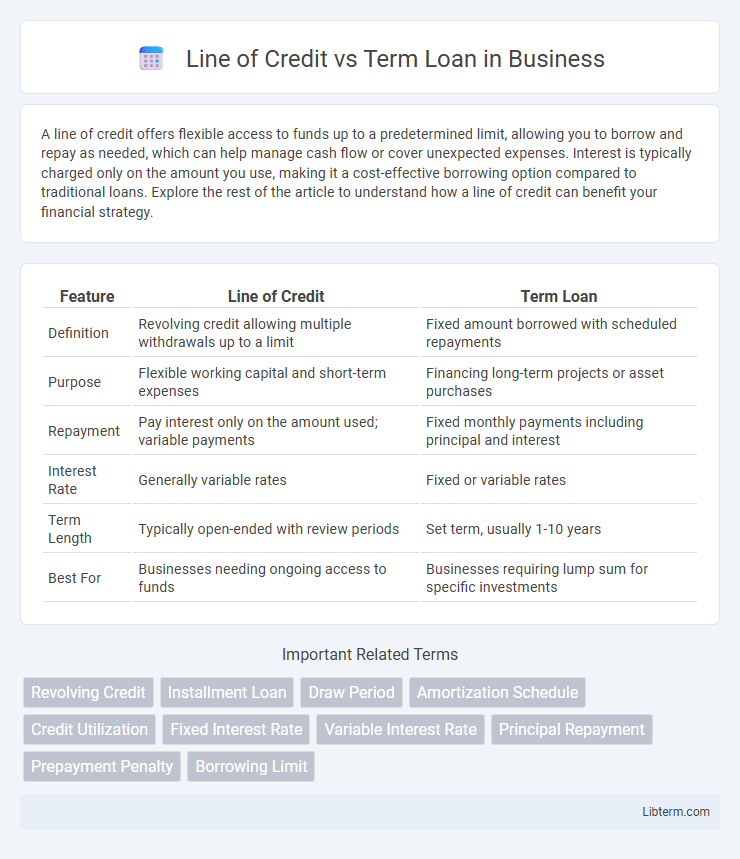

A line of credit offers flexible access to funds up to a predetermined limit, allowing you to borrow and repay as needed, which can help manage cash flow or cover unexpected expenses. Interest is typically charged only on the amount you use, making it a cost-effective borrowing option compared to traditional loans. Explore the rest of the article to understand how a line of credit can benefit your financial strategy.

Table of Comparison

| Feature | Line of Credit | Term Loan |

|---|---|---|

| Definition | Revolving credit allowing multiple withdrawals up to a limit | Fixed amount borrowed with scheduled repayments |

| Purpose | Flexible working capital and short-term expenses | Financing long-term projects or asset purchases |

| Repayment | Pay interest only on the amount used; variable payments | Fixed monthly payments including principal and interest |

| Interest Rate | Generally variable rates | Fixed or variable rates |

| Term Length | Typically open-ended with review periods | Set term, usually 1-10 years |

| Best For | Businesses needing ongoing access to funds | Businesses requiring lump sum for specific investments |

Understanding Line of Credit and Term Loan

A line of credit provides flexible access to funds up to a predetermined limit, allowing borrowers to draw, repay, and redraw as needed, ideal for managing cash flow or short-term expenses. A term loan offers a lump sum with a fixed repayment schedule and interest rate, suitable for long-term investments and major purchases. Understanding these key differences helps businesses choose financing that aligns with their operational needs and financial goals.

Key Differences Between Line of Credit and Term Loan

A Line of Credit offers flexible access to funds up to a set limit, allowing borrowers to draw and repay repeatedly, while a Term Loan provides a lump sum with fixed repayment schedules over a specified period. Interest rates on Lines of Credit are often variable, reflecting usage, whereas Term Loans typically feature fixed or variable rates with structured amortization. The primary distinction lies in flexibility and usage: Lines of Credit suit ongoing cash flow needs, whereas Term Loans are ideal for one-time, significant expenses or investments.

How Line of Credit Works

A line of credit provides flexible access to funds up to a predetermined limit, allowing borrowers to withdraw, repay, and reuse the credit as needed during the draw period. Interest is typically charged only on the amount drawn, making it cost-effective for managing short-term cash flow fluctuations. Unlike term loans with fixed repayment schedules, lines of credit offer revolving credit that supports ongoing operational expenses or unexpected costs.

How Term Loan Works

A term loan provides a lump sum of money upfront, which is repaid over a fixed schedule with regular installments of principal and interest. Interest rates on term loans can be fixed or variable, and the repayment period typically ranges from one to ten years. Borrowers use term loans for specific, one-time expenses like purchasing equipment or real estate, benefiting from predictable payments and structured timelines.

When to Choose a Line of Credit

A Line of Credit is ideal for businesses or individuals requiring flexible access to funds for ongoing expenses or short-term cash flow management. When unpredictable costs arise or working capital fluctuates, a Line of Credit provides revolving credit to draw upon as needed without reapplying. This financing option suits scenarios needing repeated borrowing up to a credit limit, unlike Term Loans which offer lump-sum amounts for fixed, long-term investments.

When to Opt for a Term Loan

A term loan is ideal for financing large, one-time investments such as equipment purchases, expansion projects, or real estate acquisitions where a fixed repayment schedule suits long-term budgeting. Businesses should opt for a term loan when cash flow stability allows for predictable monthly payments and the loan amount exceeds the flexibility limits typically offered by a line of credit. Choosing a term loan ensures access to a lump sum with lower interest rates compared to revolving credit, optimizing capital structure for substantial asset investments.

Interest Rates: Line of Credit vs Term Loan

Interest rates on a line of credit typically fluctuate based on prime rates or credit score, offering variable costs that can be more affordable for short-term borrowing. Term loans usually feature fixed interest rates, providing predictable monthly payments and overall cost for long-term financing. Comparing these, businesses seeking flexibility might prefer a line of credit for variable interest savings, whereas those needing stability and consistent repayments lean towards term loans with fixed rates.

Repayment Structures Compared

Line of credit offers flexible repayment where borrowers repay only the amount they use plus interest, often with revolving access to funds. Term loans require fixed monthly payments of principal and interest over a set period, providing predictable repayment schedules. The choice depends on cash flow stability and borrowing needs, as lines of credit accommodate variable expenses while term loans suit long-term investments.

Pros and Cons of Line of Credit

A Line of Credit offers flexible access to funds up to a set limit, allowing borrowers to use and repay money repeatedly, which is ideal for managing fluctuating cash flow or emergencies. It typically has variable interest rates, which can lead to lower initial costs but potential rate increases over time, and requires regular monitoring to avoid overspending. However, Lines of Credit may come with higher ongoing fees or stricter approval criteria compared to Term Loans, and lack the predictable repayment schedule of fixed-term financing.

Pros and Cons of Term Loan

Term loans provide borrowers with a fixed amount of capital that is repaid over a set period, offering predictable monthly payments and the ability to plan long-term investments. However, term loans lack flexibility since funds are received as a lump sum and early repayment may incur penalties or fees. The structured nature of term loans benefits businesses with stable cash flow but can pose challenges if unexpected expenses arise or cash flow fluctuates.

Line of Credit Infographic

libterm.com

libterm.com