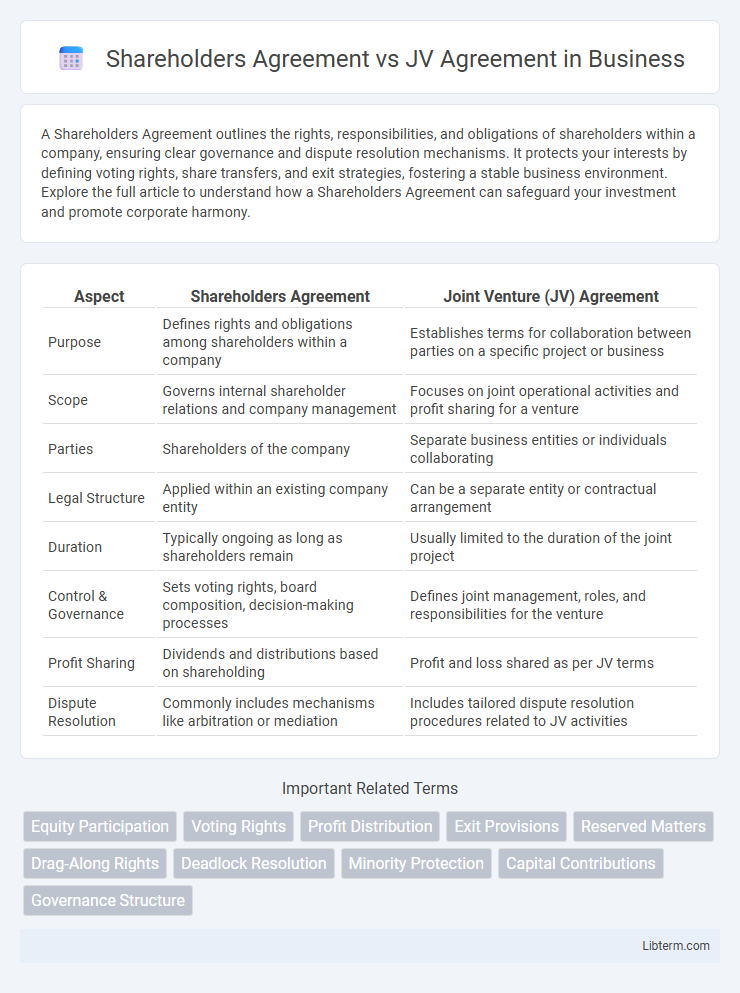

| Aspect | Shareholders Agreement | Joint Venture (JV) Agreement |

|---|---|---|

| Purpose | Defines rights and obligations among shareholders within a company | Establishes terms for collaboration between parties on a specific project or business |

| Scope | Governs internal shareholder relations and company management | Focuses on joint operational activities and profit sharing for a venture |

| Parties | Shareholders of the company | Separate business entities or individuals collaborating |

| Legal Structure | Applied within an existing company entity | Can be a separate entity or contractual arrangement |

| Duration | Typically ongoing as long as shareholders remain | Usually limited to the duration of the joint project |

| Control & Governance | Sets voting rights, board composition, decision-making processes | Defines joint management, roles, and responsibilities for the venture |

| Profit Sharing | Dividends and distributions based on shareholding | Profit and loss shared as per JV terms |

| Dispute Resolution | Commonly includes mechanisms like arbitration or mediation | Includes tailored dispute resolution procedures related to JV activities |

Introduction to Shareholders and JV Agreements

A Shareholders Agreement outlines the rights, responsibilities, and protections of company shareholders, detailing governance, decision-making processes, and share transfer restrictions to safeguard investor interests. In contrast, a Joint Venture (JV) Agreement establishes a collaborative business arrangement between parties, defining the purpose, contributions, profit sharing, and management of a specific project or enterprise. Both agreements are critical legal frameworks that allocate control, resolve disputes, and align expectations among stakeholders in corporate partnerships.

Definition: What is a Shareholders Agreement?

A Shareholders Agreement is a legally binding contract among a company's shareholders that outlines their rights, responsibilities, and obligations, regulating how the company is managed and how shares can be transferred. It establishes frameworks for decision making, dispute resolution, and protection of minority shareholders, ensuring alignment on key operational and financial matters. Unlike a JV Agreement, which governs the collaboration between separate entities for a specific project, a Shareholders Agreement is focused on the internal relationship within a single company's ownership structure.

