Debt crowdfunding offers an innovative way to secure financing by borrowing small amounts from a large group of investors, making it easier for businesses and individuals to access capital without traditional banks. This funding model provides competitive interest rates and flexible repayment terms tailored to your financial needs. Discover how debt crowdfunding can transform your funding approach by exploring the full article.

Table of Comparison

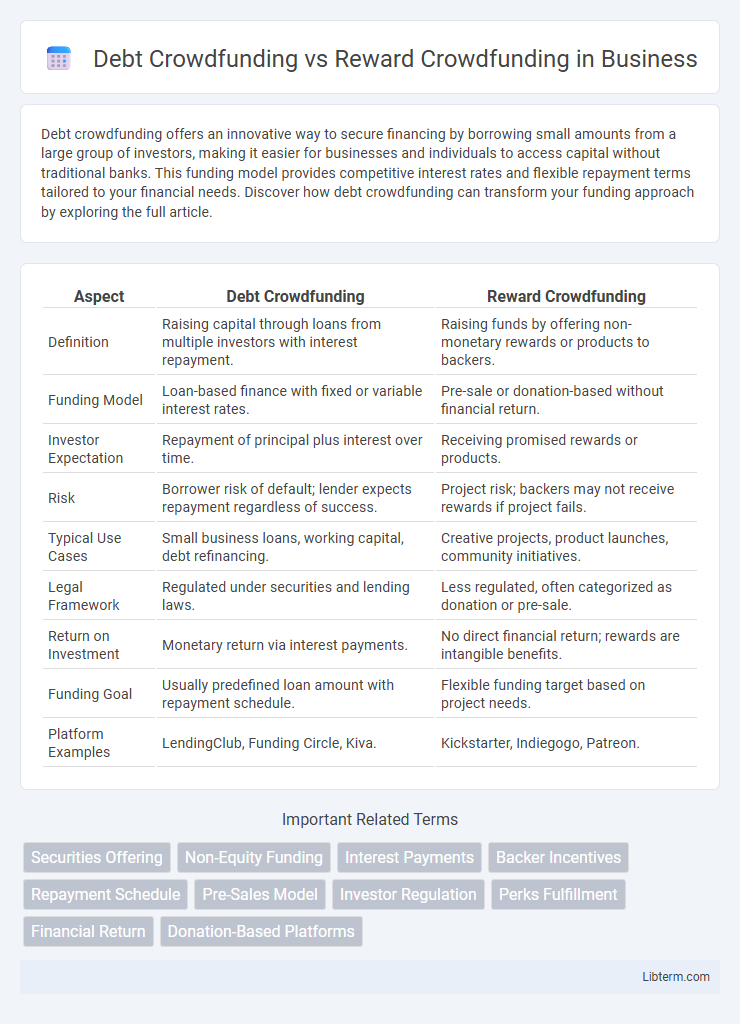

| Aspect | Debt Crowdfunding | Reward Crowdfunding |

|---|---|---|

| Definition | Raising capital through loans from multiple investors with interest repayment. | Raising funds by offering non-monetary rewards or products to backers. |

| Funding Model | Loan-based finance with fixed or variable interest rates. | Pre-sale or donation-based without financial return. |

| Investor Expectation | Repayment of principal plus interest over time. | Receiving promised rewards or products. |

| Risk | Borrower risk of default; lender expects repayment regardless of success. | Project risk; backers may not receive rewards if project fails. |

| Typical Use Cases | Small business loans, working capital, debt refinancing. | Creative projects, product launches, community initiatives. |

| Legal Framework | Regulated under securities and lending laws. | Less regulated, often categorized as donation or pre-sale. |

| Return on Investment | Monetary return via interest payments. | No direct financial return; rewards are intangible benefits. |

| Funding Goal | Usually predefined loan amount with repayment schedule. | Flexible funding target based on project needs. |

| Platform Examples | LendingClub, Funding Circle, Kiva. | Kickstarter, Indiegogo, Patreon. |

Introduction to Debt and Reward Crowdfunding

Debt crowdfunding involves raising capital by seeking loans from a large pool of investors who expect regular interest payments and principal repayment. Reward crowdfunding offers backers non-financial incentives such as products, services, or experiences in exchange for their contributions. Both models provide innovative alternatives to traditional financing, catering to different project needs and investor expectations.

