Series A funding represents a critical stage where startups secure significant capital to scale their operations, enhance product development, and expand market reach. This round typically involves venture capital firms seeking strong business models with clear growth potential and a viable path to profitability. Discover how understanding the nuances of Series A funding can strategically position your startup for long-term success.

Table of Comparison

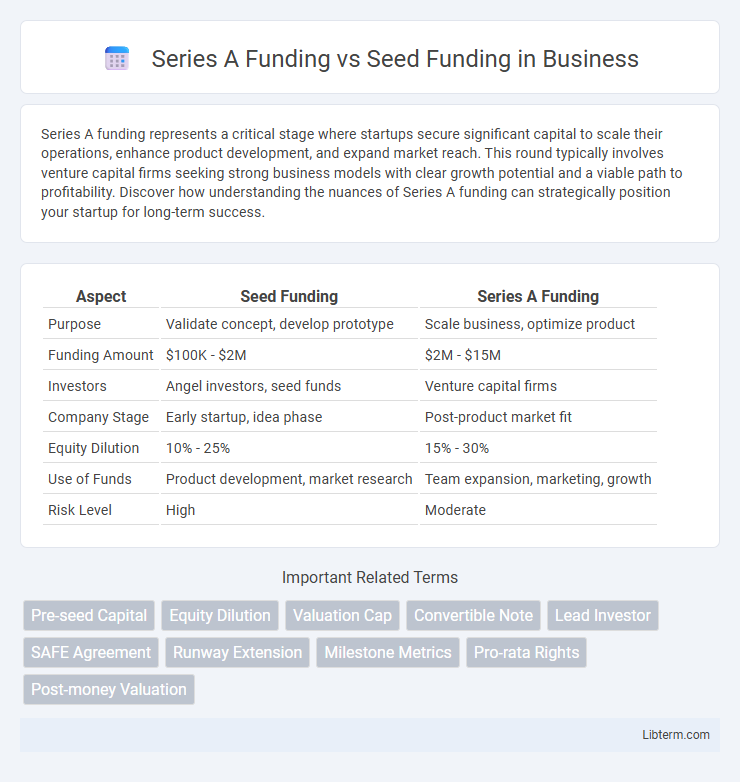

| Aspect | Seed Funding | Series A Funding |

|---|---|---|

| Purpose | Validate concept, develop prototype | Scale business, optimize product |

| Funding Amount | $100K - $2M | $2M - $15M |

| Investors | Angel investors, seed funds | Venture capital firms |

| Company Stage | Early startup, idea phase | Post-product market fit |

| Equity Dilution | 10% - 25% | 15% - 30% |

| Use of Funds | Product development, market research | Team expansion, marketing, growth |

| Risk Level | High | Moderate |

Introduction to Startup Funding Stages

Seed funding marks the initial capital raised by startups to develop their product, conduct market research, and establish business foundations, typically sourced from angel investors or early-stage venture funds. Series A funding follows as the first significant round of venture capital financing, aimed at scaling operations, expanding the team, and refining the business model based on validated market traction. Understanding these funding stages is critical for startups to secure appropriate financial resources aligned with their growth milestones and investor expectations.

What is Seed Funding?

Seed funding is the initial capital invested in a startup to develop its product, conduct market research, and build a viable business model. Typically sourced from angel investors, family, or seed venture capital firms, this funding stage aims to support early-stage operations before the company generates significant revenue. Seed funding amounts usually range from $100,000 to $2 million, providing the essential resources for startups to validate their ideas and prepare for Series A funding.

What is Series A Funding?

Series A funding is the first significant round of venture capital financing, typically ranging from $2 million to $15 million, aimed at scaling a startup's product, market reach, and team. Investors in Series A prioritize startups with a proven business model, demonstrated traction, and clear potential for revenue growth. This funding stage bridges the gap between early seed capital and later growth rounds, enabling startups to optimize their product-market fit and expand operations.

Key Differences Between Seed and Series A Funding

Seed funding is the initial capital used to validate a business idea, typically ranging from $500K to $2 million, aimed at product development and market research. Series A funding follows, involving larger investments usually between $2 million and $15 million to scale operations, optimize the business model, and expand the team. Key differences include the stage of the company, funding amount, investor expectations, and focus on growth metrics versus proof of concept.

Typical Investors in Seed vs Series A Rounds

Seed funding typically attracts angel investors, early-stage venture capital firms, and startup accelerators focused on supporting high-potential startups with initial capital to develop their product and market fit. Series A funding rounds involve more established venture capital firms that provide larger investments aimed at scaling the business, optimizing product-market fit, and expanding market reach. Seed investors often take higher risks on unproven concepts, while Series A investors expect validated business models and clear growth potential.

Funding Amounts: Seed vs Series A

Seed funding typically ranges from $500,000 to $2 million, aimed at validating product concepts and initial market entry. Series A funding involves larger investments, usually between $2 million and $15 million, focused on scaling operations and expanding market reach. These funding amounts reflect the company's growth stage, investor confidence, and business milestones achieved.

Startup Valuation in Seed and Series A Rounds

Seed funding valuation typically ranges from $2 million to $10 million, reflecting early-stage risk and product-market fit potential, whereas Series A valuation often increases to $10 million to $50 million due to demonstrated traction and scalable business models. Investors in seed rounds prioritize innovative ideas and founding teams, while Series A investors focus on revenue growth metrics, market validation, and customer acquisition cost. The valuation jump from seed to Series A is driven by reduced uncertainty, validated business hypotheses, and initial financial performance indicators.

Requirements and Milestones for Raising Each Round

Seed funding typically requires a clear proof of concept, a strong founding team, and initial market validation, with milestones focused on product development and early user acquisition. Series A funding demands demonstrated product-market fit, scalable business models, and revenue traction, with milestones centered on customer growth, operational efficiency, and team expansion. Investors in Series A expect detailed financial metrics and strategic plans that indicate potential for significant market capture and sustainable growth.

Dilution and Equity Considerations

Seed funding typically involves smaller capital amounts and results in higher equity dilution as founders sell larger ownership percentages to early investors, often angel investors or seed-focused venture funds. Series A funding raises more substantial capital from institutional venture capital firms, leading to relatively lower dilution per dollar raised but demanding substantial equity stakes and governance influence. Founders must strategically balance the amount of equity offered to preserve control while acquiring sufficient capital for growth during both funding stages.

Choosing the Right Funding Round for Your Startup

Choosing the right funding round for your startup depends on your business stage and capital needs. Seed funding is ideal for early-stage startups looking to develop a prototype or conduct market research, typically involving smaller investments from angel investors or seed funds. Series A funding targets startups with validated business models aiming to scale operations, requiring larger capital injections from venture capitalists to fuel growth and market expansion.

Series A Funding Infographic

libterm.com

libterm.com