Operating expenses encompass the day-to-day costs required to run your business, including rent, utilities, salaries, and office supplies. Effectively managing these expenses is crucial for maintaining profitability and ensuring sustainable growth. Explore the rest of this article to discover strategies for optimizing your operating expenses and boosting your financial health.

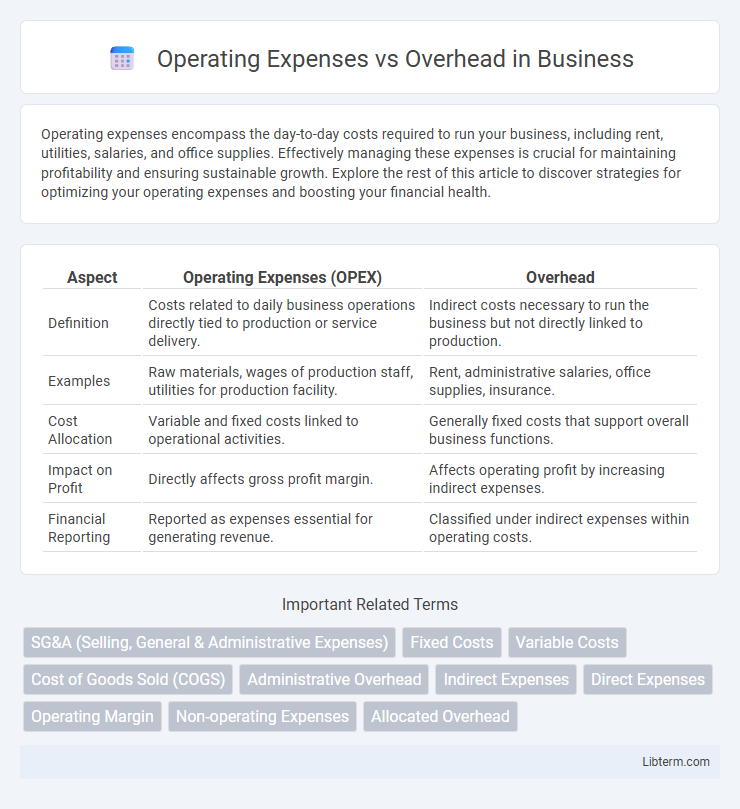

Table of Comparison

| Aspect | Operating Expenses (OPEX) | Overhead |

|---|---|---|

| Definition | Costs related to daily business operations directly tied to production or service delivery. | Indirect costs necessary to run the business but not directly linked to production. |

| Examples | Raw materials, wages of production staff, utilities for production facility. | Rent, administrative salaries, office supplies, insurance. |

| Cost Allocation | Variable and fixed costs linked to operational activities. | Generally fixed costs that support overall business functions. |

| Impact on Profit | Directly affects gross profit margin. | Affects operating profit by increasing indirect expenses. |

| Financial Reporting | Reported as expenses essential for generating revenue. | Classified under indirect expenses within operating costs. |

Introduction to Operating Expenses and Overhead

Operating expenses encompass all costs necessary to run a business day-to-day, including rent, utilities, salaries, and office supplies. Overhead specifically refers to ongoing fixed costs such as rent, insurance, and administrative salaries, which are not directly tied to production. Understanding the distinction between operating expenses and overhead is crucial for effective budgeting and cost management in any business.

Defining Operating Expenses

Operating expenses refer to the ongoing costs necessary for the day-to-day functioning of a business, including salaries, rent, utilities, and office supplies. These expenses are directly tied to the core operations and can be variable or fixed, distinguishing them from capital expenditures. Understanding operating expenses is crucial for budgeting, financial analysis, and determining operational efficiency.

Understanding Overhead Costs

Overhead costs refer to ongoing business expenses that are not directly tied to producing goods or services, such as rent, utilities, and administrative salaries. These expenses are categorized under operating expenses but specifically cover indirect costs necessary to maintain daily business operations. Understanding overhead is crucial for accurate budgeting and financial analysis, as it impacts pricing, profitability, and cost control strategies.

Key Differences Between Operating Expenses and Overhead

Operating expenses encompass all costs a business incurs to run daily operations, including rent, utilities, and salaries, while overhead specifically refers to ongoing indirect expenses necessary to maintain business functions, such as administrative salaries and facility maintenance. The key difference lies in operating expenses covering both direct and indirect costs, whereas overhead strictly involves indirect costs that cannot be directly tied to product production. Understanding these distinctions is crucial for accurate budgeting, financial analysis, and cost control strategies in business management.

Examples of Operating Expenses

Operating expenses include costs directly related to daily business activities such as rent, utilities, salaries, office supplies, and marketing expenses. These expenses differ from overhead, which represents fixed costs like depreciation, insurance, and property taxes that support general business operations regardless of production levels. Understanding the distinction aids in accurate budgeting and financial analysis for efficient resource allocation.

Examples of Overhead Costs

Overhead costs include expenses such as rent, utilities, property taxes, insurance, and salaries of administrative staff that are necessary to maintain the business infrastructure but are not directly tied to production. Operating expenses encompass all overhead costs plus variable expenses like raw materials, direct labor, and sales commissions involved in day-to-day operations. Recognizing overhead costs separately helps businesses accurately allocate indirect expenses and improve financial analysis and budgeting.

Impact on Business Profitability

Operating expenses directly affect business profitability by encompassing all daily costs required to run core activities, including salaries, rent, and utilities. Overhead, a subset of operating expenses, consists of indirect costs not tied to production volume, such as administrative salaries and depreciation, which must be controlled to maintain profit margins. Effective management of both operating expenses and overhead enables businesses to optimize cost efficiency, improve net income, and sustain long-term financial health.

Strategies for Managing Expenses and Overhead

Effective strategies for managing operating expenses and overhead include implementing detailed budget tracking systems and regularly reviewing expense reports to identify cost-saving opportunities. Leveraging technology such as automated accounting software enhances accuracy and reduces administrative costs, directly impacting overhead reduction. Strategic renegotiation of supplier contracts and optimizing resource allocation ensure controlled spending, improving overall financial efficiency.

Reporting and Tracking Expenses in Accounting

Operating expenses encompass all costs required for the day-to-day functioning of a business, including both variable and fixed expenses, while overhead specifically refers to fixed ongoing expenses not directly tied to production. Accurate reporting and tracking of operating expenses and overhead in accounting involve categorizing costs correctly to ensure precise financial statements and effective budgeting. Utilizing detailed expense accounts and integrated accounting software enhances visibility, allowing businesses to monitor spending patterns and control costs efficiently.

Common Mistakes in Classifying Expenses and Overhead

Classifying operating expenses versus overhead often results in common mistakes such as mislabeling direct costs like production wages as overhead, which skews cost analysis and budgeting accuracy. Overhead should include indirect expenses like rent, utilities, and administrative salaries, whereas operating expenses encompass all costs required to run daily business functions. Proper differentiation ensures accurate financial reporting, cost control, and profitability assessment.

Operating Expenses Infographic

libterm.com

libterm.com