Angel investors provide crucial early-stage funding to startups, often offering capital in exchange for equity to help new businesses grow and succeed. These investors not only inject financial resources but also bring valuable expertise, mentorship, and network connections to foster innovation. Discover how angel investors can transform your entrepreneurial journey by reading the rest of this article.

Table of Comparison

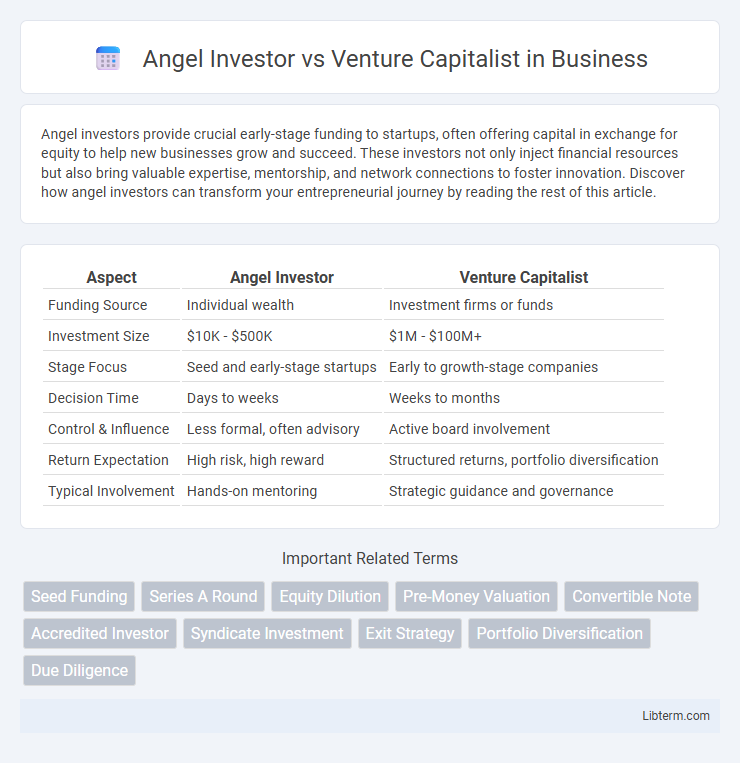

| Aspect | Angel Investor | Venture Capitalist |

|---|---|---|

| Funding Source | Individual wealth | Investment firms or funds |

| Investment Size | $10K - $500K | $1M - $100M+ |

| Stage Focus | Seed and early-stage startups | Early to growth-stage companies |

| Decision Time | Days to weeks | Weeks to months |

| Control & Influence | Less formal, often advisory | Active board involvement |

| Return Expectation | High risk, high reward | Structured returns, portfolio diversification |

| Typical Involvement | Hands-on mentoring | Strategic guidance and governance |

Introduction: Understanding Investment Options

Angel investors are individuals who provide early-stage funding to startups, often contributing personal capital and mentorship, typically investing amounts ranging from $25,000 to $100,000. Venture capitalists manage pooled funds from institutions or high-net-worth individuals, offering larger investments usually starting at $1 million, targeting high-growth potential companies in exchange for equity. Understanding these investment options is crucial for entrepreneurs seeking capital tailored to their business stage and growth trajectory.

Defining Angel Investors

Angel investors are high-net-worth individuals who provide early-stage capital to startups, often in exchange for equity or convertible debt. They typically invest their own funds and offer not only financial support but also mentorship, industry connections, and strategic guidance. Unlike venture capitalists, angel investors usually engage at the seed or pre-seed phase, taking higher risks in nascent companies before scaling and institutional funding rounds.

Defining Venture Capitalists

Venture capitalists are professional investors who manage pooled funds from institutions and high-net-worth individuals to invest in high-growth startups and emerging companies. They conduct rigorous due diligence, offer strategic guidance, and seek significant equity stakes to maximize returns within a defined investment horizon. Unlike angel investors, venture capitalists typically operate within structured firms and focus on scaling businesses through multiple funding rounds.

Key Differences Between Angel Investors and Venture Capitalists

Angel investors typically invest their own personal funds in early-stage startups, often providing smaller amounts ranging from $10,000 to $500,000, while venture capitalists manage pooled funds from various institutions and invest larger sums, usually starting at $1 million or more. Angel investors often take a more hands-on mentorship role with startups, offering guidance and industry connections, whereas venture capitalists usually focus on strategic growth, scaling operations, and preparing companies for exit events such as acquisitions or IPOs. The risk tolerance of angel investors tends to be higher due to earlier-stage investments in unproven companies, while venture capitalists prefer startups with some market validation and established revenue streams.

Funding Stages and Amounts

Angel investors typically fund early-stage startups during seed or pre-seed rounds, providing amounts ranging from $25,000 to $500,000. Venture capitalists invest in later funding stages such as Series A and beyond, with investments often starting at $1 million and reaching tens of millions. The funding scale and stage distinction reflect the risk tolerance and involvement level between angel investors and venture capital firms.

Decision-making Processes

Angel investors typically make quicker, more flexible decisions based on personal judgment and potential for high returns, often investing their own capital. Venture capitalists employ a rigorous, data-driven decision-making process involving comprehensive due diligence, market analysis, and investment committee approvals. The structured approach of venture capitalists contrasts with the more intuitive and faster decisions of angel investors.

Involvement and Value-Add

Angel investors typically provide early-stage funding and offer personalized mentorship, leveraging their industry expertise and networks to guide startups through initial growth phases. Venture capitalists engage in later funding rounds, delivering substantial capital and strategic resources while often requiring board seats to influence company decisions and scale operations. Both play crucial roles, but angels tend to focus more on hands-on support, whereas venture capitalists emphasize structured growth and governance oversight.

Pros and Cons for Startups

Angel investors offer startups early-stage funding with fewer formalities and often provide valuable mentorship, but their capital is usually limited compared to venture capitalists. Venture capitalists bring larger investment amounts and extensive networks, enabling rapid scaling, yet they often impose stricter terms and demand significant equity, which may dilute founders' control. Startups must weigh the trade-off between personalized support and greater resources against potential loss of autonomy and increased pressure for high returns.

Choosing the Right Investor for Your Business

Angel investors typically invest their own funds in early-stage startups, offering flexible terms and often providing valuable mentorship. Venture capitalists manage pooled funds from multiple investors, focusing on scalable businesses with higher growth potential and requiring more substantial capital injections. Choosing the right investor depends on your business stage, funding needs, and long-term growth strategy, with angel investors better suited for seed funding and venture capitalists ideal for rapid expansion.

Conclusion: Making an Informed Decision

Angel investors provide early-stage funding often accompanied by mentorship, making them ideal for startups seeking initial support and flexible terms. Venture capitalists, managing larger funds and targeting scalable ventures, typically require equity stakes and formal due diligence, suited for companies aiming rapid growth. Choosing between them depends on your startup's stage, funding needs, and willingness to share control while aligning with strategic goals.

Angel Investor Infographic

libterm.com

libterm.com