Core assets are fundamental to a company's primary business operations, driving growth and profitability, while non-core assets are peripheral holdings that do not directly contribute to the main business focus. Efficient management of both asset types can enhance your company's financial health and strategic flexibility. Explore the rest of the article to understand how leveraging core and non-core assets can optimize your business performance.

Table of Comparison

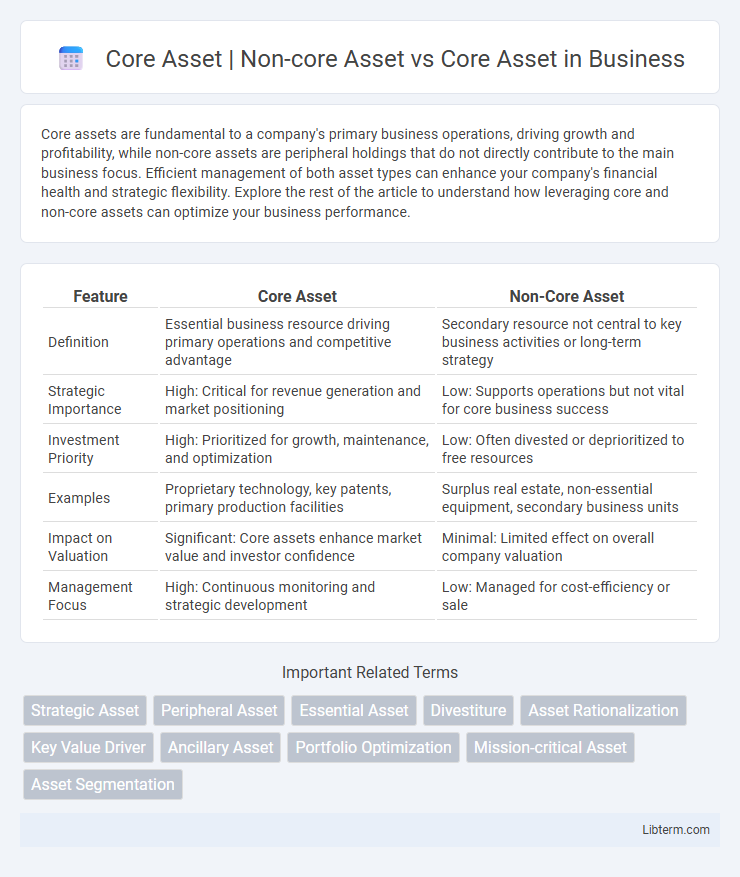

| Feature | Core Asset | Non-Core Asset |

|---|---|---|

| Definition | Essential business resource driving primary operations and competitive advantage | Secondary resource not central to key business activities or long-term strategy |

| Strategic Importance | High: Critical for revenue generation and market positioning | Low: Supports operations but not vital for core business success |

| Investment Priority | High: Prioritized for growth, maintenance, and optimization | Low: Often divested or deprioritized to free resources |

| Examples | Proprietary technology, key patents, primary production facilities | Surplus real estate, non-essential equipment, secondary business units |

| Impact on Valuation | Significant: Core assets enhance market value and investor confidence | Minimal: Limited effect on overall company valuation |

| Management Focus | High: Continuous monitoring and strategic development | Low: Managed for cost-efficiency or sale |

Introduction to Core and Non-core Assets

Core assets represent essential business components critical for generating primary revenue and maintaining competitive advantage, such as proprietary technology, key manufacturing facilities, or flagship brands. Non-core assets include subsidiaries, properties, or investments that are not integral to the main business strategy and can be divested without disrupting core operations. Efficient management of core and non-core assets enables companies to optimize resource allocation, enhance shareholder value, and focus on growth drivers.

Defining Core Assets

Core assets represent the fundamental resources or capabilities that provide a company with a competitive advantage and directly contribute to its long-term value and growth potential. Non-core assets are peripheral to the main business operations and may include underutilized properties, investments, or divisions that do not significantly impact the firm's strategic objectives. Clearly defining core assets involves identifying those critical intangible and tangible resources that are essential for sustaining market leadership and driving innovation within the industry.

Understanding Non-core Assets

Non-core assets refer to company holdings that are not essential to its primary business operations or strategic goals, often including excess properties, subsidiary businesses, or non-strategic investments. Understanding non-core assets is crucial for effective portfolio management, as their divestiture can improve capital allocation, reduce operational complexity, and enhance shareholder value. Companies prioritize core assets to maintain competitive advantage and long-term growth while assessing non-core assets for potential monetization or restructuring opportunities.

Key Differences Between Core and Non-core Assets

Core assets are essential resources or properties central to a company's primary operations and long-term strategy, such as manufacturing plants, patents, or key customer relationships. Non-core assets, by contrast, include secondary or non-essential items like surplus real estate, minority equity stakes, or outdated equipment that can be divested without disrupting core business functions. The key difference lies in their strategic importance: core assets drive competitive advantage and revenue growth, while non-core assets are typically maintained for liquidity or potential sale to optimize corporate value.

Strategic Importance of Core Assets

Core assets represent essential resources or capabilities critical for a company's competitive advantage and long-term growth, often driving key revenue streams and market differentiation. Non-core assets, by contrast, include resources that do not directly contribute to the company's primary business objectives and are frequently candidates for divestiture to improve focus and capital allocation. Emphasizing the strategic importance of core assets allows organizations to concentrate investments on innovation, operational excellence, and customer value, thereby sustaining sustainable competitive positioning.

Examples of Core Assets Across Industries

Core assets represent essential resources or capabilities that provide a company with competitive advantages, such as patented technologies in pharmaceuticals, proprietary algorithms in tech firms, or prime real estate in retail. Non-core assets, like surplus equipment or secondary office spaces, do not directly contribute to the primary value creation and can often be divested. Examples of core assets across industries include Boeing's aircraft design patents, Apple's iOS ecosystem, and Amazon's extensive distribution network.

Criteria for Identifying Non-core Assets

Non-core assets are identified based on criteria such as limited contribution to a company's strategic objectives, low profitability, or non-essential operations that do not align with the core business focus. These assets often include underutilized properties, obsolete equipment, or subsidiaries unrelated to the main revenue-generating activities. Core assets, in contrast, are integral to a firm's competitive advantage and long-term growth, driving value through sustained operational importance and direct alignment with corporate strategy.

Impact of Asset Classification on Business Performance

Core assets, essential to a company's primary operations, drive revenue growth and competitive advantage, while non-core assets are peripheral and often divested to improve financial efficiency. Proper classification enables businesses to allocate resources effectively, enhance operational focus, and optimize capital investment decisions. Misclassification risks resource misallocation, reducing overall business performance and shareholder value.

Approaches to Managing Core and Non-core Assets

Approaches to managing core assets emphasize strategic investment, maintenance, and optimization to sustain competitive advantage and long-term value generation. Non-core assets are often evaluated for divestiture, monetization, or repurposing to improve organizational focus and liquidity, leveraging asset rationalization frameworks and portfolio optimization techniques. Effective management integrates asset classification, performance metrics, and risk assessment to balance resource allocation between core operations and non-core asset streamlining.

Conclusion: Optimizing Asset Portfolios for Growth

Core assets represent the essential investments driving a company's primary revenue and competitive advantage, while non-core assets are peripheral holdings that may not align with strategic objectives. Optimizing asset portfolios by identifying and divesting non-core assets allows firms to reallocate resources towards core assets, enhancing operational efficiency and growth potential. Strategic management of asset portfolios ultimately maximizes return on investment and strengthens market positioning.

Core Asset | Non-core Asset Infographic

libterm.com

libterm.com