Corporate venture involves established companies investing in or partnering with startups to drive innovation and gain a competitive edge. This strategic approach accelerates growth by leveraging external entrepreneurial talent and emerging technologies. Discover how embracing corporate venture can transform your business and unlock new opportunities in the full article ahead.

Table of Comparison

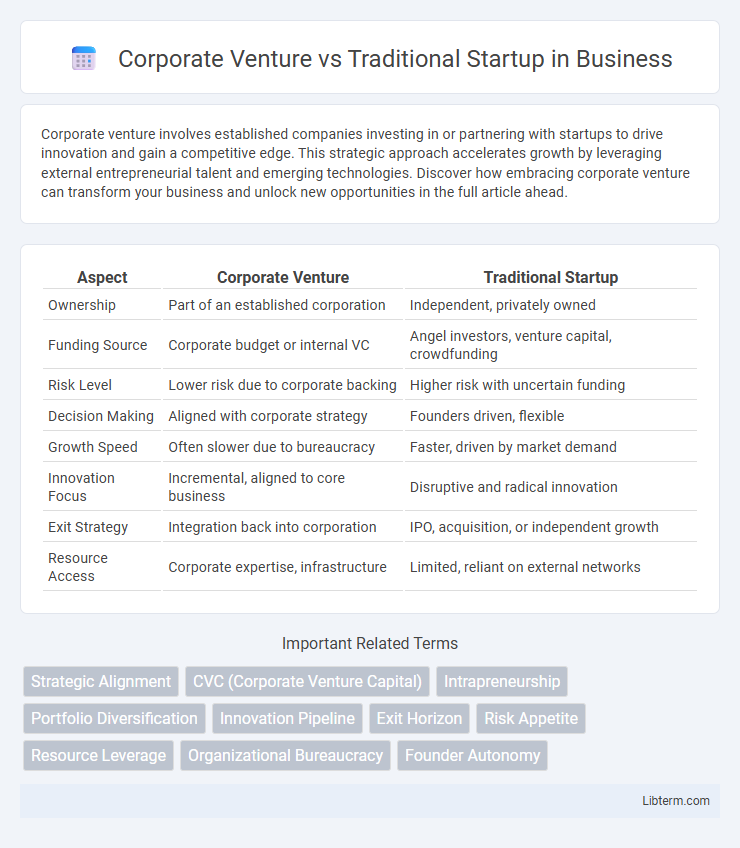

| Aspect | Corporate Venture | Traditional Startup |

|---|---|---|

| Ownership | Part of an established corporation | Independent, privately owned |

| Funding Source | Corporate budget or internal VC | Angel investors, venture capital, crowdfunding |

| Risk Level | Lower risk due to corporate backing | Higher risk with uncertain funding |

| Decision Making | Aligned with corporate strategy | Founders driven, flexible |

| Growth Speed | Often slower due to bureaucracy | Faster, driven by market demand |

| Innovation Focus | Incremental, aligned to core business | Disruptive and radical innovation |

| Exit Strategy | Integration back into corporation | IPO, acquisition, or independent growth |

| Resource Access | Corporate expertise, infrastructure | Limited, reliant on external networks |

Understanding Corporate Venture and Traditional Startup Models

Corporate venture models leverage the resources, market access, and established networks of large corporations to accelerate innovation, often focusing on strategic alignment with the parent company's goals. Traditional startup models prioritize agility, rapid iteration, and independent decision-making, relying heavily on venture capital funding to scale. Understanding these distinctions highlights how corporate ventures balance risk with corporate backing, while startups emphasize disruptive potential and scalability in dynamic markets.

Key Differences Between Corporate Ventures and Traditional Startups

Corporate ventures often benefit from established resources, brand reputation, and access to existing customer bases, enabling faster market entry compared to traditional startups. Traditional startups typically face higher uncertainty and resource constraints but maintain greater agility and freedom to innovate without corporate oversight. The governance structure in corporate ventures involves alignment with parent company goals, while startups operate with independent decision-making and risk tolerance.

