Equity carve-out involves a parent company selling a percentage of its subsidiary through an initial public offering while retaining control, enabling access to capital and unlocking value. This strategic move can enhance financial flexibility and market visibility for both entities. Explore the rest of the article to understand how an equity carve-out can impact your business growth and investment strategy.

Table of Comparison

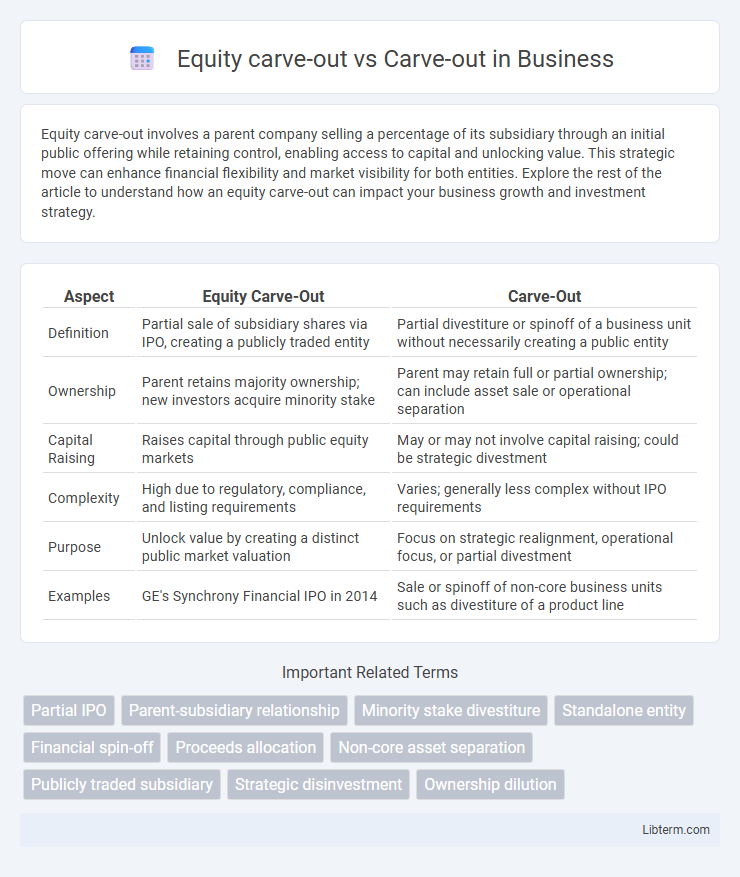

| Aspect | Equity Carve-Out | Carve-Out |

|---|---|---|

| Definition | Partial sale of subsidiary shares via IPO, creating a publicly traded entity | Partial divestiture or spinoff of a business unit without necessarily creating a public entity |

| Ownership | Parent retains majority ownership; new investors acquire minority stake | Parent may retain full or partial ownership; can include asset sale or operational separation |

| Capital Raising | Raises capital through public equity markets | May or may not involve capital raising; could be strategic divestment |

| Complexity | High due to regulatory, compliance, and listing requirements | Varies; generally less complex without IPO requirements |

| Purpose | Unlock value by creating a distinct public market valuation | Focus on strategic realignment, operational focus, or partial divestment |

| Examples | GE's Synchrony Financial IPO in 2014 | Sale or spinoff of non-core business units such as divestiture of a product line |

Introduction to Equity Carve-Outs and Carve-Outs

Equity carve-outs involve a parent company selling a minority stake of a subsidiary to public investors through an initial public offering (IPO), allowing the parent to raise capital while retaining control. Carve-outs refer broadly to divestitures where a company separates a business unit or subsidiary, either by selling equity stakes or the entire entity, to unlock value or focus on core operations. This strategic move enhances financial flexibility and market valuation by isolating business segments with distinct growth profiles.

Defining Equity Carve-Out: Key Features

Equity carve-out involves a parent company selling a minority stake in a subsidiary through a public offering while retaining control, enabling capital raising without a full divestiture. Key features include partial ownership retention, separate public listing of the carved-out entity, and the ability to unlock the intrinsic value of the subsidiary. Unlike a general carve-out that may involve asset sales or spin-offs, equity carve-outs maintain strategic influence and promote transparency for investors.

