Private negotiation offers a confidential environment where parties can discuss terms and resolve disputes without public scrutiny, ensuring discretion and control over the process. This approach often leads to faster agreements and reduces legal costs by avoiding lengthy court procedures. Explore the benefits of private negotiation and how it can protect your interests throughout the negotiation process.

Table of Comparison

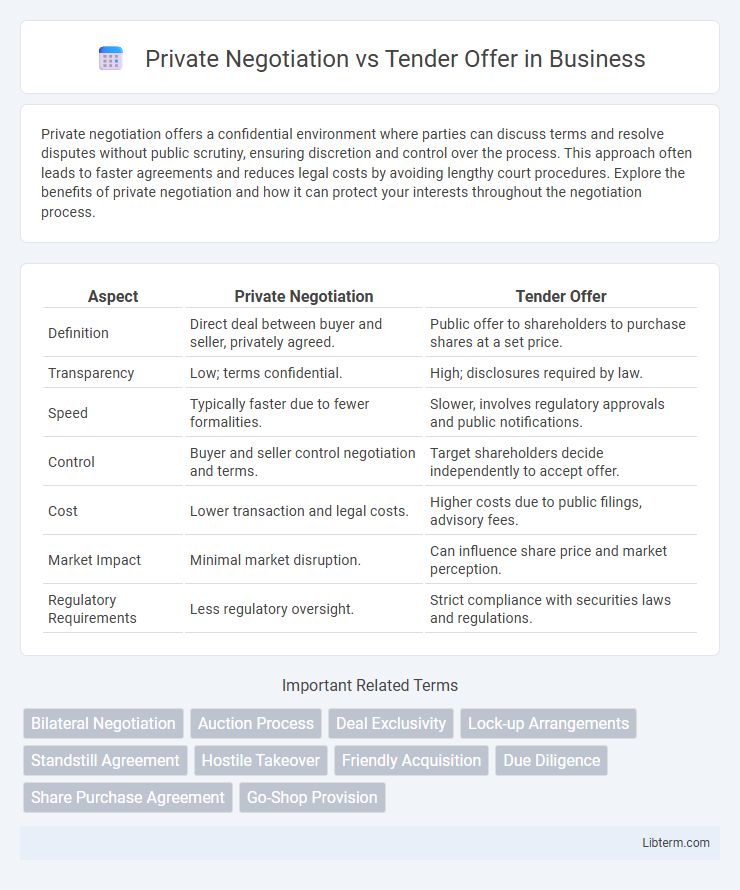

| Aspect | Private Negotiation | Tender Offer |

|---|---|---|

| Definition | Direct deal between buyer and seller, privately agreed. | Public offer to shareholders to purchase shares at a set price. |

| Transparency | Low; terms confidential. | High; disclosures required by law. |

| Speed | Typically faster due to fewer formalities. | Slower, involves regulatory approvals and public notifications. |

| Control | Buyer and seller control negotiation and terms. | Target shareholders decide independently to accept offer. |

| Cost | Lower transaction and legal costs. | Higher costs due to public filings, advisory fees. |

| Market Impact | Minimal market disruption. | Can influence share price and market perception. |

| Regulatory Requirements | Less regulatory oversight. | Strict compliance with securities laws and regulations. |

Introduction to Private Negotiation and Tender Offer

Private negotiation involves direct, confidential discussions between a buyer and seller to reach an agreement on asset or company acquisition, often allowing for tailored terms and faster execution. In contrast, a tender offer is a public proposal by an acquirer to purchase shares from shareholders at a specified price, typically at a premium to market value, aiming to gain control or increase ownership stake. While private negotiations prioritize discretion and personalized arrangements, tender offers emphasize transparency and broad shareholder participation.

Key Differences Between Private Negotiation and Tender Offer

Private negotiations involve confidential, direct discussions between specific parties for acquiring shares or assets, often tailored to individual terms without public disclosure. Tender offers are public proposals to all shareholders to sell their shares at a specified price within a set timeframe, typically regulated and designed to accumulate control efficiently. The key differences lie in transparency, scope of participants, transaction speed, and regulatory requirements, with private negotiations being discreet and flexible, whereas tender offers are formal, public, and structured.

