Non-callable bonds provide investors with the assurance that the issuer cannot redeem the bond before maturity, ensuring a predictable stream of interest payments. This feature protects your investment from reinvestment risk in declining interest rate environments, making it a safer choice for long-term income stability. Explore the rest of the article to understand how non-callable bonds can fit into your portfolio strategy.

Table of Comparison

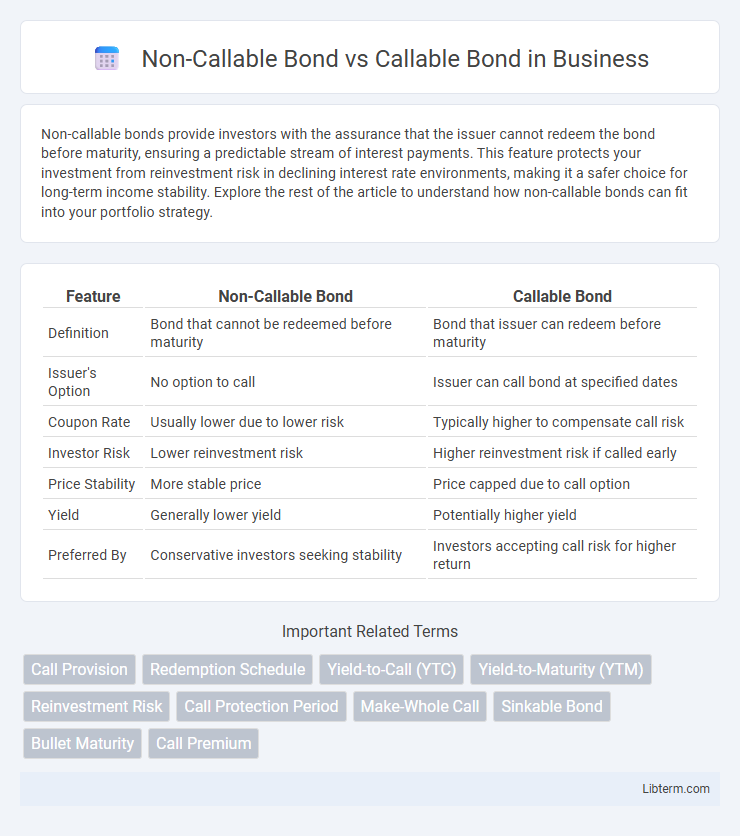

| Feature | Non-Callable Bond | Callable Bond |

|---|---|---|

| Definition | Bond that cannot be redeemed before maturity | Bond that issuer can redeem before maturity |

| Issuer's Option | No option to call | Issuer can call bond at specified dates |

| Coupon Rate | Usually lower due to lower risk | Typically higher to compensate call risk |

| Investor Risk | Lower reinvestment risk | Higher reinvestment risk if called early |

| Price Stability | More stable price | Price capped due to call option |

| Yield | Generally lower yield | Potentially higher yield |

| Preferred By | Conservative investors seeking stability | Investors accepting call risk for higher return |

Introduction to Non-Callable and Callable Bonds

Non-callable bonds are fixed-income securities that cannot be redeemed by the issuer before their maturity date, providing investors with predictable interest payments and principal return. Callable bonds grant issuers the right to repurchase the bonds at a specified call price before maturity, allowing them to refinance debt if interest rates decline. The choice between non-callable and callable bonds influences risk, yield, and investment strategy due to the issuer's early redemption option in callable bonds.

Definition of Non-Callable Bonds

Non-callable bonds are fixed-income securities that cannot be redeemed by the issuer before their maturity date, ensuring that investors receive interest payments until maturity without the risk of early repayment. These bonds provide greater certainty and stability in cash flow compared to callable bonds, which allow issuers to repay the principal early, often when interest rates decline. The absence of a call option typically results in lower yields for non-callable bonds due to reduced risk for investors.

Definition of Callable Bonds

Callable bonds are debt securities that allow the issuer to redeem the bond before its maturity date, usually at a predetermined call price. These bonds provide issuers flexibility to refinance debt if interest rates decline, potentially lowering borrowing costs. Non-callable bonds, in contrast, cannot be redeemed early, offering investors greater price stability and predictable income streams.

Key Differences Between Non-Callable and Callable Bonds

Non-callable bonds provide investors with fixed interest payments until maturity without the risk of early redemption, ensuring predictable cash flow and principal repayment. Callable bonds, however, give issuers the right to redeem the bonds before maturity, often at a premium, potentially limiting investor returns due to reinvestment risk if interest rates decline. The key differences lie in call provisions, risk exposure, and yield, with callable bonds typically offering higher yields to compensate for call risk, while non-callable bonds offer greater security and stability for investors.

Advantages of Non-Callable Bonds

Non-callable bonds offer investors greater certainty and protection by guaranteeing fixed interest payments and principal repayment without the risk of early redemption by the issuer. This stability makes them attractive for long-term income planning, as investors avoid reinvestment risk associated with callable bonds being redeemed when interest rates drop. The increased predictability and lower risk profile often result in more favorable terms for investors seeking consistent returns.

Advantages of Callable Bonds

Callable bonds offer issuers flexibility to refinance debt at lower interest rates, potentially reducing overall borrowing costs. Investors in callable bonds often receive higher yields as compensation for the call risk, enhancing income potential. This feature allows companies to manage debt more efficiently in changing interest rate environments.

Risks Associated With Callable Bonds

Callable bonds carry higher risks compared to non-callable bonds, primarily due to reinvestment risk, where issuers may redeem the bonds early during declining interest rates, forcing investors to reinvest at lower yields. Price volatility is another concern since callable bonds typically exhibit price compression below the call price, limiting potential price appreciation during market rallies. Credit risk may increase if issuers exercise calls during adverse credit conditions, posing challenges for income-dependent investors.

Investment Strategies: When to Choose Non-Callable vs Callable

Non-callable bonds suit investors seeking stable, predictable income with minimal reinvestment risk, especially in a declining interest rate environment where bond prices rise. Callable bonds attract investors aiming for higher yields in exchange for the risk of early redemption, making them suitable when anticipating stable or rising interest rates. Selecting between non-callable and callable bonds depends on balancing yield preferences against potential call risk within specific market conditions.

Impact on Yield and Pricing

Non-callable bonds typically offer lower yields due to the absence of issuer call risk, ensuring fixed interest payments until maturity, which enhances price stability for investors. Callable bonds, however, carry higher yields to compensate investors for the call risk, where the issuer can redeem the bond early, potentially limiting price appreciation and reinvestment opportunities. The pricing of callable bonds incorporates this embedded option, often making them more volatile and sensitive to interest rate changes compared to non-callable bonds.

Which Bond Type Suits Your Investment Goals?

Non-callable bonds offer predictable income and stability by protecting investors from early redemption risk, making them ideal for conservative investors seeking long-term, steady returns. Callable bonds provide issuers the flexibility to refinance debt when interest rates drop, resulting in higher yields to compensate investors for the reinvestment risk, appealing to those willing to accept potential volatility for enhanced income. Choosing between non-callable and callable bonds depends on your investment goals, risk tolerance, and preference for certainty versus yield potential.

Non-Callable Bond Infographic

libterm.com

libterm.com