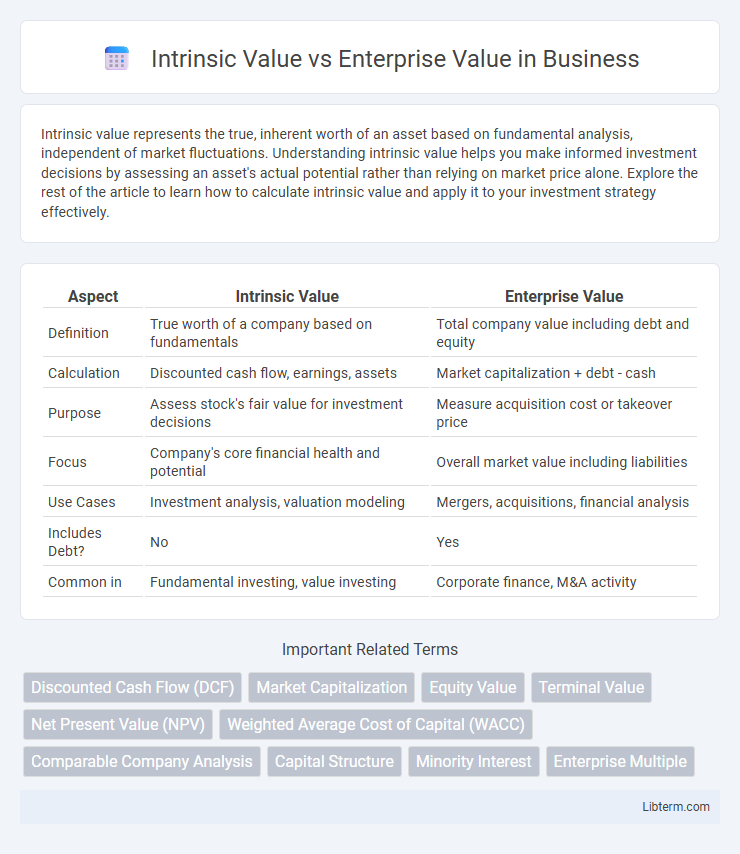

Intrinsic value represents the true, inherent worth of an asset based on fundamental analysis, independent of market fluctuations. Understanding intrinsic value helps you make informed investment decisions by assessing an asset's actual potential rather than relying on market price alone. Explore the rest of the article to learn how to calculate intrinsic value and apply it to your investment strategy effectively.

Table of Comparison

| Aspect | Intrinsic Value | Enterprise Value |

|---|---|---|

| Definition | True worth of a company based on fundamentals | Total company value including debt and equity |

| Calculation | Discounted cash flow, earnings, assets | Market capitalization + debt - cash |

| Purpose | Assess stock's fair value for investment decisions | Measure acquisition cost or takeover price |

| Focus | Company's core financial health and potential | Overall market value including liabilities |

| Use Cases | Investment analysis, valuation modeling | Mergers, acquisitions, financial analysis |

| Includes Debt? | No | Yes |

| Common in | Fundamental investing, value investing | Corporate finance, M&A activity |

Understanding Intrinsic Value: A Fundamental Overview

Intrinsic value represents the true worth of an asset based on its fundamental characteristics, including cash flow projections, growth potential, and risk factors. It is calculated through discounted cash flow (DCF) analysis or other valuation methods that assess an asset's inherent financial health and future earning capacity. Investors use intrinsic value to identify undervalued securities by comparing it to the current market price, enabling more informed investment decisions.

What is Enterprise Value? Key Components Explained

Enterprise Value (EV) represents the total value of a company, encompassing market capitalization, total debt, minority interest, and preferred shares, minus cash and cash equivalents. It provides a comprehensive measure reflecting the cost to acquire a business, including debt obligations beyond just equity value. Key components of EV include equity value, net debt (debt minus cash), and non-controlling interests, offering investors a clearer picture of a company's overall financial health and acquisition worth.

Calculating Intrinsic Value: Methods and Models

Calculating intrinsic value involves models such as Discounted Cash Flow (DCF), which projects future cash flows and discounts them to present value using an appropriate discount rate. The Dividend Discount Model (DDM) estimates intrinsic value based on expected dividends and growth rates, primarily for dividend-paying companies. Other methods include Residual Income Valuation and Earnings Power Value, which assess a company's fundamental worth by analyzing earnings and book value.

Determining Enterprise Value: Step-by-Step Approach

Determining Enterprise Value involves calculating a company's total market capitalization plus its net debt, which includes debt minus cash and cash equivalents, to assess the full value of the business. Start by identifying the market capitalization through multiplying the current share price by total outstanding shares, then add total debt, including long-term and short-term liabilities. Subtracting cash and cash equivalents from this sum provides the net debt, resulting in the calculation of Enterprise Value essential for merger and acquisition analyses and investment decisions.

Intrinsic Value vs Enterprise Value: Core Differences

Intrinsic value represents the true worth of a company based on fundamental analysis of assets, earnings, and cash flows, reflecting its real economic value to investors. Enterprise value measures the total value of a company, including market capitalization, debt, and cash, providing a comprehensive picture of a firm's overall financial standing. The core difference lies in intrinsic value focusing on inherent worth through detailed valuation models, while enterprise value captures market perception and capital structure impact.

Role of Intrinsic Value in Investment Decisions

Intrinsic value represents the true, inherent worth of an asset based on fundamental analysis, including cash flow projections and risk assessments. It guides investors in making informed decisions by highlighting whether a stock is undervalued or overvalued compared to its market price. Enterprise value, encompassing market capitalization, debt, and cash, serves more as a comprehensive measure for mergers or acquisitions rather than direct investment value judgment.

Why Enterprise Value Matters in Company Analysis

Enterprise Value (EV) represents the total value of a company, encompassing market capitalization, debt, and cash, making it essential for evaluating a firm's true cost to acquire. Unlike Intrinsic Value, which estimates a company's actual worth based on fundamentals, EV provides a comprehensive snapshot reflecting both equity and debt obligations. This makes EV crucial for investors and analysts when comparing companies with different capital structures or assessing takeover targets.

Limitations of Intrinsic and Enterprise Value Metrics

Intrinsic value calculations often rely on subjective assumptions about future cash flows and discount rates, making them sensitive to estimation errors and potentially misleading. Enterprise value does not account for the company's operational risks or future growth potential and ignores off-balance-sheet liabilities, which can distort the true economic worth. Both metrics may fail to reflect market conditions or investor sentiment, limiting their effectiveness as standalone valuation tools.

Practical Examples: Comparing Intrinsic Value and Enterprise Value

Intrinsic value measures a company's true worth based on discounted future cash flows, highlighting the fundamental value an investor derives from ownership. Enterprise value calculates the total value of a business, including market capitalization, debt, and cash, useful in assessing acquisition prices. For example, a tech firm with a market cap of $500 million, debt of $100 million, and cash reserves of $50 million has an enterprise value of $550 million, while its intrinsic value might be estimated at $600 million based on projected earnings and growth.

Choosing the Right Valuation Method for Your Needs

Choosing between intrinsic value and enterprise value depends on the specific financial analysis context and investment goals. Intrinsic value focuses on the present value of expected future cash flows, ideal for assessing stock price fairness, while enterprise value provides a comprehensive measure of a company's total market value including debt, useful for mergers and acquisitions or comparing companies with different capital structures. Evaluating your purpose--whether equity valuation, acquisition analysis, or financial health assessment--guides the selection of the appropriate valuation method.

Intrinsic Value Infographic

libterm.com

libterm.com