Legal Framework Governing Both Approaches

The legal framework governing private negotiations often involves confidential contracts and negotiated terms under securities laws, emphasizing privacy and limited disclosure requirements. In contrast, tender offers are heavily regulated by the Securities Exchange Act of 1934, requiring public disclosure, formal filings with the SEC, and strict timelines to protect shareholders and ensure transparency. Both approaches demand compliance with rules on insider trading, anti-fraud provisions, and shareholder rights, but tender offers are subject to more rigorous statutory oversight and procedural safeguards.

Pros and Cons of Private Negotiation

Private negotiation allows for confidential and flexible deal terms, enabling parties to customize agreements without public scrutiny, which can preserve company reputation and reduce competitive pressure. However, it may limit market exposure, potentially resulting in lower valuation and fewer bidding parties compared to a tender offer. The lack of transparency in private negotiation can also raise concerns about fairness and regulatory compliance.

Advantages and Disadvantages of Tender Offers

Tender offers provide a transparent and competitive process for acquiring a substantial number of shares directly from shareholders at a fixed price, often resulting in quicker control transfers compared to private negotiations. The advantages include price certainty for shareholders and the ability to reach a large shareholder base efficiently, while disadvantages involve higher regulatory scrutiny, potential for hostile bids, and the risk of overpaying due to competitive bid escalation. Tender offers can generate market volatility and may require extensive disclosure, increasing costs and complexity for the offeror.

Strategic Considerations for Buyers and Sellers

Private negotiation offers buyers and sellers greater flexibility in structuring deals, allowing for tailored terms and confidentiality that can preserve competitive advantages and reduce market disruption. Tender offers provide a transparent, regulatory-compliant process that can expedite transactions and appeal to a broader shareholder base, but may involve higher costs and less control over deal timing. Strategic considerations include assessing the urgency of the sale, desired level of disclosure, potential impact on stock prices, and the importance of maintaining strategic relationships throughout the transaction.

Impact on Shareholder Value and Company Control

Private negotiation enables targeted shareholder transactions, often preserving company control by limiting the pool of buyers and avoiding market speculation, which can maintain or enhance shareholder value through strategic alignment. Tender offers, publicly solicited, can rapidly increase shareholder liquidity but may trigger premium prices and potential changes in company control, possibly diluting existing ownership and impacting long-term shareholder value. The choice between private negotiation and tender offer depends on the desired balance between immediate shareholder returns and maintaining strategic company governance.

Regulatory and Disclosure Requirements

Private negotiations typically involve limited regulatory scrutiny and fewer disclosure obligations since transactions occur directly between parties without public solicitation. Tender offers trigger extensive regulatory requirements, including filings with the Securities and Exchange Commission (SEC) such as Schedule 14D-9, mandatory disclosure of offer terms, and compliance with the Williams Act to protect shareholders. Disclosure rules in tender offers aim to ensure transparency and fairness, contrasting with private negotiations' confidentiality and minimal public disclosure.

Case Studies: Real-World Examples

Private negotiation and tender offer strategies have shaped significant M&A deals, such as Dell's privatization in 2013 through a private negotiation led by Michael Dell and Silver Lake Partners, contrasting with Kraft Heinz's 2015 tender offer acquisition of Kraft Foods Group. In Alibaba's 2012 privatization, a private negotiation enabled founder Jack Ma to gain greater control, while Facebook's tender offer for WhatsApp in 2014 demonstrated rapid stake acquisition via public bid. These case studies highlight how private negotiations often secure deeper strategic alignment, whereas tender offers emphasize speed and transparency in shareholder transactions.

Choosing the Right Approach for Your Transaction

Selecting between private negotiation and tender offer depends on transaction goals, confidentiality needs, and market conditions. Private negotiation suits transactions requiring discretion, tailored terms, and direct buyer-seller engagement, often seen in strategic acquisitions or sensitive asset sales. Tender offers work well in competitive environments or when speed and broad market access are critical, enabling multiple shareholders to participate under uniform conditions.

Private Negotiation Infographic

libterm.com

libterm.com