How Debt Crowdfunding Works

Debt crowdfunding enables businesses or individuals to raise capital by borrowing money from a large number of investors who expect repayment with interest over a predetermined period. Investors receive regular interest payments and the return of their principal once the loan term ends, creating a stream of predictable cash flow. This model contrasts with reward crowdfunding, where backers receive non-monetary incentives instead of financial returns.

How Reward Crowdfunding Works

Reward crowdfunding operates by inviting backers to fund a project in exchange for non-financial rewards, such as early access to products, exclusive merchandise, or unique experiences. Project creators set funding goals and deadlines on platforms like Kickstarter or Indiegogo, where contributors pledge money based on the perceived value of the offered incentives. Unlike debt crowdfunding, reward crowdfunding does not involve repayment or equity shares, making it an appealing option for startups and creative ventures seeking capital without incurring debt.

Key Differences Between Debt and Reward Crowdfunding

Debt crowdfunding involves investors lending money to businesses or individuals with the expectation of repayment plus interest, while reward crowdfunding offers backers non-monetary incentives such as products or services in exchange for their contributions. Debt crowdfunding typically targets investors seeking financial returns and is regulated to ensure repayment terms, whereas reward crowdfunding appeals to supporters who want to help bring a project to life without financial gain. The primary key difference lies in the nature of the return: debt crowdfunding provides financial returns, whereas reward crowdfunding offers tangible rewards or experiences.

Pros and Cons of Debt Crowdfunding

Debt crowdfunding enables businesses to raise capital through loans from multiple investors, offering the advantage of retaining full ownership and potentially lower interest rates compared to traditional bank loans. It carries risks such as the obligation to repay principal with interest regardless of business performance, potentially straining cash flow during downturns. Investors benefit from predictable returns, but borrowers must carefully assess their capacity to meet fixed repayment schedules to avoid default.

Pros and Cons of Reward Crowdfunding

Reward crowdfunding offers entrepreneurs the advantage of raising funds without incurring debt or equity loss, enabling project validation and customer engagement through early product offerings. However, it requires delivering promised rewards on time, which can lead to fulfillment challenges and potential reputational risks if delays occur. Limited funding amounts and dependency on strong marketing campaigns are notable drawbacks compared to debt crowdfunding's structured repayment terms and interest obligations.

Best Platforms for Debt Crowdfunding

Debt crowdfunding platforms such as Funding Circle, LendingClub, and Prosper specialize in connecting businesses and individuals with investors willing to offer loans, emphasizing fixed returns and repayment terms. In contrast, reward crowdfunding platforms like Kickstarter and Indiegogo focus on project-based fundraising where backers receive non-monetary rewards instead of financial returns. For debt crowdfunding, platforms with strong track records in credit assessment, low default rates, and robust investor protection, such as Funding Circle, are considered the most reliable choices.

Popular Platforms for Reward Crowdfunding

Popular platforms for reward crowdfunding include Kickstarter, Indiegogo, and GoFundMe, each enabling creators to raise funds by offering non-financial rewards or early access to products. Unlike debt crowdfunding platforms such as LendingClub or Funding Circle, which focus on lending money with interest repayments, reward crowdfunding emphasizes community engagement and product validation. These platforms attract entrepreneurs, artists, and inventors looking to secure funding without incurring debt or giving up equity.

Which Crowdfunding Model Suits Your Project?

Debt crowdfunding suits projects seeking capital through loans with fixed repayment terms, ideal for businesses with predictable cash flow and desire to retain equity. Reward crowdfunding works best for creative or community-driven projects offering non-monetary incentives, perfect for startups testing product-market fit and building customer engagement. Assessing project goals, funding needs, and stakeholder expectations determines the most effective crowdfunding model.

Final Thoughts: Choosing the Right Crowdfunding Approach

Debt crowdfunding offers businesses access to capital with structured repayment terms and interest obligations, ideal for ventures seeking predictable financing without equity dilution. Reward crowdfunding emphasizes community engagement by offering non-monetary incentives, suitable for creative projects or startups aiming to build a loyal customer base. Selecting the right crowdfunding approach depends on financial goals, risk tolerance, and the nature of the project or business model.

Debt Crowdfunding Infographic

libterm.com

libterm.com