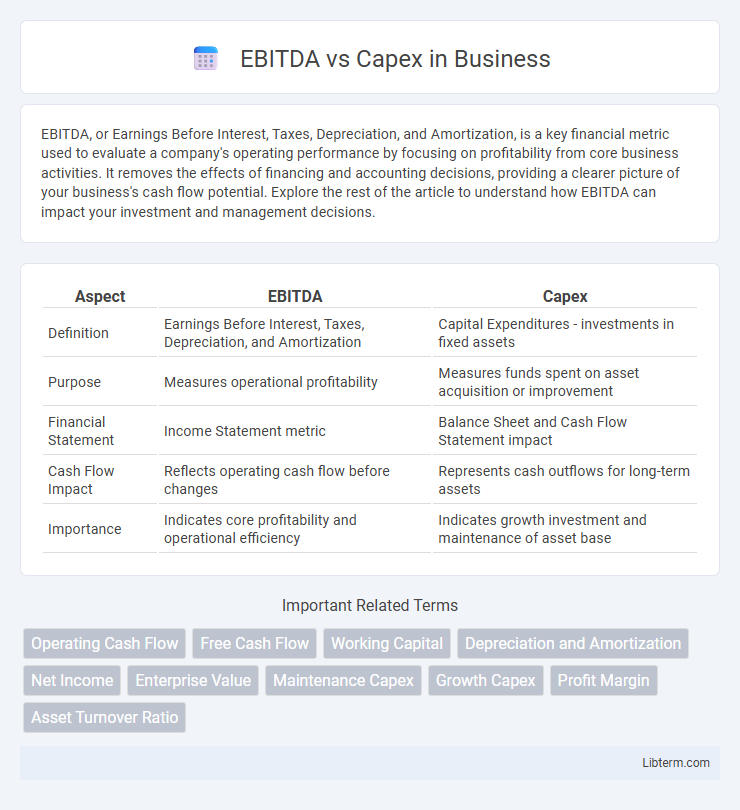

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a key financial metric used to evaluate a company's operating performance by focusing on profitability from core business activities. It removes the effects of financing and accounting decisions, providing a clearer picture of your business's cash flow potential. Explore the rest of the article to understand how EBITDA can impact your investment and management decisions.

Table of Comparison

| Aspect | EBITDA | Capex |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization | Capital Expenditures - investments in fixed assets |

| Purpose | Measures operational profitability | Measures funds spent on asset acquisition or improvement |

| Financial Statement | Income Statement metric | Balance Sheet and Cash Flow Statement impact |

| Cash Flow Impact | Reflects operating cash flow before changes | Represents cash outflows for long-term assets |

| Importance | Indicates core profitability and operational efficiency | Indicates growth investment and maintenance of asset base |

Introduction: Understanding EBITDA and Capex

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) measures a company's operating performance by excluding non-operational expenses, reflecting core profitability. Capex (Capital Expenditures) represents funds used to acquire or upgrade physical assets, critical for sustaining and expanding business operations. Analyzing EBITDA alongside Capex provides insights into cash flow generation and investment efficiency essential for financial health assessment.

Defining EBITDA: Meaning and Importance

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, represents a company's operational profitability by excluding non-operating expenses and non-cash charges. It is crucial for assessing core business performance and comparing companies across industries without the distortion of financing and accounting decisions. Investors and analysts rely on EBITDA to evaluate cash flow potential and operational efficiency before considering capital expenditures (Capex), which reflect investments in long-term assets.

Capex Explained: What Counts as Capital Expenditure

Capital Expenditure (Capex) refers to funds used by a company to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment essential for operational efficiency and growth. Unlike EBITDA, which measures operational profitability by excluding interest, taxes, depreciation, and amortization, Capex represents the actual cash outflow invested in long-term asset development. Capital expenditures are critical for sustaining and expanding business operations, often involving significant initial costs that impact cash flow but are capitalized on the balance sheet rather than expensed immediately.

Key Differences Between EBITDA and Capex

EBITDA measures a company's operational profitability by excluding interest, taxes, depreciation, and amortization, reflecting cash earnings before capital investments. Capex, or capital expenditures, represents the funds used to acquire, upgrade, or maintain physical assets like property, industrial buildings, or equipment. The key difference lies in EBITDA being a performance metric indicating cash-generating ability, while Capex is an investment metric showing cash outflow for long-term asset growth and maintenance.

EBITDA’s Role in Financial Performance Analysis

EBITDA serves as a key indicator of a company's operational profitability by measuring earnings before interest, taxes, depreciation, and amortization, allowing investors to evaluate core business performance without the impact of accounting decisions and capital structure. Capex, or capital expenditures, represents funds used to acquire or upgrade physical assets, reflecting long-term investment rather than immediate profitability. Analyzing EBITDA alongside Capex provides insight into cash flow availability and operational efficiency, aiding stakeholders in assessing financial health and sustainability of growth strategies.

How Capex Impacts Long-Term Business Growth

Capital expenditures (Capex) represent investments in physical assets that drive future production capacity and operational efficiency, directly influencing long-term business growth. While EBITDA measures current operational profitability by excluding non-operational costs, it does not account for the necessary reinvestments captured by Capex that sustain and expand business value. Companies with robust Capex strategies tend to generate stronger asset bases and competitive advantages, fueling sustained revenue growth beyond what EBITDA alone can indicate.

Why Investors Compare EBITDA vs Capex

Investors compare EBITDA vs Capex to evaluate a company's operational profitability against its capital expenditure needs, assessing how efficiently earnings can cover long-term investments. EBITDA reflects core earnings before non-operational costs, while Capex indicates funds required for maintaining or expanding physical assets. This comparison helps determine cash flow sustainability and potential for growth or risk due to heavy capital spending.

Common Misconceptions About EBITDA and Capex

EBITDA is often mistaken for cash flow, while it excludes capital expenditures (Capex), which are essential for maintaining and growing physical assets. Capex represents long-term investments in property, plant, and equipment, directly impacting a company's cash reserves, unlike EBITDA which reflects operational profitability before non-cash expenses. Ignoring Capex when evaluating EBITDA can lead to an inaccurate assessment of a firm's financial health and sustainability.

Real-World Examples: EBITDA vs Capex in Practice

EBITDA measures a company's operating performance by excluding non-cash expenses and capital expenditures, while Capex represents the funds used to acquire or upgrade physical assets. For example, a tech firm like Apple reports high EBITDA reflecting profitability, but heavy Capex investment in new manufacturing facilities impacts free cash flow. Conversely, utility companies show stable EBITDA with substantial Capex for infrastructure maintenance, illustrating how both metrics provide complementary insights into financial health.

Choosing the Right Metric: Strategic Financial Decision-Making

EBITDA measures a company's operational profitability by excluding non-operating expenses, offering insights into core earnings, while Capex represents capital expenditures essential for long-term asset investment and growth. Choosing the right metric depends on strategic focus--EBITDA is ideal for assessing short-term operational efficiency, whereas Capex highlights the scale of future expansion and maintenance commitments. Effective financial decision-making requires balancing EBITDA's profitability perspective with Capex's investment impact to align with business goals and sustainable growth.

EBITDA Infographic

libterm.com

libterm.com