Creative accounting involves the strategic manipulation of financial statements within legal boundaries to present a favorable image of a company's financial health. This practice can influence investor perceptions, impact stock prices, and affect managerial decisions, often blurring the line between ethical reporting and financial deception. Explore the rest of this article to understand how creative accounting works and how to identify its signs in your financial reports.

Table of Comparison

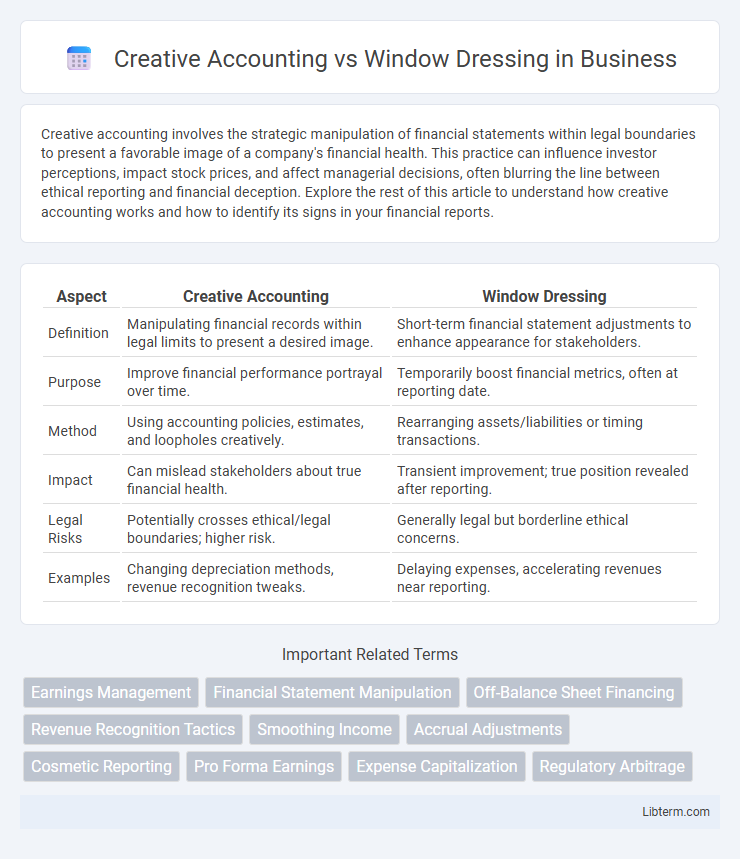

| Aspect | Creative Accounting | Window Dressing |

|---|---|---|

| Definition | Manipulating financial records within legal limits to present a desired image. | Short-term financial statement adjustments to enhance appearance for stakeholders. |

| Purpose | Improve financial performance portrayal over time. | Temporarily boost financial metrics, often at reporting date. |

| Method | Using accounting policies, estimates, and loopholes creatively. | Rearranging assets/liabilities or timing transactions. |

| Impact | Can mislead stakeholders about true financial health. | Transient improvement; true position revealed after reporting. |

| Legal Risks | Potentially crosses ethical/legal boundaries; higher risk. | Generally legal but borderline ethical concerns. |

| Examples | Changing depreciation methods, revenue recognition tweaks. | Delaying expenses, accelerating revenues near reporting. |

Understanding Creative Accounting: Definition and Scope

Creative accounting involves the manipulation of financial records within legal frameworks to present a desired image of a company's financial health, often by exploiting accounting rules and principles. Its scope includes income smoothing, revenue recognition shifts, and asset revaluation methods aimed at influencing stakeholders' perceptions without outright fraud. Unlike outright deception, creative accounting operates in gray areas, making it crucial for analysts to scrutinize financial statements carefully for such practices.

What is Window Dressing in Financial Reporting?

Window dressing in financial reporting refers to the practice of temporarily altering financial statements to present a more favorable view of a company's financial position. Techniques include manipulating asset valuations, accelerating revenue recognition, or deferring expenses to improve key financial ratios at the reporting date. This practice aims to influence stakeholders' perception without necessarily reflecting the company's true long-term financial health.

