A Special Purpose Acquisition Company (SPAC) is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, allowing it to go public without the traditional IPO process. This method offers faster access to public markets and potential capital infusion, but it also carries risks such as less regulatory scrutiny and potential valuation challenges. Learn how a SPAC could impact your investment strategy and uncover key insights in the rest of this article.

Table of Comparison

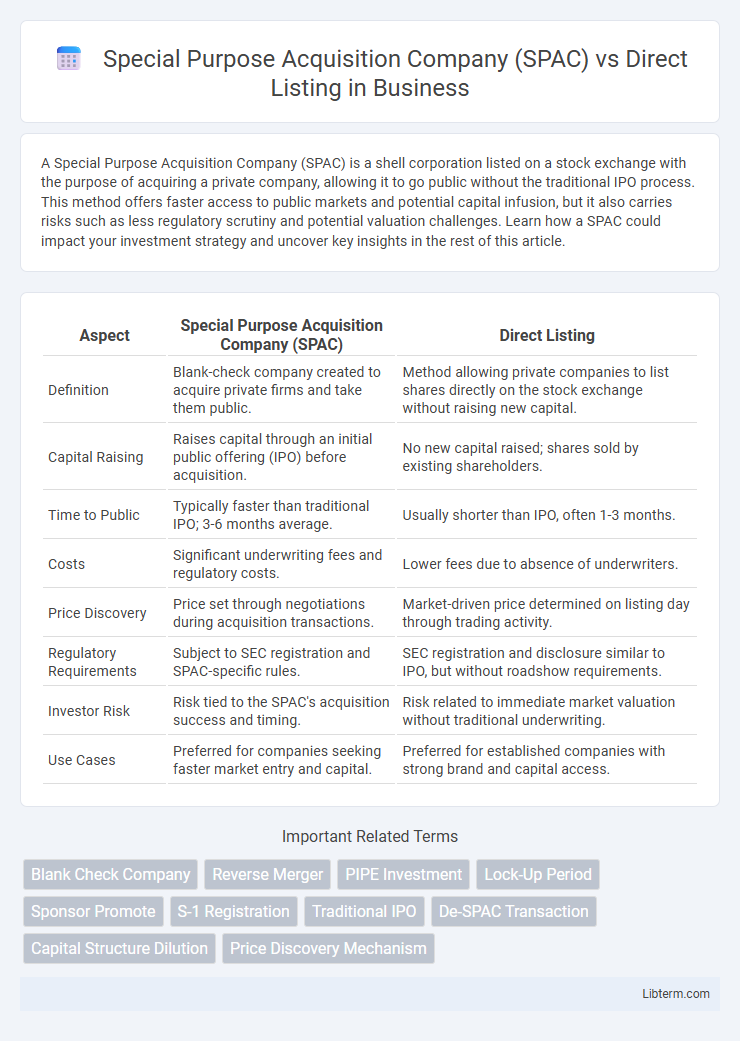

| Aspect | Special Purpose Acquisition Company (SPAC) | Direct Listing |

|---|---|---|

| Definition | Blank-check company created to acquire private firms and take them public. | Method allowing private companies to list shares directly on the stock exchange without raising new capital. |

| Capital Raising | Raises capital through an initial public offering (IPO) before acquisition. | No new capital raised; shares sold by existing shareholders. |

| Time to Public | Typically faster than traditional IPO; 3-6 months average. | Usually shorter than IPO, often 1-3 months. |

| Costs | Significant underwriting fees and regulatory costs. | Lower fees due to absence of underwriters. |

| Price Discovery | Price set through negotiations during acquisition transactions. | Market-driven price determined on listing day through trading activity. |

| Regulatory Requirements | Subject to SEC registration and SPAC-specific rules. | SEC registration and disclosure similar to IPO, but without roadshow requirements. |

| Investor Risk | Risk tied to the SPAC's acquisition success and timing. | Risk related to immediate market valuation without traditional underwriting. |

| Use Cases | Preferred for companies seeking faster market entry and capital. | Preferred for established companies with strong brand and capital access. |

Introduction to SPACs and Direct Listings

Special Purpose Acquisition Companies (SPACs) are publicly traded shell companies created to raise capital through an initial public offering (IPO) with the intent to acquire or merge with a private company, enabling it to go public without the traditional IPO process. Direct listings allow existing private company shareholders to sell shares directly to the public on a stock exchange, bypassing underwriters and new capital raises. Both methods offer alternative paths to public markets, with SPACs providing capital infusion and streamlined mergers, while direct listings emphasize liquidity and cost efficiency.

