Warrants are financial instruments that give you the right to purchase a company's stock at a specific price before expiration, often used to leverage investment potential. They can offer significant upside if the underlying stock price increases but carry the risk of expiring worthless if the price does not reach the exercise level. Explore the article to understand how warrants function and how they could fit into your investment strategy.

Table of Comparison

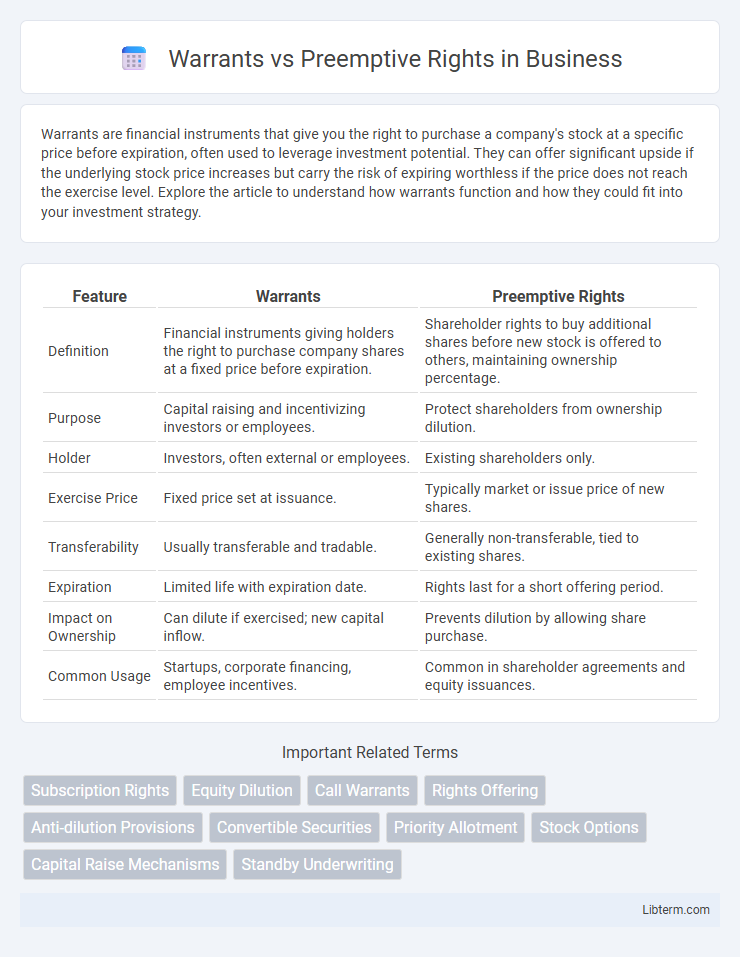

| Feature | Warrants | Preemptive Rights |

|---|---|---|

| Definition | Financial instruments giving holders the right to purchase company shares at a fixed price before expiration. | Shareholder rights to buy additional shares before new stock is offered to others, maintaining ownership percentage. |

| Purpose | Capital raising and incentivizing investors or employees. | Protect shareholders from ownership dilution. |

| Holder | Investors, often external or employees. | Existing shareholders only. |

| Exercise Price | Fixed price set at issuance. | Typically market or issue price of new shares. |

| Transferability | Usually transferable and tradable. | Generally non-transferable, tied to existing shares. |

| Expiration | Limited life with expiration date. | Rights last for a short offering period. |

| Impact on Ownership | Can dilute if exercised; new capital inflow. | Prevents dilution by allowing share purchase. |

| Common Usage | Startups, corporate financing, employee incentives. | Common in shareholder agreements and equity issuances. |

Understanding Warrants and Preemptive Rights

Warrants grant investors the option to purchase company shares at a specific price within a set timeframe, often used as incentives or to raise capital. Preemptive rights allow existing shareholders to maintain their proportional ownership by buying new shares before the company offers them to outsiders. Understanding these mechanisms is crucial for protecting shareholder equity and navigating investment opportunities in corporate finance.

