A leveraged buyout (LBO) is a financial transaction where a company is acquired using a significant amount of borrowed money, often secured by the assets of the company being acquired. This strategy aims to maximize returns by using debt to finance the purchase, allowing investors to leverage their capital investment. Explore the rest of the article to understand how leveraged buyouts work and their impact on businesses and investors.

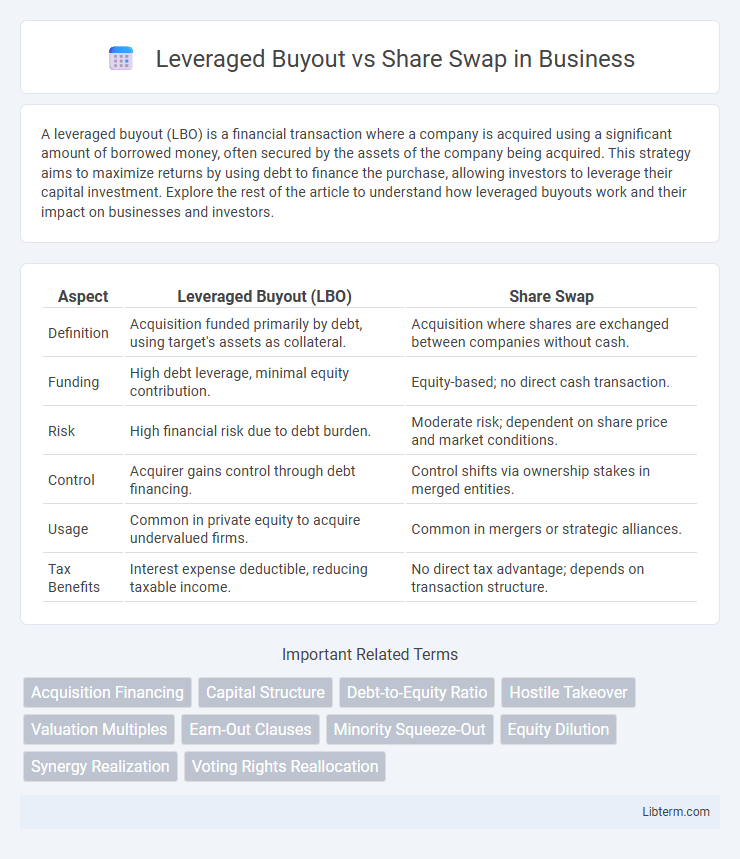

Table of Comparison

| Aspect | Leveraged Buyout (LBO) | Share Swap |

|---|---|---|

| Definition | Acquisition funded primarily by debt, using target's assets as collateral. | Acquisition where shares are exchanged between companies without cash. |

| Funding | High debt leverage, minimal equity contribution. | Equity-based; no direct cash transaction. |

| Risk | High financial risk due to debt burden. | Moderate risk; dependent on share price and market conditions. |

| Control | Acquirer gains control through debt financing. | Control shifts via ownership stakes in merged entities. |

| Usage | Common in private equity to acquire undervalued firms. | Common in mergers or strategic alliances. |

| Tax Benefits | Interest expense deductible, reducing taxable income. | No direct tax advantage; depends on transaction structure. |

Introduction to Leveraged Buyout and Share Swap

A Leveraged Buyout (LBO) involves acquiring a company primarily through borrowed funds, where the acquired company's assets often serve as collateral for the debt. In contrast, a Share Swap is a transaction where shareholders exchange their shares in one company for shares in another, facilitating mergers or acquisitions without immediate cash exchange. Both methods serve as strategic tools in corporate finance, offering different approaches to ownership transfer and capital structuring.

Definition of Leveraged Buyout

A Leveraged Buyout (LBO) is a financial transaction where a company is acquired using a significant amount of borrowed capital, typically secured by the assets of the company being purchased. This method allows investors to make large acquisitions without committing a lot of equity, increasing potential returns while taking on higher risk. In contrast, a Share Swap involves exchanging shares between companies for acquisition or merger purposes, without necessarily involving debt financing.

