A bank loan provides essential funding for personal or business needs, offering flexible repayment terms and competitive interest rates tailored to your financial situation. Understanding the types of loans, eligibility criteria, and application process can help you secure the best deal for your goals. Read on to explore how you can make informed decisions and maximize the benefits of a bank loan.

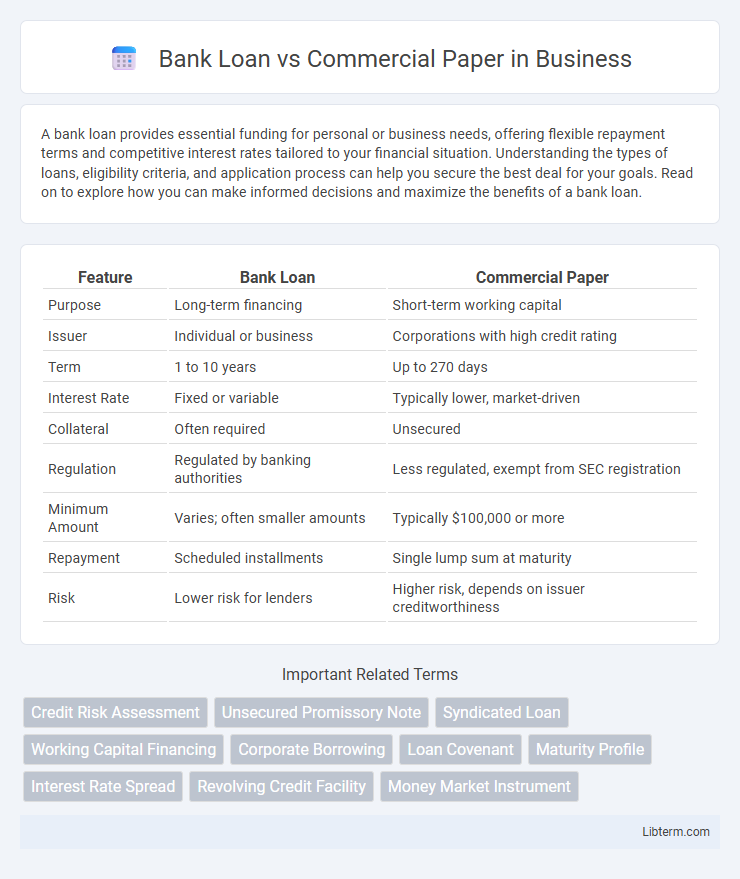

Table of Comparison

| Feature | Bank Loan | Commercial Paper |

|---|---|---|

| Purpose | Long-term financing | Short-term working capital |

| Issuer | Individual or business | Corporations with high credit rating |

| Term | 1 to 10 years | Up to 270 days |

| Interest Rate | Fixed or variable | Typically lower, market-driven |

| Collateral | Often required | Unsecured |

| Regulation | Regulated by banking authorities | Less regulated, exempt from SEC registration |

| Minimum Amount | Varies; often smaller amounts | Typically $100,000 or more |

| Repayment | Scheduled installments | Single lump sum at maturity |

| Risk | Lower risk for lenders | Higher risk, depends on issuer creditworthiness |

Introduction to Bank Loans and Commercial Paper

Bank loans are debt instruments provided by financial institutions, typically involving negotiated terms such as interest rates, repayment schedules, and collateral requirements, making them suitable for long-term financing needs. Commercial paper represents short-term, unsecured promissory notes issued by corporations to meet immediate working capital demands, often sold at a discount with maturities usually under 270 days. Both financial tools serve distinct purposes in the corporate finance landscape, with bank loans offering structured borrowing and commercial paper providing flexible, rapid funding.

Definition and Key Features

A bank loan is a debt financing method where a financial institution provides a borrower with a fixed or revolving credit amount, often requiring collateral and involving longer repayment terms. Commercial paper is an unsecured, short-term promissory note issued by corporations to meet immediate liquidity needs, typically maturing within 270 days without collateral. Key features of bank loans include negotiated interest rates and covenants, while commercial paper offers lower interest rates but carries higher risk due to its unsecured nature and short maturity.

Eligibility Criteria

Bank loans generally require borrowers to demonstrate strong creditworthiness, a detailed business plan, and collateral, with eligibility often favoring established companies and individuals with a solid credit history. Commercial paper eligibility is restricted primarily to financially stable corporations with high credit ratings, as it is typically unsecured and issued for short-term funding needs. Both financing options demand rigorous financial scrutiny, but commercial paper is accessible only to entities deemed low-risk by investors and rating agencies.

Application and Approval Process

Bank loans require a detailed credit evaluation, extensive documentation, and a formal application process often taking several weeks to approve, making them suitable for long-term financing. Commercial paper is issued by corporations with high credit ratings and involves a simpler, faster approval process, typically completed within days to meet short-term funding needs. The application for commercial paper bypasses traditional bank underwriting but demands strong market credibility and compliance with regulatory disclosures.

Interest Rates and Costs

Bank loans typically carry higher interest rates compared to commercial paper due to the longer-term nature and greater risk assessment involved. Commercial paper, usually issued at a discount, offers lower interest costs as a short-term unsecured debt instrument for corporations with high credit ratings. Businesses seeking cost-effective financing often prefer commercial paper for short-term needs, while bank loans suit longer-term funding despite higher interest expenses.

Loan Amounts and Maturity Periods

Bank loans typically involve higher loan amounts ranging from $100,000 to several million dollars, with maturity periods extending from one to ten years or more. Commercial paper is issued in smaller amounts, generally starting at $100,000 up to $1 million, and has very short maturities, usually ranging from a few days to 270 days. The longer maturity of bank loans suits financing long-term projects, while commercial paper is ideal for short-term liquidity needs.

Risk and Security Requirements

Bank loans typically require collateral or security, reducing lender risk and offering borrowers lower interest rates, while commercial paper is unsecured and poses higher risk to investors due to lack of collateral. Commercial paper is usually issued by firms with strong credit ratings, minimizing default risk despite its unsecured nature. Risk for bank loans centers on borrower creditworthiness and asset valuation, whereas commercial paper risk hinges largely on issuer's short-term financial stability and market conditions.

Flexibility and Accessibility

Bank loans offer higher flexibility in terms of customized repayment schedules, loan amounts, and collateral requirements, making them accessible to a broad range of businesses regardless of size and credit history. Commercial paper provides quick access to short-term funding with minimal documentation but is typically limited to large, creditworthy corporations due to its unsecured nature. The accessibility of bank loans extends to small and medium enterprises, while commercial paper markets primarily cater to well-established firms with strong credit ratings.

Advantages and Disadvantages

Bank loans provide long-term financing with fixed interest rates, offering stability and predictable repayment schedules; however, they involve rigorous credit assessments and often require collateral. Commercial paper offers a cost-effective, short-term financing option with lower interest rates and quick access to funds, but it is typically unsecured, posing higher risk, and is limited to financially strong corporations. While bank loans support substantial capital needs for expansion, commercial paper suits temporary liquidity gaps, emphasizing the trade-off between security, cost, and flexibility.

Choosing the Right Financing Option

When selecting between a bank loan and commercial paper, consider the financing duration, cost, and creditworthiness. Bank loans offer longer terms with fixed interest rates suitable for large-scale, long-term projects, while commercial paper provides short-term, lower-cost financing primarily accessed by well-rated companies. Assess the urgency of funds, interest rate environment, and repayment flexibility to determine the most effective financing option for your business.

Bank Loan Infographic

libterm.com

libterm.com