How SPACs Work: An Overview

Special Purpose Acquisition Companies (SPACs) raise capital through an initial public offering (IPO) to acquire or merge with a private company, enabling it to go public without a traditional IPO process. Investors in SPACs initially buy shares in a shell company with the intent that the SPAC will identify and merge with a target business within a specified timeframe, usually 18-24 months. This structure offers private companies faster access to public markets while providing investors the ability to redeem shares if they disapprove of the proposed acquisition.

Understanding the Direct Listing Process

The direct listing process allows companies to go public by selling existing shares directly on the stock exchange without issuing new shares or raising capital, contrasting with a SPAC that merges with a private company to facilitate public listing. In a direct listing, there is no underwriter involvement, which reduces costs and dilutes share ownership less compared to traditional IPOs or SPAC mergers. The process emphasizes price discovery through market demand, relying on institutional and retail investors to establish a stock price based on existing shares available for trading.

Key Differences Between SPACs and Direct Listings

Special Purpose Acquisition Companies (SPACs) involve raising capital through an initial public offering (IPO) to acquire a private company, providing a faster route to the public markets with a shell company structure. Direct listings, in contrast, allow existing shareholders to sell shares directly to the public without raising new capital or diluting ownership, emphasizing market-driven price discovery. Key differences include SPACs offering capital infusion and negotiated valuations prior to public trading, whereas direct listings forego capital raising and depend on market demand for pricing.

Advantages of Choosing a SPAC

Special Purpose Acquisition Companies (SPACs) offer a faster and more certain path to public markets compared to direct listings, with streamlined regulatory approval and reduced market volatility at IPO. SPACs provide private companies with access to substantial capital through upfront fundraising and enable negotiated valuations, unlike the market-driven pricing seen in direct listings. The structure of SPACs also allows founders and investors to retain more control and secure strategic partnerships during the merger process.

Benefits of Direct Listing for Companies

Direct listings offer companies immediate liquidity without diluting existing shareholders, as no new shares are issued during the process. This method reduces underwriting fees significantly compared to traditional IPOs or SPAC mergers, resulting in cost savings. Enhanced price discovery through real-time market demand ensures a more transparent and potentially fair valuation.

Potential Risks and Challenges

Special Purpose Acquisition Companies (SPACs) carry risks such as potential conflicts of interest, high dilution for existing shareholders, and uncertainty about the target company's valuation and business model. Direct listings present challenges including limited capital raising opportunities and heightened price volatility due to the absence of traditional underwriting stabilization. Both methods expose companies to regulatory scrutiny and market perception risks that can impact long-term investor confidence.

Regulatory Considerations and Compliance

Special Purpose Acquisition Companies (SPACs) undergo a two-step regulatory process involving initial registration with the SEC as shell companies under Form S-1, followed by a De-SPAC merger requiring additional disclosures, creating a complex compliance landscape. Direct Listings bypass traditional underwriting and IPO roadshows but demand thorough adherence to continuous SEC disclosure obligations and market listing requirements, emphasizing transparency and investor protection. Both routes require careful navigation of Securities Act regulations, Exchange Act ongoing reporting standards, and stock exchange listing rules to ensure full regulatory compliance.

Market Trends: SPACs vs Direct Listings

SPACs have surged in popularity as an alternative to traditional IPOs, enabling faster access to public markets with fewer regulatory hurdles, attracting companies in technology and healthcare sectors. Direct listings are increasingly favored for providing liquidity without dilution, appealing to established firms with strong brand recognition such as Spotify and Coinbase. Current market trends indicate a cooling in SPAC activity due to regulatory scrutiny and investor caution, while direct listings gain momentum for transparent valuation and reduced underwriting costs.

Which Path is Best for Your Company?

Choosing between a Special Purpose Acquisition Company (SPAC) and a direct listing depends on your company's goals, timeline, and desire for capital infusion. SPACs provide faster access to public markets and certainty of capital through a merger with a pre-existing shell company, making them suitable for companies seeking speed and funding. Direct listings offer a transparent, cost-effective route without diluting existing shareholders but lack the capital raise component, ideal for companies with strong brand recognition and sufficient cash reserves.

Special Purpose Acquisition Company (SPAC) Infographic

libterm.com

libterm.com