Market capitalization reflects the total value of a company's outstanding shares, offering a clear snapshot of its size and market worth. Investors often use market cap to compare companies across industries, assess growth potential, and make informed investment decisions. Explore this article to understand how market capitalization impacts your investment strategy and financial goals.

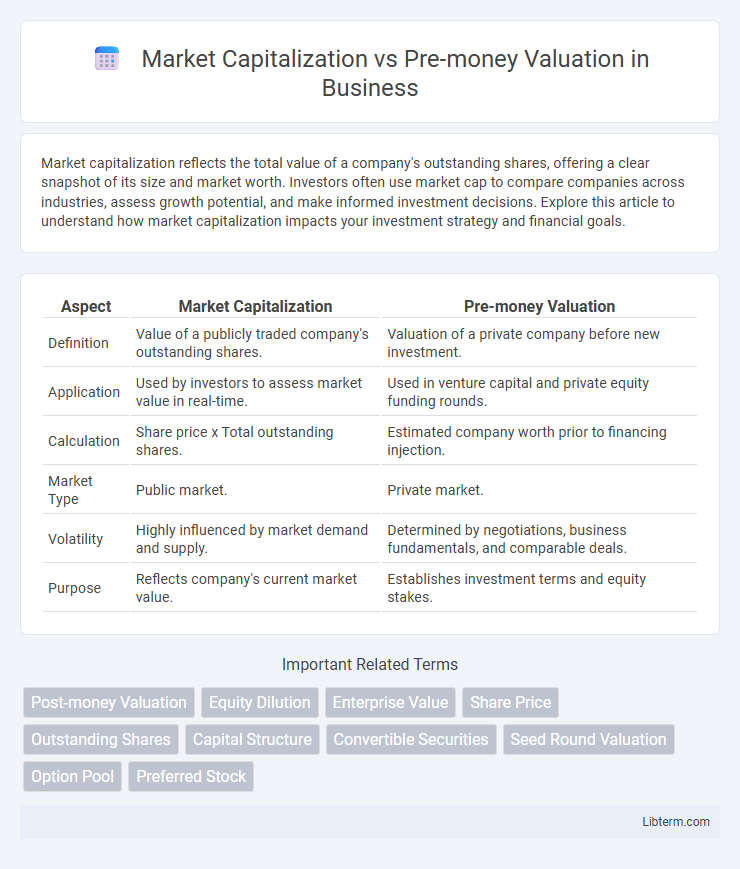

Table of Comparison

| Aspect | Market Capitalization | Pre-money Valuation |

|---|---|---|

| Definition | Value of a publicly traded company's outstanding shares. | Valuation of a private company before new investment. |

| Application | Used by investors to assess market value in real-time. | Used in venture capital and private equity funding rounds. |

| Calculation | Share price x Total outstanding shares. | Estimated company worth prior to financing injection. |

| Market Type | Public market. | Private market. |

| Volatility | Highly influenced by market demand and supply. | Determined by negotiations, business fundamentals, and comparable deals. |

| Purpose | Reflects company's current market value. | Establishes investment terms and equity stakes. |

Introduction to Market Capitalization and Pre-Money Valuation

Market capitalization represents the total market value of a publicly traded company's outstanding shares, calculated by multiplying the current stock price by the total number of outstanding shares. Pre-money valuation refers to a private company's estimated worth immediately before a new round of funding or investment, reflecting the company's value excluding the new capital injection. Understanding the distinction between these financial metrics is crucial for investors and entrepreneurs evaluating company worth and investment potential in different market contexts.

Defining Market Capitalization

Market capitalization represents the total market value of a publicly traded company's outstanding shares, calculated by multiplying the current stock price by the total number of shares outstanding. This metric reflects the company's size and investor perception in the stock market, serving as a key indicator for investors and analysts. Unlike pre-money valuation, which estimates a company's value before new investment rounds, market capitalization is based on real-time market pricing and public trading activity.

Understanding Pre-Money Valuation

Pre-money valuation refers to the value of a company before receiving outside investment or funding, serving as a critical metric for investors to determine ownership percentages in new financing rounds. Unlike market capitalization, which reflects the public market's current valuation based on share price and number of outstanding shares, pre-money valuation is often negotiated during private funding rounds and considers potential growth and risk factors. Understanding pre-money valuation helps stakeholders assess the company's worth before capital infusion, guiding investment decisions and equity allocation.

Key Differences Between Market Capitalization and Pre-Money Valuation

Market capitalization represents the total market value of a company's outstanding shares, calculated by multiplying the current stock price by the total number of shares outstanding, reflecting public market perception. Pre-money valuation refers to the estimated value of a company before receiving new external funding or investment, often used in private equity and venture capital to negotiate ownership stakes. The key difference lies in market capitalization being a real-time public market metric, whereas pre-money valuation is a negotiated figure used during private financing rounds.

How Market Capitalization is Calculated

Market capitalization is calculated by multiplying the current share price by the total number of outstanding shares of a publicly traded company, reflecting its total market value. Pre-money valuation represents a company's estimated worth before new investment or financing rounds, often used in private funding contexts. Understanding the difference highlights that market capitalization depends on market sentiment and public trading, while pre-money valuation is based on negotiated investment values.

Methods for Determining Pre-Money Valuation

Pre-money valuation is typically determined using methods like the discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions, each leveraging financial projections and market data to estimate a startup's worth before new investment. The DCF method calculates present value based on expected future cash flows, while comparable company analysis benchmarks valuation multiples from similar businesses. Pre-money valuation contrasts with market capitalization, which is simply the total market value of a company's outstanding shares, reflecting current investor sentiment rather than detailed intrinsic valuation.

Importance of Market Capitalization in Public Markets

Market capitalization represents the total value of a company's outstanding shares in public markets, serving as a real-time indicator of company size and investor sentiment. Unlike pre-money valuation, which estimates a private company's worth before new funding, market capitalization reflects actual market dynamics and liquidity. Understanding market capitalization is crucial for investors to assess market performance, compare companies, and make informed decisions in public equity trading.

Role of Pre-Money Valuation in Startup Fundraising

Pre-money valuation represents a startup's value before new capital investment, directly influencing the equity stake investors receive during fundraising rounds. Unlike market capitalization, which reflects the total market value of a publicly traded company's outstanding shares, pre-money valuation is a negotiated figure critical for determining ownership dilution in private startups. Accurate pre-money valuation ensures fair investor returns and startup control retention while guiding strategic funding decisions.

Impact on Investors: Market Capitalization vs Pre-Money Valuation

Market capitalization reflects the total value of a company's outstanding shares at current market prices, providing investors with a real-time valuation that affects liquidity and trading decisions. Pre-money valuation estimates a startup's worth before new investment, guiding investors on equity stake and potential dilution during funding rounds. Understanding both metrics helps investors assess risk, ownership percentage, and the company's growth potential accurately.

Choosing the Right Metric: Practical Considerations

Choosing between market capitalization and pre-money valuation depends on the context of the investment and business stage. Market capitalization reflects the current market value of a publicly traded company's outstanding shares, providing real-time investor sentiment and liquidity insight. Pre-money valuation is essential for private companies during funding rounds, focusing on the company's worth before new capital infusion, which helps investors assess ownership dilution and funding impact.

Market Capitalization Infographic

libterm.com

libterm.com