A poison pill is a defensive strategy used by companies to prevent hostile takeovers by making their stock less attractive to potential acquirers. This tactic dilutes the value of shares, solidifying control among existing shareholders and discouraging unwanted bids. Discover how poison pills affect your investment decisions and corporate control in the rest of the article.

Table of Comparison

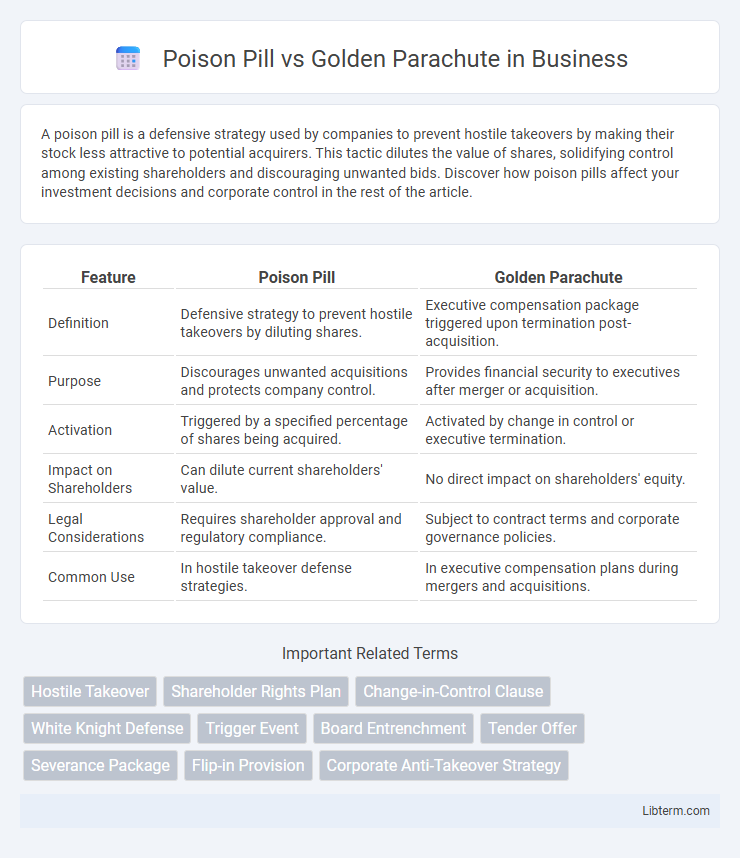

| Feature | Poison Pill | Golden Parachute |

|---|---|---|

| Definition | Defensive strategy to prevent hostile takeovers by diluting shares. | Executive compensation package triggered upon termination post-acquisition. |

| Purpose | Discourages unwanted acquisitions and protects company control. | Provides financial security to executives after merger or acquisition. |

| Activation | Triggered by a specified percentage of shares being acquired. | Activated by change in control or executive termination. |

| Impact on Shareholders | Can dilute current shareholders' value. | No direct impact on shareholders' equity. |

| Legal Considerations | Requires shareholder approval and regulatory compliance. | Subject to contract terms and corporate governance policies. |

| Common Use | In hostile takeover defense strategies. | In executive compensation plans during mergers and acquisitions. |

Introduction to Corporate Defense Strategies

Poison pills and golden parachutes are essential corporate defense strategies designed to protect companies from hostile takeovers and ensure management stability. Poison pills dilute the value of shares to make acquisitions prohibitively expensive, while golden parachutes provide lucrative severance packages to top executives if a takeover occurs. Both mechanisms serve to align shareholder and executive interests, deterring unwanted bids and safeguarding long-term corporate governance.

What Is a Poison Pill?

A Poison Pill is a defensive strategy used by companies to prevent hostile takeovers by making the company less attractive or more costly to acquire. This tactic typically involves issuing new shares or rights to existing shareholders, diluting the acquirer's stake and increasing the overall cost of the takeover. Poison Pills protect shareholder value by discouraging unsolicited bids and providing the company with bargaining power during acquisition attempts.

Understanding the Golden Parachute

The golden parachute is a contractual agreement that provides senior executives with significant financial benefits if they are terminated following a merger or acquisition. This package typically includes severance pay, bonuses, stock options, or other incentives designed to protect executives from the uncertainties of corporate takeovers. Understanding the golden parachute is crucial for evaluating corporate governance strategies and the impact of executive compensation on shareholder value.

Key Differences Between Poison Pill and Golden Parachute

Poison pills are shareholder rights plans designed to prevent hostile takeovers by diluting the stock when an acquirer surpasses a certain ownership threshold, while golden parachutes guarantee executives substantial financial benefits in the event of job loss following a merger or acquisition. Poison pills primarily protect the company from unwanted takeovers, whereas golden parachutes serve to retain key executives and ease transition concerns. The poison pill impacts shareholders by altering voting power or stock value, whereas golden parachutes directly affect executive compensation packages.

How Poison Pills Work in Mergers and Acquisitions

Poison pills function as defensive strategies in mergers and acquisitions by allowing existing shareholders to purchase additional shares at a discount, diluting the ownership interest of a potential acquirer and making a hostile takeover prohibitively expensive. This mechanism triggers once an acquiring entity surpasses a certain ownership threshold, effectively deterring unsolicited bids. Golden parachutes, in contrast, provide lucrative severance packages to executives post-acquisition but do not directly prevent hostile takeovers like poison pills.

Structure and Implementation of Golden Parachutes

Golden parachutes are contractual agreements granting executives substantial benefits if terminated due to mergers or acquisitions, structured to provide severance pay, bonuses, stock options, and accelerated vesting. These packages are implemented through detailed employment contracts or change-in-control agreements, ensuring clear trigger events and benefit formulas to protect key personnel during corporate transitions. The structure aligns executive incentives with shareholder interests while offering a safety net that facilitates smoother corporate negotiations.

Advantages and Drawbacks of Poison Pills

Poison pills provide companies with a powerful defense mechanism against hostile takeovers by diluting the acquirer's shares and making the acquisition prohibitively expensive. The advantages include protecting shareholder interests and giving the board more negotiation leverage, while the drawbacks involve potential negative impacts on shareholder value, management entrenchment, and reduced stock liquidity. Critics argue that poison pills may discourage beneficial mergers and acquisitions, limiting shareholder gains and market efficiency.

Pros and Cons of Golden Parachutes

Golden Parachutes offer executives significant financial security during mergers or acquisitions, incentivizing retention and smooth transitions. However, high payout costs can strain company resources and provoke shareholder dissatisfaction, potentially undermining corporate governance. These agreements may also encourage riskier decision-making by executives, knowing they have guaranteed compensation regardless of outcomes.

Real-World Examples: Poison Pill vs Golden Parachute

Poison pill strategies were notably used by Netflix in 2012 to prevent hostile takeovers, deterring unwanted investors through shareholder rights plans. In contrast, golden parachutes provided a lucrative exit package for executives at Yahoo during the Verizon acquisition in 2017, ensuring top-level management received significant severance despite corporate upheaval. These real-world examples highlight poison pills as defensive mechanisms to block hostile bids, while golden parachutes protect executives' financial interests during mergers or acquisitions.

Choosing the Right Strategy for Corporate Takeover Defense

Selecting the appropriate corporate takeover defense requires analyzing the specific risks and corporate goals associated with your organization. Poison Pill strategies, which dilute the value of shares during a hostile takeover, effectively deter aggressive acquirers by making acquisitions cost-prohibitive. Golden Parachute agreements provide financial security to executives upon change of control, aligning management's interests with shareholder value while potentially discouraging hostile bids through increased acquisition costs.

Poison Pill Infographic

libterm.com

libterm.com