A vertical merger involves the combination of two companies operating at different stages within the same industry's supply chain, such as a manufacturer merging with a supplier or distributor. This type of merger can enhance operational efficiencies, reduce costs, and improve supply chain coordination, ultimately strengthening the merged entity's competitive edge. Discover how vertical mergers impact market dynamics and what they mean for your business strategy in the rest of this article.

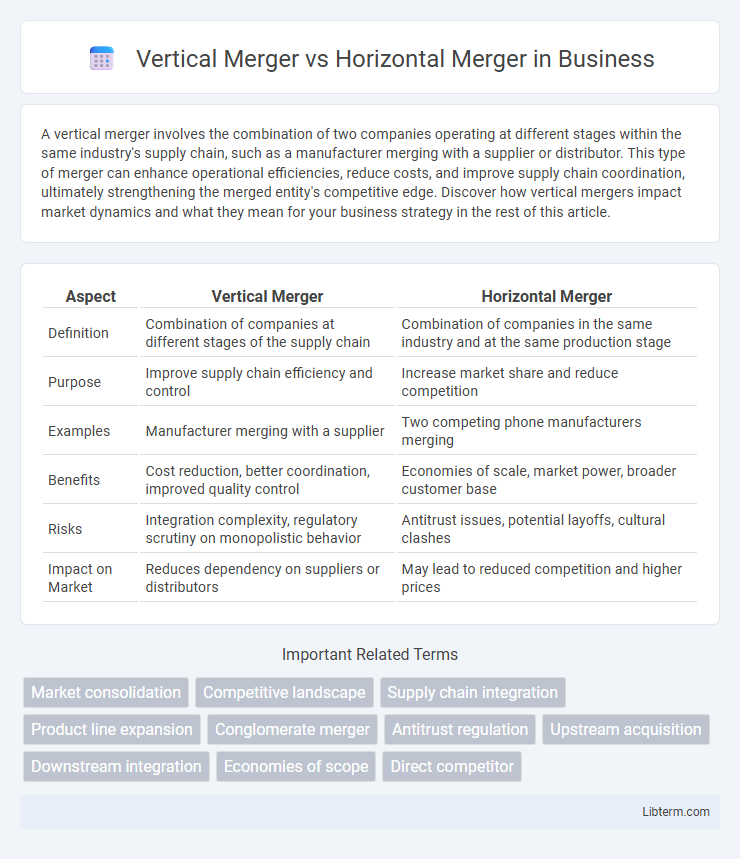

Table of Comparison

| Aspect | Vertical Merger | Horizontal Merger |

|---|---|---|

| Definition | Combination of companies at different stages of the supply chain | Combination of companies in the same industry and at the same production stage |

| Purpose | Improve supply chain efficiency and control | Increase market share and reduce competition |

| Examples | Manufacturer merging with a supplier | Two competing phone manufacturers merging |

| Benefits | Cost reduction, better coordination, improved quality control | Economies of scale, market power, broader customer base |

| Risks | Integration complexity, regulatory scrutiny on monopolistic behavior | Antitrust issues, potential layoffs, cultural clashes |

| Impact on Market | Reduces dependency on suppliers or distributors | May lead to reduced competition and higher prices |

Introduction to Mergers: Vertical vs Horizontal

Vertical mergers combine companies operating at different stages of the supply chain, enhancing control over production, distribution, and reducing costs. Horizontal mergers involve the union of firms within the same industry and market level, aiming to increase market share, reduce competition, and achieve economies of scale. Understanding the distinctions helps businesses strategically optimize operational efficiency and competitive positioning.

Definition of Vertical Merger

A vertical merger occurs when two companies operating at different stages of the production process or supply chain combine, such as a manufacturer merging with a supplier or distributor. This type of merger aims to increase efficiency, reduce costs, and improve supply chain coordination by integrating upstream and downstream operations. Vertical mergers contrast with horizontal mergers, which involve companies at the same industry level competing in similar product lines.

Definition of Horizontal Merger

A horizontal merger occurs when two companies operating in the same industry and at the same stage of production combine to increase their market share and reduce competition. This type of merger aims to achieve economies of scale, enhance product offerings, and expand customer base by consolidating similar operations. Unlike vertical mergers, which involve companies at different stages of the supply chain, horizontal mergers focus on integrating direct competitors.

Key Differences Between Vertical and Horizontal Mergers

Vertical mergers occur between companies operating at different stages of the same supply chain, enhancing control over production and distribution processes. Horizontal mergers involve companies in the same industry and at the same stage of production, aiming to increase market share and reduce competition. Key differences include the strategic objectives, with vertical mergers focusing on efficiency and cost reduction through integration, while horizontal mergers emphasize market dominance and economies of scale.

Strategic Goals of Vertical Mergers

Vertical mergers aim to enhance supply chain efficiency by integrating firms operating at different stages of production or distribution, reducing transaction costs and improving control over raw materials or product delivery. These mergers strategically target cost reduction, increased market power through improved coordination, and mitigation of supply uncertainties. Vertical integration can also lead to stronger competitive advantages by fostering innovation and enabling better quality control across the production process.

Strategic Goals of Horizontal Mergers

Horizontal mergers primarily aim to increase market share by combining companies operating in the same industry and at the same production stage. These mergers seek to reduce competition, achieve economies of scale, and enhance bargaining power with suppliers and customers. Strategic goals often include expanding geographic reach, diversifying product offerings within the same market, and improving operational efficiency.

Advantages of Vertical Mergers

Vertical mergers enhance supply chain efficiency by integrating different stages of production, reducing costs and improving coordination. This consolidation leads to greater control over raw materials and distribution channels, minimizing dependency on external suppliers. Improved operational synergy from vertical mergers can result in faster production times and increased market competitiveness.

Advantages of Horizontal Mergers

Horizontal mergers enhance market share by combining companies operating in the same industry, leading to increased economies of scale and reduction in production costs. They also improve competitive positioning by eliminating direct competitors, allowing for greater pricing power and increased market influence. Enhanced research and development capabilities result from pooled resources and expertise, driving innovation and accelerating product development.

Risks and Challenges of Both Merger Types

Vertical mergers face risks such as supply chain integration difficulties, cultural clashes between different operational stages, and regulatory scrutiny over potential monopolistic practices. Horizontal mergers encounter challenges including antitrust concerns, overlap in product lines leading to redundancy and layoffs, and potential loss of market competition that can trigger consumer backlash. Both merger types require careful strategic alignment and robust due diligence to mitigate operational disruption and compliance risks.

Real-World Examples: Vertical and Horizontal Mergers

Vertical mergers occur when companies at different stages of the supply chain combine, such as Disney's acquisition of Pixar, integrating content creation with distribution powers. Horizontal mergers involve companies within the same industry and stage, like Facebook's acquisition of Instagram, aimed at consolidating market share and reducing competition. These real-world examples highlight strategic objectives: vertical mergers enhance control and efficiency across production, while horizontal mergers focus on expanding market dominance and customer base.

Vertical Merger Infographic

libterm.com

libterm.com