A corporation is a legal entity distinct from its owners, providing limited liability protection and allowing for perpetual existence. It enables businesses to raise capital through stock issuance and offers a structured management framework. Discover how understanding corporations can benefit your business goals by exploring the full article.

Table of Comparison

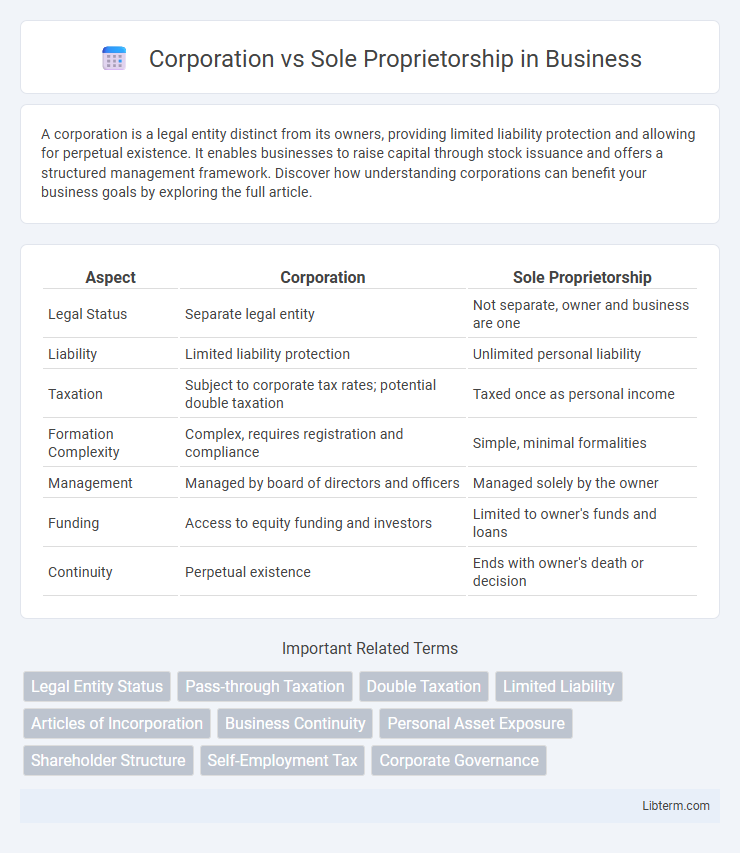

| Aspect | Corporation | Sole Proprietorship |

|---|---|---|

| Legal Status | Separate legal entity | Not separate, owner and business are one |

| Liability | Limited liability protection | Unlimited personal liability |

| Taxation | Subject to corporate tax rates; potential double taxation | Taxed once as personal income |

| Formation Complexity | Complex, requires registration and compliance | Simple, minimal formalities |

| Management | Managed by board of directors and officers | Managed solely by the owner |

| Funding | Access to equity funding and investors | Limited to owner's funds and loans |

| Continuity | Perpetual existence | Ends with owner's death or decision |

Overview of Corporation and Sole Proprietorship

A corporation is a legal entity separate from its owners, providing limited liability protection, centralized management, and enhanced opportunities for raising capital through stock issuance. Sole proprietorship is the simplest business structure, owned and operated by one individual who bears unlimited personal liability and full control over decision-making. Corporations require formal registration and compliance with regulations, whereas sole proprietorships have minimal regulatory burden and simpler tax filing processes.

Legal Structure Comparison

A corporation is a separate legal entity distinct from its owners, providing limited liability protection and enduring beyond the involvement of original shareholders. A sole proprietorship lacks legal separation from its owner, resulting in personal liability for debts and obligations. Corporations require formal registration and compliance with corporate laws, while sole proprietorships have simpler setup processes with fewer regulatory requirements.

Formation and Registration Process

Forming a corporation involves filing articles of incorporation with the state, creating bylaws, and appointing a board of directors, which ensures a structured legal entity separate from its owners. In contrast, establishing a sole proprietorship requires minimal paperwork, typically just obtaining local business licenses or permits without formal state registration. Corporations face more complex and costly registration processes, including ongoing compliance and reporting requirements, while sole proprietorships enjoy simpler setup and fewer regulatory obligations.

Liability and Risk Management

A corporation provides limited liability protection, meaning shareholders are typically not personally responsible for business debts and obligations, reducing individual financial risk. In contrast, a sole proprietorship exposes the owner to unlimited personal liability, placing personal assets at risk for business liabilities. This fundamental difference makes corporations a preferred choice for entrepreneurs seeking enhanced risk management and protection against potential legal claims.

Taxation Differences

Corporations face double taxation, where profits are taxed at the corporate level and dividends are taxed at the shareholder level, whereas sole proprietorships experience pass-through taxation, meaning income is reported on the owner's personal tax return. Corporate tax rates can vary but often include federal and state levels, while sole proprietorships pay personal income tax rates on net business income. Furthermore, corporations may benefit from tax deductions on employee benefits and reinvested earnings, advantages typically unavailable to sole proprietors.

Ownership and Management Flexibility

Corporations offer ownership through shareholders, allowing for the transfer of shares without disrupting business operations, while sole proprietorships are owned and managed by a single individual, providing maximum control and direct decision-making. Management flexibility in sole proprietorships is high due to the absence of formal governance structures, whereas corporations require adherence to bylaws and board decisions, potentially limiting managerial autonomy. Ownership in corporations enables raising capital through stock issuance, contrasting with sole proprietorships that rely largely on personal funds and have limited scalability.

Fundraising and Capital Access

Corporations have greater fundraising capabilities due to their ability to issue stocks and attract a wide range of investors, facilitating access to substantial capital. Sole proprietorships face limitations in capital acquisition as funding primarily depends on personal savings, loans, or small-scale investments, restricting expansion opportunities. The structure of corporations supports easier equity financing and enhances credibility with financial institutions compared to sole proprietorships.

Regulatory and Reporting Requirements

Corporations face stringent regulatory and reporting requirements, including filing annual reports, maintaining corporate minutes, and adhering to securities laws if publicly traded. Sole proprietorships have minimal regulatory burdens, often only needing local business licenses and simple tax filings under the owner's Social Security number. The complexity and cost of compliance are significantly higher for corporations, impacting administrative overhead and legal obligations.

Business Continuity and Succession

Corporations ensure business continuity through perpetual existence, allowing ownership transfer via stock sales without disrupting operations. Sole proprietorships lack legal separation from the owner, causing business termination upon the owner's death or decision to exit. Succession in sole proprietorships requires asset transfer and client retention efforts, whereas corporations benefit from structured governance and established succession plans.

Pros and Cons Summary

Corporations offer limited liability protection, easier capital accumulation through stock issuance, and perpetual existence, making them ideal for larger businesses seeking growth. Sole proprietorships provide full managerial control, simpler tax filings, and lower startup costs, appealing to individual entrepreneurs and small businesses. However, corporations face double taxation and complex regulations, while sole proprietorships expose owners to unlimited personal liability and challenges in raising capital.

Corporation Infographic

libterm.com

libterm.com