Key Differences Between Creative Accounting and Window Dressing

Creative accounting involves manipulating financial records and accounting policies to misrepresent a company's true financial performance, often bending or exploiting accounting standards. Window dressing focuses on temporarily improving financial statements at reporting periods to create an appealing but misleading snapshot without necessarily violating accounting rules. The key difference lies in creative accounting's broader and ongoing manipulation versus window dressing's short-term, superficial adjustments aimed solely at enhancing appearance.

Techniques Used in Creative Accounting

Creative accounting employs techniques such as income smoothing, where revenues and expenses are manipulated across periods to present consistent profitability, and off-balance-sheet financing, which hides liabilities to enhance financial ratios. Another common method involves aggressive revenue recognition, recognizing income prematurely to inflate earnings. These approaches differ from window dressing, which primarily involves temporary changes to financial statements near reporting dates to create a misleading appearance of financial health.

Common Window Dressing Practices in Companies

Common window dressing practices in companies include inflating accounts receivable, delaying expense recognition, and manipulating inventory valuation to present a healthier financial position. Firms may accelerate revenue recognition or defer liabilities to enhance key financial ratios such as return on assets and debt-to-equity ratio. These techniques, aimed at improving short-term appearance rather than enhancing true financial performance, blur the line between creative accounting and unethical financial reporting.

Motivations Behind Creative Accounting and Window Dressing

Creative accounting is motivated by the desire to manipulate financial statements to present a more favorable picture of a company's financial health, often to influence investor decisions, secure loans, or meet regulatory requirements. In contrast, window dressing aims to improve appearance temporarily, typically at the end of a reporting period, to attract short-term benefits such as better credit terms or stock prices. Both practices reflect management's intent to enhance perceived performance, but creative accounting involves deeper, more systematic alterations, whereas window dressing is more superficial and transient.

Legal and Ethical Implications

Creative accounting involves manipulating financial records within legal boundaries to present an overly favorable view of a company's performance, often exploiting gaps or ambiguities in accounting standards. Window dressing refers to cosmetic adjustments intended to improve financial statements temporarily without altering the underlying economic reality, which may mislead stakeholders despite being technically legal. Both practices pose significant ethical challenges, risking reputational damage and regulatory scrutiny if perceived as deceptive or intentionally misleading.

Impact on Stakeholders and Financial Statements

Creative accounting manipulates financial data within legal boundaries to present a more favorable view, often misleading stakeholders about a company's true performance and financial health. Window dressing involves temporary adjustments or timing shifts in financial records to enhance short-term appearances, which can create false confidence among investors, creditors, and regulators. Both practices undermine the reliability of financial statements, distort decision-making processes, and can lead to loss of trust, reduced market value, and potential legal repercussions for the company.

Detection and Prevention Mechanisms

Creative accounting involves manipulation of financial statements within legal boundaries, making detection challenging through standard audits, whereas window dressing is a more temporary, surface-level enhancement of financial reports designed to mislead stakeholders. Detection mechanisms include forensic accounting techniques, trend analysis, and ratio analysis to identify inconsistencies, while prevention relies on strong internal controls, transparent disclosure policies, and rigorous regulatory oversight by bodies such as the SEC or IFRS. Leveraging AI-driven analytics and continuous monitoring systems enhances early detection and deters manipulation by increasing audit accuracy and accountability.

Best Practices for Transparent Financial Reporting

Creative accounting manipulates financial statements through aggressive interpretation of accounting standards, while window dressing involves temporary adjustments to improve financial appearance at reporting dates. Best practices for transparent financial reporting emphasize adherence to Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), full disclosure of accounting methods, and regular external audits by independent firms. Ensuring consistency in financial policies and fostering a corporate culture of ethical financial practices are essential to prevent misleading representations and maintain investor trust.

Creative Accounting Infographic

libterm.com

libterm.com