Debentures are long-term debt instruments issued by companies to raise capital, offering a fixed interest rate to investors. They are unsecured loans relying on the issuer's creditworthiness rather than collateral, making it important to assess the company's financial health carefully. Explore this article to understand how debentures can impact your investment portfolio and financial strategy.

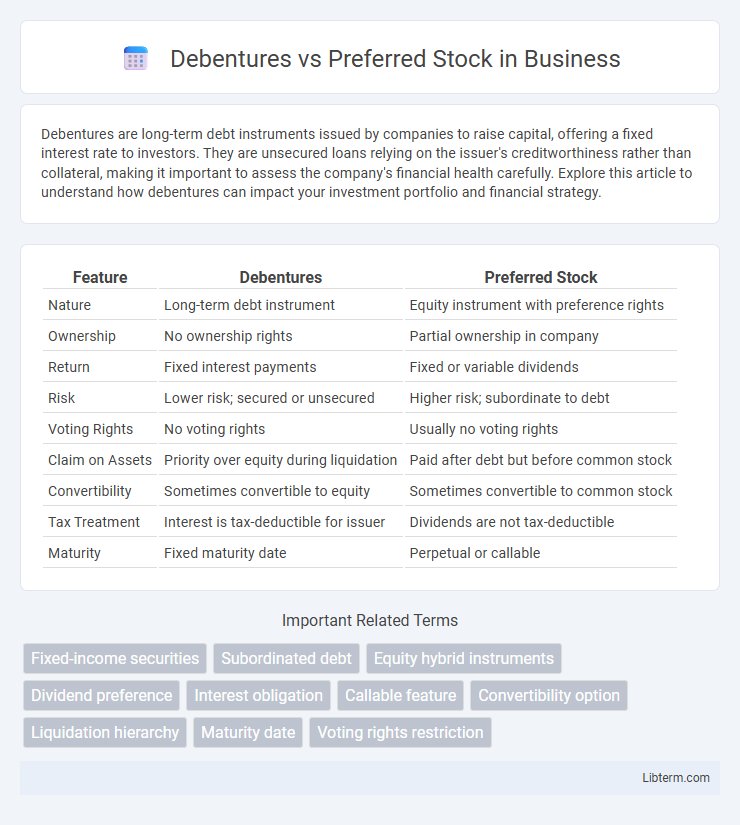

Table of Comparison

| Feature | Debentures | Preferred Stock |

|---|---|---|

| Nature | Long-term debt instrument | Equity instrument with preference rights |

| Ownership | No ownership rights | Partial ownership in company |

| Return | Fixed interest payments | Fixed or variable dividends |

| Risk | Lower risk; secured or unsecured | Higher risk; subordinate to debt |

| Voting Rights | No voting rights | Usually no voting rights |

| Claim on Assets | Priority over equity during liquidation | Paid after debt but before common stock |

| Convertibility | Sometimes convertible to equity | Sometimes convertible to common stock |

| Tax Treatment | Interest is tax-deductible for issuer | Dividends are not tax-deductible |

| Maturity | Fixed maturity date | Perpetual or callable |

Introduction to Debentures and Preferred Stock

Debentures are long-term debt instruments issued by companies to raise capital, offering fixed interest payments and priority over equity in case of liquidation. Preferred stock represents equity ownership with preferential rights to dividends and asset distribution but typically lacks voting rights. Both debentures and preferred stock serve as hybrid financing tools, balancing risk and return for investors and issuers.

Key Definitions and Concepts

Debentures are long-term, unsecured debt instruments issued by corporations to raise capital, carrying fixed interest payments without ownership rights. Preferred stock represents equity with priority over common stock in dividend payments and asset liquidation but typically lacks voting rights. Both serve as hybrid financing tools balancing risk, return, and control for investors and issuers.

Structural Differences Between Debentures and Preferred Stock

Debentures are unsecured debt instruments representing loans made to a company, typically with fixed interest payments and a specified maturity date, while preferred stock is an equity security with preferential dividend payments but no maturity date. Debentures hold creditor status, meaning debenture holders are paid before shareholders in the event of liquidation, whereas preferred stockholders have a claim on assets after debt holders but before common shareholders. The structural distinction also includes voting rights; debenture holders generally lack voting rights, while preferred stockholders may have limited or no voting privileges depending on the terms.

Risk and Return Profiles

Debentures typically carry higher risk than preferred stock due to their status as unsecured debt, but they offer fixed interest payments providing predictable returns. Preferred stock combines elements of equity and debt, offering dividends that may be deferred without default risk, and ranks higher than common stock but below debentures in claims priority. Investors seeking steady income with moderate risk may prefer preferred stock, while those aiming for fixed interest with potential credit exposure might opt for debentures.

Priority in Claims: Assets and Earnings

Debentures hold a higher priority over preferred stock in claims on assets during liquidation, as they are considered unsecured debt instruments with fixed interest payments. Preferred stockholders receive dividend payments before common stockholders but rank below debenture holders in asset claims. Earnings distribution prioritizes debentures through interest payments, while preferred stock dividends are paid only after debenture obligations are fulfilled.

Voting Rights and Control Implications

Debentures are debt instruments that do not confer voting rights, allowing issuers to raise capital without diluting control or shareholder influence. Preferred stockholders typically have limited or no voting rights but hold a higher claim on assets and dividends compared to common shareholders. The absence of voting rights in debentures preserves managerial control, whereas preferred stock can slightly affect control dynamics depending on specific issuance terms.

Dividend and Interest Payment Structures

Debentures typically involve fixed interest payments that must be paid before any dividends are distributed to equity holders, reflecting their status as debt instruments. Preferred stock dividends are usually fixed but may be deferred without triggering default, providing issuers flexibility in cash flow management. Interest payments on debentures are tax-deductible expenses for companies, whereas preferred stock dividends are paid from after-tax earnings and do not offer tax shields.

Convertibility and Redemption Options

Debentures often feature convertibility options allowing holders to convert debt into equity, providing potential upside in company growth, whereas preferred stock may or may not be convertible depending on specific terms set by the issuer. Redemption options in debentures typically involve fixed maturity dates or call provisions enabling the issuer to repay principal early, while preferred stock redemption can include callable features or mandatory redemption events based on predetermined conditions. The choice between convertible debentures and redeemable preferred stock impacts investor risk, liquidity, and potential returns through varying degrees of security and equity participation.

Tax Implications for Investors and Issuers

Debentures offer tax-deductible interest expenses for issuers, lowering taxable income, while investors are taxed on interest as ordinary income. Preferred stock dividends are not tax-deductible for issuers, increasing corporate tax liability, but investors may benefit from dividend tax credits or qualified dividend rates. Understanding these distinctions helps investors and issuers optimize tax efficiency in capital structuring decisions.

Suitability for Different Types of Investors

Debentures offer fixed interest payments and are typically suited for conservative investors seeking steady income with lower risk compared to equity. Preferred stock provides dividend income with potential for capital appreciation, appealing to investors interested in equity-like returns but with priority over common stockholders during liquidation. Risk-tolerant investors aiming for higher returns may prefer preferred stocks, while risk-averse investors prioritize debentures for capital preservation.

Debentures Infographic

libterm.com

libterm.com