A unitary board combines executive and non-executive directors into a single group responsible for overseeing a company's management and strategic decisions. This structure promotes balanced decision-making by incorporating diverse perspectives while maintaining clear accountability. Explore the rest of this article to understand how a unitary board can impact Your organization's governance and performance.

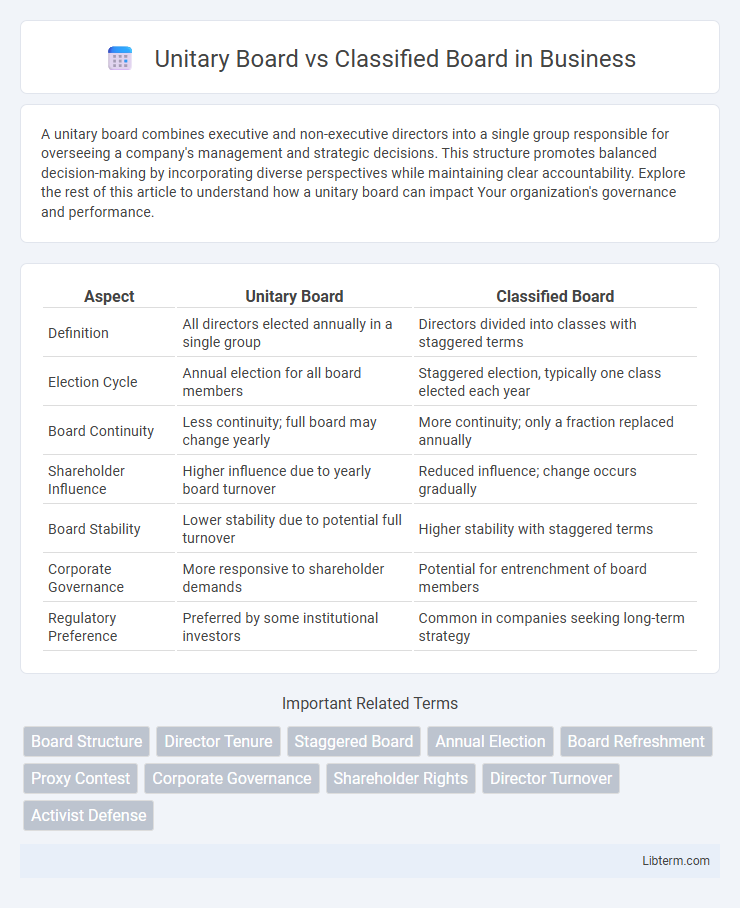

Table of Comparison

| Aspect | Unitary Board | Classified Board |

|---|---|---|

| Definition | All directors elected annually in a single group | Directors divided into classes with staggered terms |

| Election Cycle | Annual election for all board members | Staggered election, typically one class elected each year |

| Board Continuity | Less continuity; full board may change yearly | More continuity; only a fraction replaced annually |

| Shareholder Influence | Higher influence due to yearly board turnover | Reduced influence; change occurs gradually |

| Board Stability | Lower stability due to potential full turnover | Higher stability with staggered terms |

| Corporate Governance | More responsive to shareholder demands | Potential for entrenchment of board members |

| Regulatory Preference | Preferred by some institutional investors | Common in companies seeking long-term strategy |

Understanding Board Structures: Unitary vs Classified

Unitary boards consist of a single tier where executive and non-executive directors collaborate, promoting streamlined decision-making and unified accountability. Classified boards divide members into separate classes with staggered terms, enhancing board continuity and stability but potentially reducing responsiveness to shareholders. Understanding these structures is crucial for evaluating governance effectiveness and aligning board dynamics with corporate strategy.

Key Features of a Unitary Board

A unitary board consists of both executive and non-executive directors serving on a single board, ensuring unified management and oversight. This board structure promotes streamlined decision-making and clear accountability by integrating strategy formulation and monitoring within one entity. Key features include a balanced composition to prevent dominance, collective responsibility for company performance, and enhanced communication across all levels of leadership.

Core Characteristics of a Classified Board

A classified board, also known as a staggered board, divides directors into separate classes serving overlapping multi-year terms to provide continuity and reduce the risk of hostile takeovers. Core characteristics include election cycles where only a portion of the board is up for election annually, enhancing stability and long-term strategic focus. This structure contrasts with a unitary board, where all directors are elected simultaneously, allowing for more immediate governance changes.

Advantages of a Unitary Board Structure

A unitary board structure offers streamlined decision-making by consolidating authority within a single, cohesive group of directors, enhancing accountability and reducing conflicts arising from divided oversight. It enables more efficient communication and quicker responses to corporate challenges due to unified responsibilities and clearer governance roles. This structure often results in better alignment between management and board members, fostering improved strategic direction and corporate performance.

Benefits of Adopting a Classified Board

Adopting a classified board enhances corporate governance by promoting board stability through staggered director terms, reducing the risk of hostile takeovers and ensuring continuity in strategic oversight. This structure allows for long-term planning and decision-making, aligning board members more closely with shareholder interests over multiple years. Increased board independence and experience contribute to more thoughtful supervision of management, ultimately supporting sustained company performance.

Drawbacks of Unitary Board Systems

Unitary board systems often face drawbacks such as potential conflicts of interest due to the combination of executive and non-executive directors, which can reduce board independence and oversight quality. This structure may limit effective monitoring of management since the same members are involved in both decision-making and execution, potentially compromising accountability and corporate governance standards. The lack of board diversity and staggered terms can also lead to slower adaptation to changing business environments and reduced strategic continuity.

Disadvantages of Classified Board Arrangements

Classified board arrangements often reduce shareholder influence by staggering director elections, which can dilute accountability and delay leadership changes. This structure may also hinder timely strategic shifts, as entrenched directors resist new policies or management adjustments. Furthermore, the lack of annual director elections can decrease board responsiveness and diminish overall corporate governance effectiveness.

Impact on Corporate Governance and Accountability

Unitary boards consolidate decision-making by having all directors serve concurrent terms, promoting streamlined governance and clearer accountability due to uniform election cycles. Classified boards stagger director terms across multiple classes, enhancing board stability but potentially reducing responsiveness and diluting shareholder influence on accountability. Research indicates unitary boards generally facilitate stronger oversight and faster adaptation to governance challenges, while classified boards may impede shareholder intervention, affecting overall corporate governance effectiveness.

Effect on Shareholder Rights and Influence

A unitary board, composed of a single tier of directors, centralizes decision-making power, enabling shareholders to exercise influence more directly through annual elections and voting on all board members simultaneously, enhancing accountability. In contrast, a classified board divides directors into staggered classes with multi-year terms, which can dilute shareholder influence by limiting their ability to replace the entire board in a single election cycle. This structure often protects management from hostile takeovers but reduces shareholders' power to swiftly enact changes, impacting their overall control and responsiveness.

Choosing the Right Board Structure for Your Organization

Choosing the right board structure for your organization depends on factors like governance style, accountability, and strategic goals. A unitary board combines executive and non-executive directors, promoting integrated decision-making and faster responses. Classified boards divide directors into staggered terms, enhancing long-term stability and protection against hostile takeovers but potentially limiting annual shareholder influence.

Unitary Board Infographic

libterm.com

libterm.com