Receivables turnover measures how efficiently a company collects its accounts receivable during a specific period, reflecting the effectiveness of its credit policies and cash flow management. A higher turnover ratio indicates quicker collection times, improving liquidity and reducing the risk of bad debts. Explore the rest of the article to learn how optimizing your receivables turnover can strengthen your business's financial health.

Table of Comparison

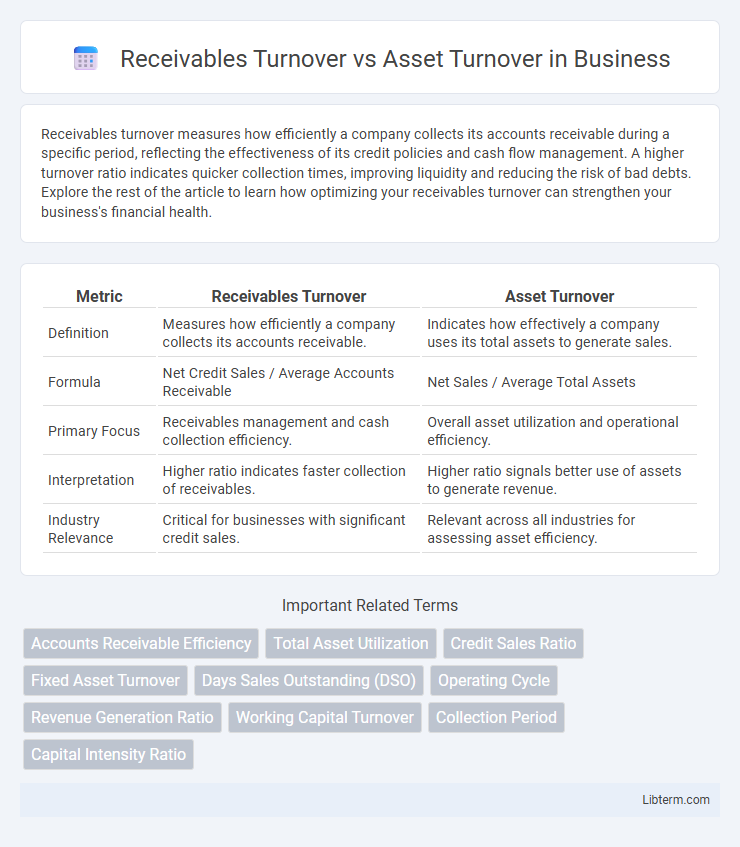

| Metric | Receivables Turnover | Asset Turnover |

|---|---|---|

| Definition | Measures how efficiently a company collects its accounts receivable. | Indicates how effectively a company uses its total assets to generate sales. |

| Formula | Net Credit Sales / Average Accounts Receivable | Net Sales / Average Total Assets |

| Primary Focus | Receivables management and cash collection efficiency. | Overall asset utilization and operational efficiency. |

| Interpretation | Higher ratio indicates faster collection of receivables. | Higher ratio signals better use of assets to generate revenue. |

| Industry Relevance | Critical for businesses with significant credit sales. | Relevant across all industries for assessing asset efficiency. |

Introduction to Turnover Ratios

Receivables turnover measures how efficiently a company collects its accounts receivable, indicating the number of times receivables are converted into cash during a period. Asset turnover evaluates how effectively a company uses its total assets to generate sales revenue, reflecting overall operational efficiency. These turnover ratios provide critical insights into liquidity and asset management, essential for assessing financial performance.

Defining Receivables Turnover

Receivables turnover measures how efficiently a company collects revenue from its credit sales by dividing net credit sales by average accounts receivable. This ratio indicates the effectiveness of a company's credit policies and cash flow management. High receivables turnover suggests faster collection cycles, which improves liquidity compared to asset turnover that evaluates overall asset productivity.

Understanding Asset Turnover

Asset Turnover measures a company's efficiency in using its total assets to generate sales revenue, calculated by dividing net sales by average total assets. Higher Asset Turnover indicates effective utilization of assets, reflecting operational performance and asset management. This metric complements Receivables Turnover, which specifically assesses how well a firm collects revenue from credit sales, by providing a broader view of overall asset productivity.

Key Differences Between Receivables and Asset Turnover

Receivables Turnover measures how efficiently a company collects its accounts receivable, calculated by dividing net credit sales by average receivables, highlighting liquidity and credit management. Asset Turnover assesses the overall efficiency of a company's use of assets to generate sales, calculated by dividing total sales by average total assets, reflecting operational performance and asset utilization. The key difference lies in Receivables Turnover focusing specifically on credit sales and receivables management, while Asset Turnover evaluates broader asset productivity across the company.

Importance in Financial Analysis

Receivables turnover measures how efficiently a company collects revenue from its credit sales, indicating the quality of accounts receivable and cash flow management. Asset turnover evaluates the firm's ability to generate sales from its total assets, reflecting operational efficiency and asset utilization. Comparing these ratios helps analysts identify strengths or weaknesses in revenue generation and asset management, essential for accurate financial performance assessment.

Calculation Methods Explained

Receivables Turnover is calculated by dividing Net Credit Sales by Average Accounts Receivable, measuring how efficiently a company collects receivables. Asset Turnover is determined by dividing Net Sales by Average Total Assets, reflecting how effectively a company uses its assets to generate sales. Both ratios offer insights into operational efficiency but focus on different components of a company's asset utilization.

Factors Affecting Each Turnover Ratio

Receivables Turnover is primarily influenced by credit policies, customer payment behavior, and the efficiency of the accounts receivable management system. Asset Turnover depends on asset utilization efficiency, sales volume, and the company's investment in fixed and current assets relative to revenue generation. Both ratios reflect operational effectiveness but are driven by distinct factors related to credit control and asset management strategies.

Industry Benchmarks and Comparisons

Receivables turnover measures how efficiently a company collects its accounts receivable, with industry benchmarks varying significantly, as retail sectors typically report higher ratios (10-15 times) compared to capital-intensive industries like manufacturing (5-7 times). Asset turnover, indicating the efficiency of asset use to generate sales, shows contrasting benchmarks where sectors with high asset investments such as utilities often exhibit lower ratios (0.5-1.5), while technology and consumer goods industries maintain higher ratios (1.5-3.0). Comparing these ratios across industries reveals that companies with faster receivables turnover may still have low asset turnover, reflecting different operational focuses and capital requirements.

Common Misinterpretations

Receivables Turnover measures how efficiently a company collects its credit sales, while Asset Turnover assesses the overall efficiency in generating revenue from total assets. A common misinterpretation is assuming a high Receivables Turnover automatically indicates strong asset utilization or overall operational efficiency. Confusing these ratios can lead to overlooking liquidity issues in accounts receivable or underestimating the broader asset management performance essential for business growth.

Improving Turnover Ratios for Better Performance

Enhancing receivables turnover involves accelerating collection processes and tightening credit policies to reduce days sales outstanding, which improves cash flow and operational efficiency. Boosting asset turnover requires optimizing asset utilization through regular maintenance and streamlining asset-heavy operations, leading to higher revenue generation per asset unit. Firms with improved turnover ratios demonstrate better liquidity and return on assets, translating to superior overall financial performance and competitiveness.

Receivables Turnover Infographic

libterm.com

libterm.com