Key Definitions and Fundamental Concepts

Warrants are financial instruments granting the holder the option to purchase company shares at a predetermined price before expiration, often used as a capital-raising tool. Preemptive rights allow existing shareholders the opportunity to buy new shares issued by the company, maintaining their proportional ownership and preventing dilution. Understanding these mechanisms is crucial for investors and companies in managing equity, control, and investment strategies.

How Warrants Function in Equity Financing

Warrants function as financial instruments that grant holders the right to purchase a company's stock at a specific price before expiration, effectively serving as sweeteners in equity financing to attract investors. They provide potential for capital gains without immediate equity dilution, enabling companies to raise funds while postponing actual stock issuance until warrant exercise. Unlike preemptive rights, which allow existing shareholders to maintain proportional ownership by buying new shares first, warrants can be offered to new or existing investors as an incentive for investment.

The Mechanics of Preemptive Rights

Preemptive rights grant existing shareholders the ability to purchase additional shares before new investors, preserving their ownership percentage and protecting against dilution. These rights are typically exercised during new share issuances, allowing shareholders to buy shares proportionate to their current holdings. This mechanism ensures shareholders maintain control and influence in the company by securing their proportional equity in future funding rounds.

Major Differences Between Warrants and Preemptive Rights

Warrants are financial instruments granting the holder the right to purchase a company's stock at a specific price before expiration, often used as a fundraising tool or incentive. Preemptive rights allow existing shareholders to buy additional shares in future stock issuances, maintaining their proportional ownership and preventing dilution. The major difference lies in warrants being tradable securities typically issued to investors or employees, while preemptive rights are protective rights given exclusively to current shareholders.

Advantages of Issuing Warrants for Companies

Issuing warrants allows companies to raise capital without immediate equity dilution, preserving existing shareholders' ownership percentage until exercise. Warrants can attract investors by offering the potential for future equity at a fixed price, enhancing fundraising flexibility and market appeal. These instruments also provide long-term incentives tied to stock performance, aligning investor interests with the company's growth trajectory.

Benefits of Preemptive Rights for Shareholders

Preemptive rights allow shareholders to maintain their proportional ownership by purchasing additional shares before the company offers them to external investors, preventing dilution of their equity stake. This protection ensures shareholders can preserve their voting power and influence over corporate decisions. Furthermore, preemptive rights provide a strategic opportunity to invest in the company's future growth under favorable terms.

Potential Risks and Drawbacks

Warrants carry the potential risk of significant dilution because they allow new shares to be issued at a pre-set price, often lower than market value, which can reduce existing shareholders' ownership percentages and earnings per share. Preemptive rights protect investors by granting them the option to purchase additional shares before new stock is offered to outside parties, but exercising these rights may require substantial capital investment that some shareholders cannot afford, leading to unintended dilution. Both mechanisms can introduce complexities in corporate governance and shareholder relations, potentially affecting stock price stability and investor confidence.

Warrants vs Preemptive Rights: Real-World Examples

Warrants and preemptive rights serve different purposes in equity financing; warrants give investors the option to purchase shares at a predetermined price, often seen in startup funding rounds like Tesla's early capital raises. Preemptive rights protect existing shareholders from dilution by allowing them to buy additional shares before outsiders, commonly exercised by long-term investors in private companies such as family-owned businesses or venture capital-backed firms. Real-world cases show warrants facilitating capital influx without immediate dilution, while preemptive rights maintain proportional ownership and voting power during new share issuances.

Choosing the Best Option: Strategic Considerations

When choosing between warrants and preemptive rights, companies must evaluate control dilution and capital-raising flexibility, as warrants offer customizable exercise terms while preemptive rights protect existing shareholders' ownership stakes from dilution. Warrants provide strategic timing advantages, allowing companies to raise capital opportunistically, whereas preemptive rights impose obligations to offer new shares proportionally, ensuring shareholder loyalty and influence retention. Assessing investor expectations and long-term ownership goals is critical for aligning the choice with corporate governance and financing strategies.

Warrants Infographic

libterm.com

libterm.com