Equity swaps are financial derivatives that allow two parties to exchange future cash flows based on the performance of equity assets without owning the underlying stocks. These contracts help you manage risk or gain exposure to equity markets by swapping returns on equities for fixed or floating interest payments. Explore the benefits and mechanics of equity swaps to understand how they can fit into your investment strategy.

Table of Comparison

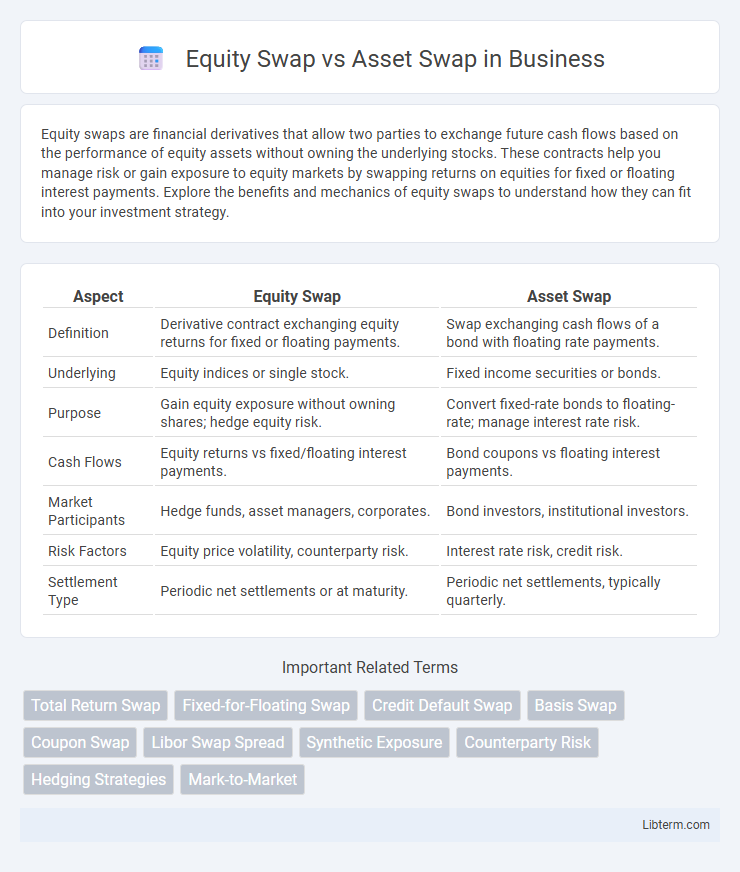

| Aspect | Equity Swap | Asset Swap |

|---|---|---|

| Definition | Derivative contract exchanging equity returns for fixed or floating payments. | Swap exchanging cash flows of a bond with floating rate payments. |

| Underlying | Equity indices or single stock. | Fixed income securities or bonds. |

| Purpose | Gain equity exposure without owning shares; hedge equity risk. | Convert fixed-rate bonds to floating-rate; manage interest rate risk. |

| Cash Flows | Equity returns vs fixed/floating interest payments. | Bond coupons vs floating interest payments. |

| Market Participants | Hedge funds, asset managers, corporates. | Bond investors, institutional investors. |

| Risk Factors | Equity price volatility, counterparty risk. | Interest rate risk, credit risk. |

| Settlement Type | Periodic net settlements or at maturity. | Periodic net settlements, typically quarterly. |

Introduction to Equity Swaps and Asset Swaps

Equity swaps are derivative contracts where two parties exchange future cash flows based on the performance of an equity asset, such as stocks or equity indices, without owning the underlying asset. Asset swaps involve exchanging fixed-income instruments' cash flows, typically combining bonds with interest rate swaps, to manage interest rate risk or achieve better liquidity. Both swaps serve distinct purposes in portfolio management, with equity swaps focused on equity market exposure and asset swaps concentrating on fixed-income securities optimization.