Definition: What is a Joint Venture Agreement?

A Joint Venture Agreement is a contractual arrangement between two or more parties who agree to pool their resources for a specific project or business activity, sharing profits, losses, and control. Unlike a Shareholders Agreement, which governs ongoing relationships and rights among shareholders within a single company, a Joint Venture Agreement typically establishes a separate entity or partnership with defined objectives and limited duration. The agreement outlines contributions, management roles, decision-making processes, and exit strategies tailored to the joint venture's unique purpose and scope.

Key Differences Between Shareholders and JV Agreements

Shareholders Agreements primarily regulate the relationship, rights, and obligations among shareholders within a single company, focusing on governance, share transfers, and decision-making processes. Joint Venture (JV) Agreements establish the terms of collaboration between two or more parties to undertake a specific business project or objective, emphasizing project scope, contributions, profit sharing, and exit mechanisms. Unlike Shareholders Agreements, JV Agreements often involve separate legal entities and outline distinct operational and financial roles tailored to the joint venture's goals.

Purpose and Objectives: Comparative Analysis

Shareholders Agreements primarily focus on governing the relationship among shareholders, outlining rights, responsibilities, and mechanisms to resolve disputes within a company, ensuring control and protection of investments. Joint Venture Agreements emphasize collaboration between parties to accomplish specific projects or business ventures, detailing contributions, profit sharing, and management structure tailored for a limited scope and duration. While Shareholders Agreements address long-term corporate governance and shareholder dynamics, JV Agreements aim at joint operational execution and risk allocation for focused business objectives.

Legal Structure and Nature of Relationships

A Shareholders Agreement governs the rights and obligations of shareholders within a corporation, outlining decision-making processes, share transfers, and dispute resolution to maintain corporate governance. In contrast, a Joint Venture (JV) Agreement establishes a collaborative partnership between entities to undertake a specific business venture, defining contributions, profit-sharing, and management roles while preserving separate legal identities. The Shareholders Agreement emphasizes internal corporate structure and long-term ownership, whereas the JV Agreement centers on the contractual relationship for a defined project or timeframe.

Governance and Control Mechanisms

Shareholders Agreements primarily focus on defining governance structures within corporations, outlining voting rights, board composition, and decision-making procedures among shareholders. Joint Venture Agreements establish control mechanisms for collaborative projects, specifying management roles, operational responsibilities, and profit-sharing arrangements between partners. Both agreements ensure clear authority lines and dispute resolution methods, but Shareholders Agreements emphasize corporate governance while JV Agreements target joint operational control.

Investment, Profit Sharing, and Liability

A Shareholders Agreement primarily governs the relationship between company shareholders, detailing investment contributions, profit-sharing ratios based on shareholding, and liability limited to the invested capital. In contrast, a JV Agreement outlines the collaboration terms between parties in a joint venture, specifying investment commitments, profit distribution according to the venture agreement, and shared liability often extending to project-related risks. Both agreements establish clear financial roles but differ in scope, with JV Agreements focusing on specific projects and broader liability arrangements compared to the corporate structure focus in Shareholders Agreements.

Exit Strategies and Dispute Resolution

Shareholders Agreements typically provide detailed exit strategies including drag-along rights, tag-along rights, and buy-sell provisions to protect minority shareholders and ensure smooth ownership transitions. JV Agreements often emphasize dispute resolution mechanisms such as mediation, arbitration, or expert determination to maintain operational continuity and avoid litigation. Clear exit and conflict resolution clauses in both agreements are critical to safeguarding investments and minimizing business interruptions.

Choosing the Right Agreement for Your Business

Selecting the right agreement depends on the business structure and objectives: a Shareholders Agreement governs the rights and obligations of company shareholders, ensuring control and protection within an incorporated entity, while a Joint Venture (JV) Agreement outlines terms for collaboration between parties on a specific project or business activity without creating a separate company. Consider factors such as the duration of partnership, profit-sharing mechanisms, decision-making processes, and exit strategies when deciding, as Shareholders Agreements suit long-term company management, whereas JV Agreements focus on strategic partnerships with defined goals. Legal clarity and tailored terms in either agreement mitigate disputes and foster aligned business interests.

Shareholders Agreement Infographic

libterm.com

libterm.com