Revenue sharing offers a strategic approach where businesses or content creators receive a portion of the income generated from their products or services, fostering collaborative growth and motivation. This model aligns the interests of all parties involved, ensuring fair compensation based on actual performance and contribution. Explore the rest of the article to understand how revenue sharing can impact your financial success.

Table of Comparison

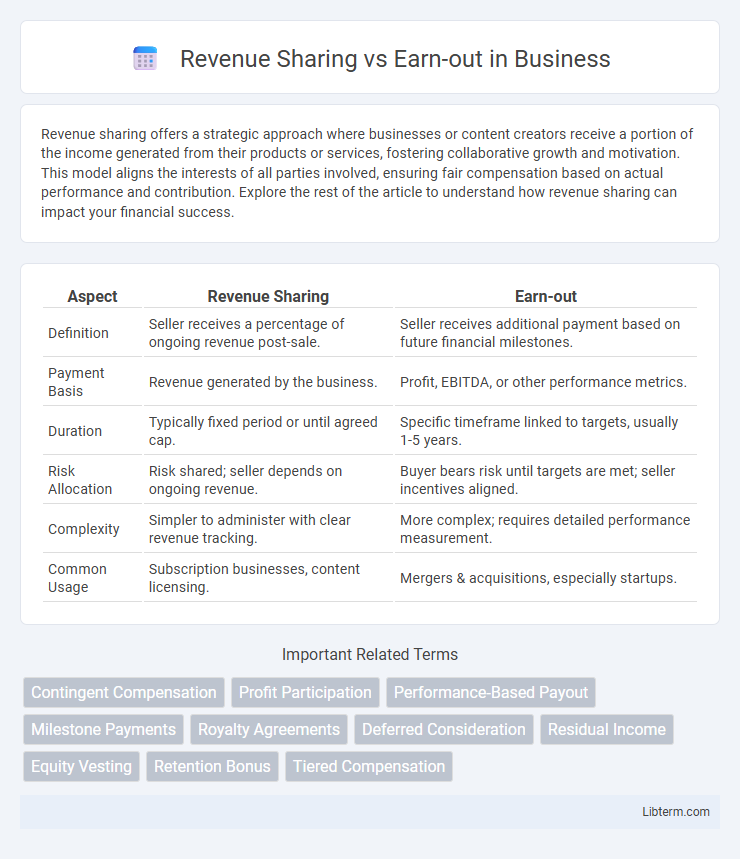

| Aspect | Revenue Sharing | Earn-out |

|---|---|---|

| Definition | Seller receives a percentage of ongoing revenue post-sale. | Seller receives additional payment based on future financial milestones. |

| Payment Basis | Revenue generated by the business. | Profit, EBITDA, or other performance metrics. |

| Duration | Typically fixed period or until agreed cap. | Specific timeframe linked to targets, usually 1-5 years. |

| Risk Allocation | Risk shared; seller depends on ongoing revenue. | Buyer bears risk until targets are met; seller incentives aligned. |

| Complexity | Simpler to administer with clear revenue tracking. | More complex; requires detailed performance measurement. |

| Common Usage | Subscription businesses, content licensing. | Mergers & acquisitions, especially startups. |

Introduction to Revenue Sharing and Earn-out Models

Revenue sharing and earn-out models are crucial financial arrangements in business acquisitions and partnerships, where revenue sharing allocates a percentage of ongoing revenues to stakeholders, aligning interests through continuous performance incentives. Earn-out models tie a portion of the purchase price to the future financial performance of the acquired company, ensuring sellers meet specific revenue or profit targets post-transaction. Both models facilitate risk management and incentivize growth, but revenue sharing emphasizes ongoing collaboration, while earn-outs focus on milestone-based payouts.

Defining Revenue Sharing Agreements

Revenue sharing agreements outline a contractual arrangement where a company distributes a portion of its revenue to partners, investors, or stakeholders based on predefined percentages or formulas. These agreements ensure continuous income streams tied directly to the performance of the business or product, fostering aligned incentives between parties involved. Unlike earn-out structures, revenue sharing emphasizes ongoing revenue distribution rather than contingent payments tied to future milestones or financial targets.