Definition of Equity Swap

An equity swap is a financial derivative contract where two parties exchange future cash flows based on the performance of an underlying equity asset, such as a stock or equity index. This agreement allows investors to gain exposure to equity markets without owning the actual shares, enabling customization for dividend returns, capital gains, or total return swaps. Unlike asset swaps, which involve fixed income securities exchanging cash flows linked to bond coupons and interest rates, equity swaps center on equity price movements and related returns.

Definition of Asset Swap

An asset swap is a financial derivative that transforms the cash flows of a fixed-income security into a floating rate indexed to a benchmark such as LIBOR, allowing investors to alter interest rate exposure without selling the underlying asset. It involves exchanging fixed coupon payments for floating rate payments, while the principal and credit risk of the bond remain with the asset holder. Unlike equity swaps, which involve equity returns, asset swaps primarily focus on fixed income securities and managing interest rate risk.

Key Features of Equity Swaps

Equity swaps involve exchanging future cash flows based on the return of an underlying equity asset, allowing investors to gain exposure without owning the actual shares. Key features include flexibility in customizing payment terms, the ability to hedge or speculate on equity performance, and avoidance of direct ownership risks such as dividends or voting rights. These swaps often settle in cash and reflect variations in stock prices plus any dividends or financing costs agreed upon in the contract.

Key Features of Asset Swaps

Asset swaps involve exchanging fixed or floating cash flows from a bond for different interest rate payments, enabling investors to manage interest rate risk effectively. Key features include customization of payment streams, typically converting bond coupons into floating rates tied to benchmarks like LIBOR or SOFR, and preservation of credit risk associated with the underlying bond. Asset swaps enhance portfolio flexibility by allowing investors to isolate credit exposure while hedging interest rate fluctuations.

Differences Between Equity Swaps and Asset Swaps

Equity swaps involve exchanging the returns on an equity asset, such as stock performance or index returns, for fixed or floating interest payments, primarily focusing on equity market exposure without ownership transfer. Asset swaps, however, combine a bond with an interest rate swap, allowing investors to transform fixed-rate bond cash flows into a different interest rate basis, often used to manage interest rate risk. The key difference lies in the underlying assets and risk exposures: equity swaps are based on equity instruments and market performance, while asset swaps are based on fixed-income securities and interest rate exposure.

Use Cases: When to Choose Equity Swap

Equity swaps are ideal for investors seeking exposure to stock market returns without direct ownership, providing opportunities for portfolio diversification and hedging against market volatility. Asset swaps suit fixed-income investors aiming to convert bond cash flows into different interest rate profiles or currencies, optimizing yield or risk management. Choose equity swaps to gain synthetic equity exposure, manage equity beta, or implement tax-efficient strategies without trading physical shares.

Use Cases: When to Choose Asset Swap

Asset swaps are ideal for investors seeking to hedge interest rate risk on a bond while retaining the bond's credit exposure and economic characteristics. They are commonly used by fixed income managers to convert fixed coupon payments into floating rates, enhancing portfolio flexibility in volatile interest rate environments. In contrast to equity swaps, asset swaps focus on fixed income securities, making them preferable when managing bond portfolios or targeting specific interest rate arbitrage strategies.

Risks Associated with Equity Swaps and Asset Swaps

Equity swaps carry risks such as market risk due to underlying equity price volatility, counterparty credit risk given the derivative nature, and liquidity risk when exiting positions early. Asset swaps expose investors to interest rate risk, credit risk from bond issuers, and basis risk arising from mismatches between swap payments and bond cash flows. Both swaps entail complex valuation challenges and require robust risk management frameworks to mitigate potential losses.

Conclusion: Equity Swap vs Asset Swap

Equity swaps and asset swaps serve distinct purposes in financial markets, with equity swaps enabling investors to gain exposure to stock price movements without owning the underlying shares, while asset swaps focus on transforming fixed-income instruments to alter risk and return profiles. Equity swaps are ideal for equity market speculation and hedging, whereas asset swaps provide flexibility in managing interest rate and credit risks linked to bonds. Choosing between them depends on investment objectives, risk tolerance, and the desired exposure to equity or fixed-income assets.

Equity Swap Infographic

libterm.com

libterm.com