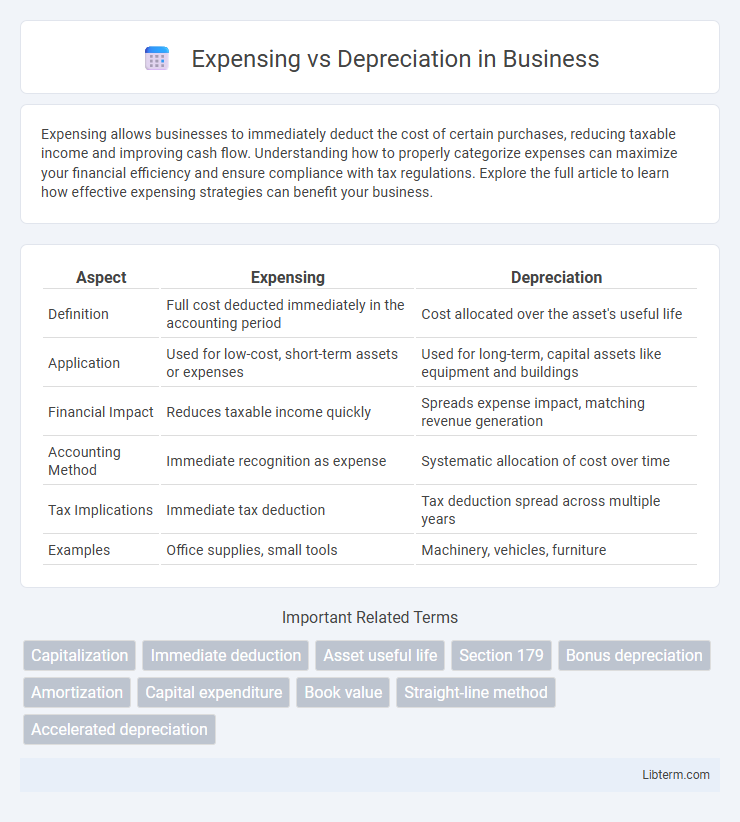

Expensing allows businesses to immediately deduct the cost of certain purchases, reducing taxable income and improving cash flow. Understanding how to properly categorize expenses can maximize your financial efficiency and ensure compliance with tax regulations. Explore the full article to learn how effective expensing strategies can benefit your business.

Table of Comparison

| Aspect | Expensing | Depreciation |

|---|---|---|

| Definition | Full cost deducted immediately in the accounting period | Cost allocated over the asset's useful life |

| Application | Used for low-cost, short-term assets or expenses | Used for long-term, capital assets like equipment and buildings |

| Financial Impact | Reduces taxable income quickly | Spreads expense impact, matching revenue generation |

| Accounting Method | Immediate recognition as expense | Systematic allocation of cost over time |

| Tax Implications | Immediate tax deduction | Tax deduction spread across multiple years |

| Examples | Office supplies, small tools | Machinery, vehicles, furniture |

Understanding Expensing and Depreciation

Expensing involves recording the entire cost of an asset as an expense in the period it is purchased, impacting the income statement immediately. Depreciation allocates the cost of a tangible asset over its useful life, spreading the expense across multiple accounting periods to reflect asset usage. Understanding the distinction helps companies manage cash flow, tax implications, and accurate financial reporting.

Key Differences Between Expensing and Depreciation

Expensing involves immediately deducting the full cost of an asset in the accounting period it is purchased, while depreciation allocates the asset's cost over its useful life through systematic expense recognition. Key differences include timing of expense recognition, with expensing impacting net income immediately and depreciation spreading the impact over multiple periods, and treatment of asset value on the balance sheet, where expensed items are not capitalized but depreciated assets remain recorded as fixed assets. Expensing suits low-cost or short-term assets, whereas depreciation applies to significant capital expenditures with long-term benefits.

When to Expense vs When to Depreciate

Expense items immediately when they provide short-term benefits or cost less than the company's capitalization threshold, such as office supplies or small tools. Depreciate assets that have a useful life extending beyond one year, like machinery, vehicles, or buildings, allocating their cost systematically over their estimated service life. Properly categorizing expenses and depreciable assets ensures accurate financial reporting and aligns with accounting standards like GAAP or IFRS.

Tax Implications of Expensing and Depreciation

Expensing allows businesses to deduct the entire cost of an asset in the purchase year, providing immediate tax relief and reducing taxable income significantly. Depreciation spreads the expense over the asset's useful life, aligning tax deductions with the asset's consumption and potentially lowering tax liability gradually. The choice between expensing and depreciation impacts cash flow, tax planning strategies, and compliance with IRS regulations such as Section 179 and bonus depreciation rules.

Impact on Financial Statements

Expensing immediately reduces net income and total assets by recognizing the full cost of an asset in the current period, leading to lower reported profits and cash flow impact reflected in operating activities. Depreciation allocates the asset's cost over its useful life, spreading expenses across periods, which results in a more stable net income and gradual reduction in asset book value on the balance sheet. This systematic allocation improves matching of revenues and expenses, affecting both the income statement through periodic depreciation expense and the balance sheet via accumulated depreciation.

Common Business Scenarios for Expensing

Small businesses often expense low-cost assets immediately to simplify accounting and reduce tax liabilities, especially for office supplies, software subscriptions, and repair costs. Expensing is also common for routine maintenance expenses that do not extend an asset's useful life, ensuring accurate reflection of operational costs in financial statements. Immediate expensing improves cash flow management and avoids the complexity of tracking asset depreciation schedules.

Asset Types Typically Depreciated

Tangible fixed assets such as machinery, vehicles, buildings, and equipment are typically subject to depreciation to allocate their cost over their useful life. Intangible assets like patents or trademarks may be amortized instead, while low-cost or short-lived assets are often expensed immediately. Depreciation schedules vary based on asset type, industry standards, and tax regulations, ensuring accurate financial reporting and matching expenses with revenue generation.

IRS Rules and Guidelines

The IRS distinguishes between expensing and depreciation based on asset cost and useful life, allowing businesses to immediately expense assets under the Section 179 deduction or bonus depreciation for qualifying property. Depreciation requires spreading the cost of assets like machinery, vehicles, and buildings over their useful life according to IRS schedules, such as the Modified Accelerated Cost Recovery System (MACRS). Strict IRS guidelines mandate accurate classification and documentation to ensure compliance and optimize tax benefits during audits.

Pros and Cons of Expensing and Depreciation

Expensing provides immediate tax benefits by fully deducting the cost of an asset in the purchase year, improving short-term cash flow but potentially distorting profitability metrics. Depreciation spreads the cost of an asset over its useful life, offering a more accurate matching of expenses to revenues while reducing taxable income gradually and enhancing long-term financial analysis. Expensing may lead to fluctuating financial results, whereas depreciation allows for smoother earnings, though it requires maintaining detailed records and assumptions about asset lifespan.

Choosing the Right Approach for Your Business

Choosing the right approach between expensing and depreciation depends largely on your business's cash flow, tax strategy, and asset lifespan. Expensing allows immediate deduction of the full cost in the year of purchase, benefiting businesses seeking quick tax relief or dealing with low-cost items. Depreciation spreads the cost over an asset's useful life, aligning expenses with revenue generation and providing a more accurate financial picture for long-term assets.

Expensing Infographic

libterm.com

libterm.com