Understanding General Carve-Out: Main Concepts

A general carve-out involves separating a division or subsidiary from the parent company to form an independent entity, often to enhance strategic focus or unlock shareholder value. Unlike an equity carve-out, where a partial stake of the carved-out unit is sold through an initial public offering (IPO), a general carve-out might be achieved via sale, spin-off, or joint venture without necessarily involving public market transactions. Key concepts include asset segregation, operational independence, and the impact on corporate structure and financial reporting.

Structural Differences Between Equity Carve-Outs and Carve-Outs

Equity carve-outs involve a parent company selling a minority stake of a subsidiary through an initial public offering (IPO) while maintaining control, whereas carve-outs typically refer to the divestiture or sale of a business unit or subsidiary, often resulting in full separation. The structural difference lies in ownership retention: equity carve-outs create a publicly traded entity with shared ownership, while carve-outs usually lead to complete transfer of ownership to a third party. This distinction impacts financial reporting, control rights, and strategic alignment between the parent company and the carved-out entity.

Strategic Motivations for Each Approach

Equity carve-out involves selling a minority stake in a subsidiary through an initial public offering while maintaining parent company control, driven by motivations to unlock value, raise capital, and enhance market visibility. Carve-out refers to divesting a business unit by separating it as a standalone entity, typically through a sale or spin-off, aiming to streamline operations, focus on core competencies, and improve financial flexibility. Strategic benefits of equity carve-outs emphasize capital market access and partial ownership retention, whereas carve-outs prioritize operational focus and balance sheet optimization.

Benefits and Drawbacks: Equity Carve-Out vs Carve-Out

Equity carve-outs offer companies the benefit of raising capital by selling a minority stake in a subsidiary through an initial public offering while retaining control, providing liquidity without full divestiture; however, they may result in complex regulatory requirements and partial ownership risks. In contrast, carve-outs involve selling a portion of a business unit or assets to streamline operations and focus on core activities, often generating immediate cash flow but potentially losing strategic control and market presence. Both strategies affect corporate structure and investor perception differently, requiring careful evaluation of financial goals and market conditions.

Financial Implications and Value Creation

Equity carve-out involves selling a minority stake of a subsidiary through an initial public offering (IPO), generating immediate capital while retaining controlling interest, which can unlock subsidiary valuation and enhance shareholder value without full divestiture. Carve-out refers to the process of separating a business unit, often involving a full or partial sale to realize value, reduce debt, and improve operational focus; it typically results in an immediate infusion of cash and potential tax benefits. Both strategies impact financial statements by altering asset composition and capital structure, but equity carve-outs offer ongoing revenue streams, whereas carve-outs usually lead to a permanent reduction in consolidated earnings.

Legal and Regulatory Considerations

Equity carve-out involves creating a new publicly traded company by selling a minority stake, requiring compliance with securities laws and ongoing disclosure obligations under regulations like the SEC's. Carve-outs, which may include asset sales or spin-offs without public stock issuance, still necessitate adherence to contractual obligations and antitrust laws relevant to the transaction structure. Both structures demand thorough due diligence to navigate legal risks, ensure regulatory approvals, and maintain compliance with corporate governance standards.

Case Studies: Real-World Examples

Equity carve-outs involve a parent company selling a minority stake of a subsidiary to public investors through an initial public offering, as demonstrated by Ford Motor Company's 2015 equity carve-out of its Mustang brand, which raised significant capital while retaining control. Carve-outs typically refer to the sale or spin-off of a business unit or subsidiary, highlighting General Electric's 2016 carve-out of its healthcare division into an independent publicly traded company, enabling sharper operational focus and unlocking shareholder value. Case studies reveal that equity carve-outs favor capital infusion with retained control, while full carve-outs align with strategic refocusing and divestment goals.

Choosing the Right Strategy: Factors to Consider

When choosing between an equity carve-out and a carve-out, companies must evaluate their strategic objectives, such as capital needs, control retention, and market perception. Equity carve-outs allow partial public offerings of a subsidiary's shares, enabling capital raising while maintaining majority ownership. In contrast, full carve-outs involve divesting a business unit entirely, suitable for firms seeking operational focus or debt reduction without ongoing involvement.

Equity carve-out Infographic

libterm.com

libterm.com