Funding Sources: Corporate Backing vs. Independent Investment

Corporate ventures primarily rely on funding from their parent company, leveraging substantial financial resources, industry expertise, and strategic partnerships to drive innovation and scale rapidly. Traditional startups depend on independent investment sources such as angel investors, venture capital firms, and crowdfunding platforms, which often entails securing multiple rounds of funding and demonstrating growth potential to attract capital. The difference in funding origins significantly impacts risk tolerance, control dynamics, and growth trajectories between corporate-backed ventures and independent startups.

Innovation Approaches: In-house Development vs. Disruptive Experimentation

Corporate ventures emphasize in-house development, leveraging existing resources and expertise to drive incremental innovation aligned with strategic goals. Traditional startups prioritize disruptive experimentation, rapidly testing novel ideas and pivoting based on market feedback to achieve breakthrough innovation. This contrast highlights corporate ventures' focus on refining core competencies versus startups' agility in exploring uncharted market opportunities.

Risk Appetite and Management Styles

Corporate ventures exhibit lower risk appetite due to their integration within established entities, prioritizing strategic alignment and long-term value over rapid growth. Their management style tends to be formal, structured, and process-oriented, emphasizing governance, compliance, and risk mitigation. Traditional startups embrace higher risk tolerance, driven by innovation and market disruption, with flexible, adaptive management focused on experimentation and rapid decision-making.

Speed to Market and Scalability Comparison

Corporate ventures leverage established resources and market access, enabling faster speed to market compared to traditional startups, which often face longer development cycles due to limited capital and infrastructure. Scalability in corporate ventures benefits from existing organizational support and customer bases, allowing rapid expansion without the constraints typical in early-stage startups. However, traditional startups may achieve higher flexibility in pivoting business models, impacting their scalability pace differently than corporate-backed initiatives.

Talent Acquisition and Organizational Culture

Corporate ventures attract talent by leveraging established brand reputation, offering job security, and access to extensive resources, differentiating from traditional startups that appeal through high-risk, high-reward opportunities and rapid decision-making environments. Organizational culture in corporate ventures emphasizes structured processes, formal hierarchies, and alignment with parent company values, whereas traditional startups foster agile, innovative cultures with flexible roles and decentralized decision-making. The contrasting environments influence talent acquisition strategies, where corporate ventures prioritize experienced professionals aligning with corporate standards, and startups seek entrepreneurial mindset and adaptability.

Strategic Objectives and Long-Term Vision

Corporate ventures prioritize strategic objectives aligned with the parent company's innovation goals, leveraging existing resources to enter new markets or technologies. Traditional startups focus on rapid growth and disruptive innovation driven by market demand and investor returns. Long-term vision in corporate ventures centers on sustainable integration and synergy within the corporation, whereas startups aim for scalability and potential acquisition or IPO.

Challenges Faced by Corporate Ventures and Traditional Startups

Corporate ventures often face challenges such as navigating internal bureaucracy, aligning innovation with existing organizational goals, and managing resource allocation within a corporate structure. Traditional startups struggle with limited funding, market entry barriers, and building brand recognition from scratch. Both models encounter difficulties in scaling rapidly, but corporate ventures benefit from established networks while startups rely heavily on agility and lean operations.

Choosing the Right Path: Factors for Entrepreneurs and Corporations

Entrepreneurs and corporations must evaluate resources, risk tolerance, and market agility when choosing between corporate ventures and traditional startups; corporate ventures benefit from established infrastructure and funding but may face bureaucratic constraints. Traditional startups offer greater flexibility and faster decision-making, appealing to founders seeking innovation with high scalability potential. Strategic alignment with long-term goals, innovation speed, and access to industry networks are critical factors influencing the optimal path for sustainable growth.

Corporate Venture Infographic

libterm.com

libterm.com