Book value represents a company's net asset value, calculated by subtracting total liabilities from total assets, reflecting the equity shareholders would theoretically receive if the company were liquidated. It serves as a crucial metric for investors to assess whether a stock is undervalued or overvalued compared to its market price. Explore the rest of the article to understand how book value impacts investment decisions and financial analysis.

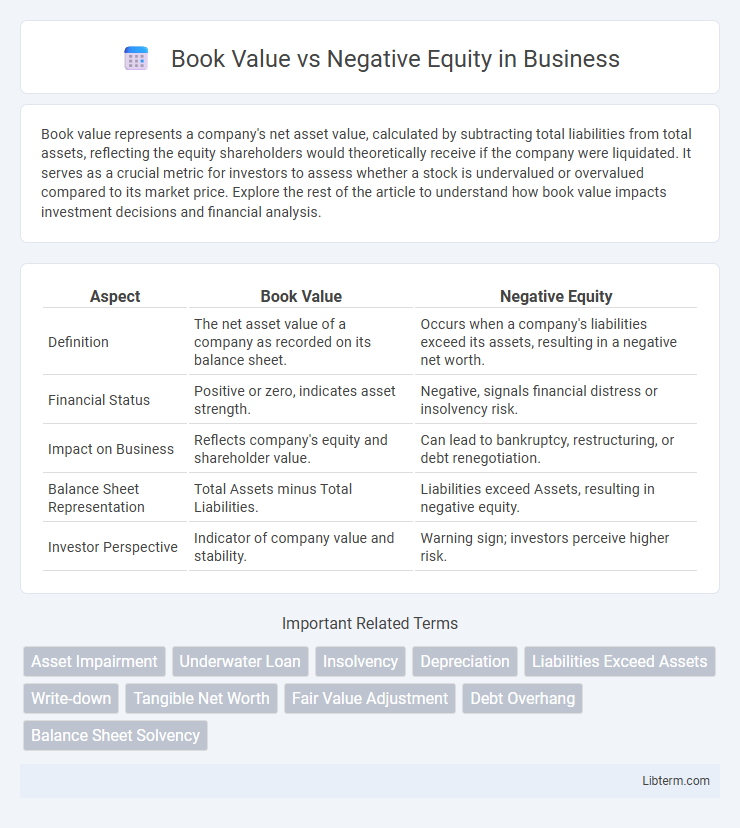

Table of Comparison

| Aspect | Book Value | Negative Equity |

|---|---|---|

| Definition | The net asset value of a company as recorded on its balance sheet. | Occurs when a company's liabilities exceed its assets, resulting in a negative net worth. |

| Financial Status | Positive or zero, indicates asset strength. | Negative, signals financial distress or insolvency risk. |

| Impact on Business | Reflects company's equity and shareholder value. | Can lead to bankruptcy, restructuring, or debt renegotiation. |

| Balance Sheet Representation | Total Assets minus Total Liabilities. | Liabilities exceed Assets, resulting in negative equity. |

| Investor Perspective | Indicator of company value and stability. | Warning sign; investors perceive higher risk. |

Introduction to Book Value and Negative Equity

Book value represents the net worth of an asset, calculated as its original cost minus accumulated depreciation and liabilities. Negative equity occurs when the outstanding loan balance exceeds the asset's book value, meaning the owner owes more than the asset's current worth. Understanding the relationship between book value and negative equity is crucial for assessing financial health in asset management and loan agreements.

Understanding Book Value: Definition and Importance

Book value represents the net asset value of a company or asset, calculated by subtracting total liabilities from total assets, reflecting the intrinsic worth on the balance sheet. Understanding book value is crucial for investors as it provides a baseline for evaluating whether an asset or company is undervalued or overvalued compared to its market price. This metric is essential in identifying negative equity situations, where liabilities exceed assets, signaling potential financial distress.

What is Negative Equity? Key Concepts Explained

Negative equity occurs when a loan or mortgage balance exceeds the current book value of the associated asset, typically a vehicle or property. This situation means the owner owes more than the asset is worth, often caused by depreciation outpacing repayments or market value declines. Understanding negative equity is crucial for financial planning, as it affects refinancing options, sale feasibility, and potential financial losses.

Key Differences Between Book Value and Negative Equity

Book value represents the net asset value of a company or asset, calculated by subtracting total liabilities from total assets, reflecting its intrinsic worth on the balance sheet. Negative equity occurs when liabilities exceed assets, indicating the entity owes more than it owns, often signaling financial distress. Key differences include that book value can be positive or negative, while negative equity specifically refers to a situation where this calculation results in a deficit, affecting investor valuation and loan agreements.

How Book Value Impacts Asset Evaluation

Book value plays a crucial role in asset evaluation by representing the net value of an asset based on its original cost minus accumulated depreciation, providing a tangible measure for financial analysis. When book value declines below outstanding liabilities, it results in negative equity, signaling potential financial distress or reduced solvency. Accurate assessment of book value ensures investors and creditors understand the true worth of assets, influencing decisions on investment, lending, and risk management.

Causes and Consequences of Negative Equity

Negative equity occurs when a car or asset's loan balance exceeds its current book value, often caused by rapid depreciation, high-interest loans, or large down payment deficiencies. Economic downturns and declining market conditions accelerate the drop in asset value, making it difficult for borrowers to refinance or sell without incurring losses. Consequences include higher default risks, negative impact on credit scores, and financial strain due to owed debts surpassing the asset's resale price.

Book Value vs Market Value: What’s the Distinction?

Book value represents the net asset value of an asset or company as recorded on the balance sheet, calculated by subtracting liabilities from total assets. Market value reflects the current price at which the asset or company can be bought or sold in the open market, often influenced by supply, demand, and investor perceptions. The distinction lies in book value being an accounting measure based on historical costs, while market value fluctuates with real-time market conditions, impacting assessments of equity whether positive or negative.

The Role of Depreciation in Book Value and Negative Equity

Depreciation systematically reduces the book value of an asset over time, reflecting its declining market worth and usage. When depreciation outpaces the asset's market value or loan balance, it can lead to negative equity, where the owed amount exceeds the asset's recorded book value. Understanding depreciation's impact is crucial for accurately assessing financial health and mitigating risks associated with negative equity.

Strategies to Mitigate Negative Equity Risks

To mitigate negative equity risks, borrowers should prioritize making larger down payments and consider shorter loan terms to reduce principal balance faster. Regularly monitoring vehicle depreciation and opting for loans with gap insurance can protect against owing more than the asset's market value. Refinancing options may also help restructure debt, improving equity position and easing financial burden.

Conclusion: Making Informed Financial Decisions

Understanding the distinction between book value and negative equity is crucial for making informed financial decisions regarding asset management and loan repayment strategies. Book value represents the intrinsic worth of an asset based on accounting records, while negative equity occurs when the outstanding loan amount exceeds this value, signaling potential financial risk. Evaluating these factors enables individuals and businesses to assess their financial health accurately and devise effective plans to mitigate losses or improve asset utilization.

Book Value Infographic

libterm.com

libterm.com