Understanding Earn-out Arrangements

Earn-out arrangements in mergers and acquisitions involve contingent payments based on future performance metrics, aligning seller incentives with the company's ongoing success. These agreements typically specify revenue targets, profit margins, or other key performance indicators that determine the payout amount over a defined period. Understanding the structure and terms of earn-outs is critical for both buyers and sellers to mitigate risks and ensure fair valuation adjustments post-transaction.

Key Differences Between Revenue Sharing and Earn-out

Revenue sharing involves distributing a percentage of ongoing revenue between parties based on sales or income generated, whereas earn-outs provide contingent payments tied to achieving specific financial or performance targets post-acquisition. Revenue sharing ensures continuous cash flow alignment between partners, while earn-outs serve as performance incentives for sellers to meet predetermined milestones within a defined period. The key difference lies in revenue sharing's basis on actual revenue streams versus earn-outs depending on future achievement of contractual benchmarks.

Advantages of Revenue Sharing for Sellers and Buyers

Revenue sharing offers sellers a consistent income stream tied directly to the business's performance, reducing risk compared to lump-sum payments, while incentivizing buyers by aligning payments with actual revenue growth. This model facilitates smoother post-sale transitions, as sellers remain motivated to support the company's success, enhancing operational continuity. For buyers, revenue sharing improves cash flow management by matching payment obligations to real-time business earnings, minimizing financial strain during initial integration.

Benefits and Risks of Earn-out Structures

Earn-out structures provide sellers with the opportunity to maximize earnings based on future business performance, aligning incentives between buyers and sellers while mitigating upfront payment risks. Key benefits include enhanced seller motivation to maintain company growth post-acquisition and flexibility in negotiating deal terms based on measurable milestones. Risks involve potential disputes over performance metrics, challenges in accurate earnings assessment, and dependency on buyer management, which can create uncertainty and conflict during the earn-out period.

When to Choose Revenue Sharing Over Earn-outs

Revenue sharing is preferable over earn-outs when a company seeks predictable, ongoing income without the complexity of performance targets or potential disputes tied to future earnings. Startups and small businesses benefit from revenue sharing when immediate cash flow alignment with sales volume is critical, whereas earn-outs typically suit acquisitions where buyers want to tie payment to specific financial milestones or profit metrics over time. Opt for revenue sharing when simplicity, transparency, and alignment with operational performance are prioritized over contingent, milestone-based compensation structures.

Common Challenges with Revenue Sharing and Earn-outs

Common challenges with revenue sharing and earn-outs include difficulty in accurately tracking revenue, disputes over calculations, and misaligned incentives between parties. These issues can lead to prolonged disagreements and cash flow complications, affecting business operations and relationships. Clear contractual terms and transparent accounting practices are essential to mitigate these risks.

Best Practices for Structuring Agreements

Effective revenue sharing agreements prioritize clear definitions of revenue sources, precise calculation methods, and transparent reporting intervals to ensure both parties have aligned expectations. Incorporating performance milestones and regular audit rights strengthens trust and minimizes disputes in earn-out structures. Legal clarity in termination clauses and dispute resolution mechanisms further safeguards interests, promoting long-term collaboration and financial clarity.

Conclusion: Choosing the Right Model for Your Business

Selecting the appropriate financial model between revenue sharing and earn-out depends on your company's cash flow needs, growth projections, and risk tolerance. Revenue sharing provides ongoing income aligned with actual sales, ideal for businesses with steady or increasing revenues, while earn-outs offer risk mitigation by tying payments to future performance milestones, suitable for acquisitions or startups with uncertain forecasts. A thorough analysis of your business model, financial stability, and strategic goals ensures choosing the model that maximizes value and aligns incentives effectively.

Revenue Sharing Infographic

libterm.com

libterm.com