Hire Purchase allows you to acquire goods by paying in installments while using the product immediately. This financing method spreads the cost over time, making expensive purchases more affordable without requiring full payment upfront. Explore the benefits and key considerations of Hire Purchase to see if it suits your financial needs.

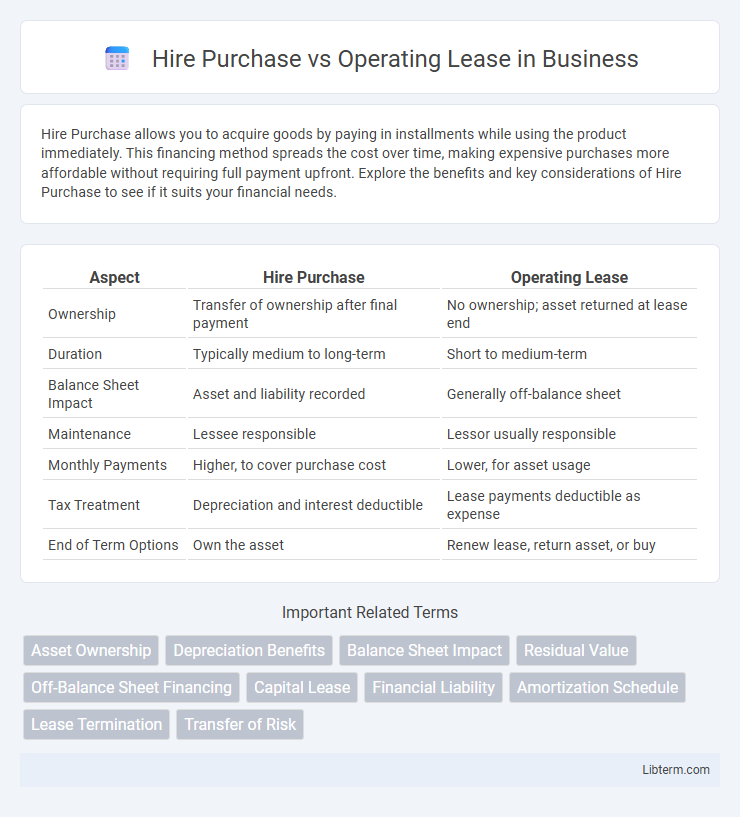

Table of Comparison

| Aspect | Hire Purchase | Operating Lease |

|---|---|---|

| Ownership | Transfer of ownership after final payment | No ownership; asset returned at lease end |

| Duration | Typically medium to long-term | Short to medium-term |

| Balance Sheet Impact | Asset and liability recorded | Generally off-balance sheet |

| Maintenance | Lessee responsible | Lessor usually responsible |

| Monthly Payments | Higher, to cover purchase cost | Lower, for asset usage |

| Tax Treatment | Depreciation and interest deductible | Lease payments deductible as expense |

| End of Term Options | Own the asset | Renew lease, return asset, or buy |

Introduction to Hire Purchase and Operating Lease

Hire Purchase (HP) is a financing method where the buyer acquires an asset by paying an initial deposit followed by fixed monthly installments, eventually owning the asset after the final payment. Operating Lease involves renting an asset for a specific period without ownership, allowing businesses to use the asset without capital expenditure and with maintenance often included. HP is commonly used for equipment ownership, while Operating Lease suits companies seeking flexibility and lower upfront costs.

Key Differences Between Hire Purchase and Operating Lease

Hire Purchase involves acquiring ownership of an asset through installment payments, with the transfer of ownership occurring at the end of the agreement, while Operating Lease provides only the right to use the asset for a specified period without ownership transfer. In Hire Purchase, the asset appears on the lessee's balance sheet as an owned asset, whereas Operating Lease assets remain on the lessor's balance sheet, impacting financial reporting and tax treatment. Payment structures differ, with Hire Purchase requiring fixed installments contributing towards ownership, contrasted with Operating Lease payments classified as rental expenses without building equity in the asset.

How Hire Purchase Works

Hire purchase allows businesses to acquire assets by paying an initial deposit followed by fixed monthly installments over an agreed period, ultimately gaining ownership after the final payment. The asset appears on the balance sheet, and the business benefits from depreciation and interest expense deductions. This method suits companies seeking long-term use and eventual ownership of vehicles or equipment without immediate full payment.

How Operating Lease Works

Operating lease allows businesses to rent assets for a specific period without ownership, enabling off-balance-sheet financing and preserving capital liquidity. Lease payments are recorded as operating expenses, providing tax benefits and flexibility in asset management. Unlike hire purchase, the asset remains the lessor's property, and lessees have the option to upgrade or return the asset at lease end.

Financial Implications for Businesses

Hire purchase agreements enable businesses to acquire assets with ownership transfer after installment completion, reflecting on the balance sheet as assets and liabilities, thereby improving equity over time. Operating leases classify payments as operating expenses, keeping liabilities off the balance sheet and preserving credit lines, which optimizes cash flow management. Financial implications include asset depreciation and interest costs under hire purchase, contrasted with predictable lease expenses and off-balance-sheet treatment under operating leases.

Tax Benefits and Considerations

Hire Purchase agreements allow businesses to claim depreciation and interest expenses on assets, providing tax relief through capital allowances and deductible finance costs. Operating Leases do not transfer asset ownership, so lease payments are fully deductible as operating expenses, offering consistent tax deductions without capital allowances. Companies must consider their tax position and cash flow implications when choosing between the asset ownership benefits of Hire Purchase and the expense-focused advantages of Operating Leases.

Ownership and Asset Control

Hire Purchase agreements transfer ownership of the asset to the buyer after all payments are completed, granting full asset control and equity buildup during the payment period. Operating Leases, however, keep ownership with the lessor, limiting the lessee's control over the asset and typically excluding long-term equity benefits. Understanding these distinctions is crucial for businesses seeking asset acquisition versus asset use flexibility.

Suitability for Different Business Needs

Hire Purchase suits businesses seeking ownership with fixed monthly payments, ideal for companies aiming to acquire assets outright and build equity over time. Operating Lease fits organizations prioritizing flexibility and lower upfront costs, valuable for those needing to upgrade equipment frequently without ownership responsibilities. Choosing between them depends on cash flow preferences, asset control desires, and long-term financial strategy.

Pros and Cons of Hire Purchase vs Operating Lease

Hire Purchase offers ownership benefits, allowing full asset control after payments, with potential tax advantages through depreciation claims, but involves higher upfront costs and long-term commitment. Operating Lease provides flexibility and lower initial expenses without ownership responsibilities, simplifying asset management and preserving capital, but lacks equity build-up and may incur usage restrictions. Choosing between Hire Purchase and Operating Lease depends on cash flow priorities, asset control preferences, and long-term financial strategies.

Choosing the Right Option for Your Business

Selecting between Hire Purchase and Operating Lease depends on your business's financial goals and asset management preferences. Hire Purchase allows ownership after all payments, offering long-term asset control and equity buildup, while Operating Lease provides short-term usage with lower upfront costs and maintenance responsibility remaining with the lessor. Evaluate cash flow impact, tax benefits, and fleet flexibility to determine which option aligns best with your operational and financial strategy.

Hire Purchase Infographic

libterm.com

libterm.com