Definition of Share Swap

A share swap is a strategic transaction where one company acquires another by exchanging its own shares for the target company's shares, enabling shareholders of the target to become shareholders in the acquirer. Unlike a leveraged buyout (LBO), which primarily uses significant debt to fund the purchase, a share swap relies on equity exchange, avoiding large cash outflows and debt burdens. This method facilitates mergers and acquisitions by aligning shareholder interests while preserving the acquirer's cash reserves.

Key Differences Between LBO and Share Swap

A Leveraged Buyout (LBO) involves acquiring a company primarily through borrowed funds, using the target's assets as collateral, which significantly increases financial risk and potential for high returns. In contrast, a Share Swap entails exchanging shares between companies, enabling ownership transfer without immediate cash flow impact, often used in mergers and acquisitions to preserve liquidity. Key differences include the source of financing--debt-heavy in LBOs versus equity-based in share swaps--and the impact on company control and financial structure.

Advantages of Leveraged Buyouts

Leveraged buyouts (LBOs) allow companies to acquire targets with minimal equity investment by using significant amounts of borrowed capital, enhancing potential returns on equity. LBOs enable existing management to maintain control and drive operational improvements, fostering value creation post-acquisition. The ability to utilize tax-deductible interest further improves financial efficiency, making LBOs a strategically advantageous method for acquisitions compared to share swaps.

Benefits of Share Swap Transactions

Share swap transactions offer significant benefits by enabling companies to acquire shares without immediate cash outflows, thereby preserving liquidity and reducing financing costs. This method facilitates strategic partnerships and aligns interests by allowing shareholders of both entities to participate in the future growth and value creation. Share swaps also streamline the acquisition process, minimizing regulatory complexities compared to leveraged buyouts, which often involve substantial debt financing and higher financial risk.

Risks and Challenges in Leveraged Buyouts

Leveraged buyouts (LBOs) carry significant financial risks due to the high levels of debt used to finance acquisitions, increasing the likelihood of cash flow issues and potential bankruptcy if the target company underperforms. Managing interest payments and debt servicing can strain operational resources, while market fluctuations and economic downturns amplify the risk of default. Unlike share swaps, which involve exchanging equity and generally avoid substantial leverage, LBOs expose investors to higher financial volatility and integration challenges.

Risks Associated with Share Swaps

Share swaps carry risks such as valuation discrepancies, where the exchanged shares may be overvalued or undervalued, leading to potential financial losses. Regulatory scrutiny and compliance issues can arise due to differing legal frameworks across jurisdictions, complicating the transaction process. Additionally, share swaps expose parties to market volatility, which can affect the post-transaction share price and overall investment stability.

Situational Suitability: When to Choose LBO or Share Swap

Leveraged Buyouts (LBOs) are suitable for acquiring companies with stable cash flows capable of servicing significant debt, often when the buyer aims to gain full control while minimizing upfront equity investment. Share swaps are preferable in mergers or acquisitions involving companies of comparable size or strategic alignment, where shareholders receive shares in the combined entity, enabling equity financing without immediate cash outlay. Situational suitability hinges on financial structure, control objectives, and the target company's operational stability, making LBOs ideal for financially robust targets and share swaps optimal for synergistic partnerships or market expansion.

Conclusion: Leveraged Buyout vs Share Swap

Leveraged Buyouts (LBOs) typically involve significant debt financing to acquire a company, offering high potential returns but increased financial risk, while Share Swaps allow companies to merge or acquire without immediate cash outflow, preserving liquidity and aligning shareholder interests. Choosing between an LBO and a Share Swap depends on factors like the target company's financial health, the acquiring firm's leverage capacity, and strategic growth objectives. LBOs are preferable for acquiring undervalued firms with stable cash flows, whereas Share Swaps suit collaborative growth strategies and minimizing debt exposure.

Leveraged Buyout Infographic

libterm.com

libterm.com