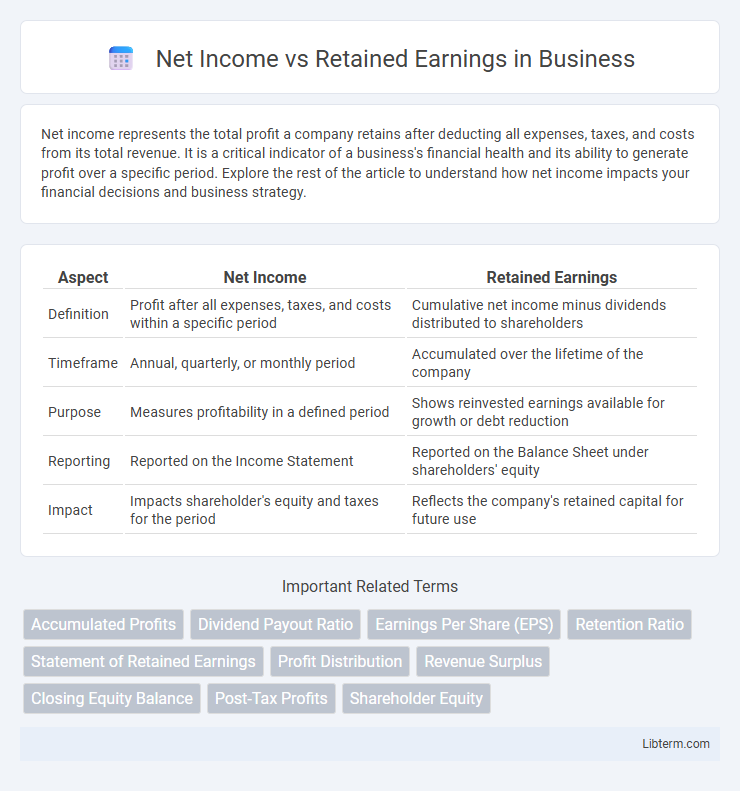

Net income represents the total profit a company retains after deducting all expenses, taxes, and costs from its total revenue. It is a critical indicator of a business's financial health and its ability to generate profit over a specific period. Explore the rest of the article to understand how net income impacts your financial decisions and business strategy.

Table of Comparison

| Aspect | Net Income | Retained Earnings |

|---|---|---|

| Definition | Profit after all expenses, taxes, and costs within a specific period | Cumulative net income minus dividends distributed to shareholders |

| Timeframe | Annual, quarterly, or monthly period | Accumulated over the lifetime of the company |

| Purpose | Measures profitability in a defined period | Shows reinvested earnings available for growth or debt reduction |

| Reporting | Reported on the Income Statement | Reported on the Balance Sheet under shareholders' equity |

| Impact | Impacts shareholder's equity and taxes for the period | Reflects the company's retained capital for future use |

Understanding Net Income

Net Income represents a company's total earnings after deducting all expenses, taxes, and costs from total revenue within a specific accounting period. It serves as a critical indicator of profitability and operational efficiency, directly impacting shareholder value and investment decisions. Unlike retained earnings, which accumulates net income over time minus dividends, net income reflects a single period's financial performance.

Defining Retained Earnings

Retained earnings represent the cumulative amount of net income a company has kept after paying dividends to shareholders, reflecting reinvested profits used for growth and debt reduction. Unlike net income, which measures profitability over a specific period, retained earnings accumulate over time on the balance sheet. This financial metric provides insight into a company's long-term financial health and operational efficiency by highlighting funds available for expansion or reserves.

Net Income vs Retained Earnings: Key Differences

Net income represents a company's total profit earned over a specific period after deducting expenses, taxes, and costs, while retained earnings refer to the cumulative net income retained in the company rather than distributed as dividends. Net income is a flow metric measured over a quarter or year, whereas retained earnings are a stock metric reported on the balance sheet reflecting accumulated profits since inception. Understanding their key differences is crucial for analyzing financial health, as net income indicates profitability for a period, and retained earnings show the company's reinvested earnings available for growth or debt reduction.

How Net Income Impacts Retained Earnings

Net income directly increases retained earnings by adding the company's earned profits to its accumulated equity, reflecting the business's profitability over a given period. When net income is positive, it boosts retained earnings, providing more funds for reinvestment or debt reduction, whereas losses reduce retained earnings and indicate a decrease in available equity. Retained earnings serve as a cumulative summary of net income minus dividends paid, demonstrating how net income impacts the company's financial strength and growth potential.

Calculation Methods Explained

Net income is calculated by subtracting total expenses from total revenues within a specific accounting period, reflecting the company's profitability. Retained earnings are computed by adding the net income to the beginning retained earnings balance and then subtracting any dividends distributed to shareholders. This method shows how much profit is reinvested in the business rather than paid out as dividends.

Importance in Financial Statements

Net income represents a company's profitability over a specific period, directly impacting the income statement by showing the net result of revenues and expenses. Retained earnings reflect the cumulative net income retained in the business after paying dividends, appearing on the balance sheet as part of shareholders' equity. Both metrics are crucial for financial statements as net income indicates operational success, while retained earnings demonstrate how profits are reinvested for future growth.

Effects on Business Growth and Expansion

Net income directly impacts business growth by increasing available profits that can be reinvested into operations, marketing, or product development, fueling expansion efforts. Retained earnings represent the cumulative portion of net income kept within the company rather than distributed as dividends, serving as a key internal financing source for acquiring assets and funding strategic initiatives. Efficient management of net income and retention policies enhances capital reserves, enabling sustained growth, scaling capacity, and competitive advantage in dynamic markets.

Role in Dividend Distribution

Net income represents a company's total profit over a specific period, serving as the primary source for dividends. Retained earnings reflect the cumulative portion of net income that is reinvested or held back instead of distributed as dividends. Companies use retained earnings to balance dividend payments with reinvestment needs, directly influencing the sustainability and size of future dividend distributions.

Common Misconceptions

Net income represents a company's total earnings during a specific period, while retained earnings reflect the cumulative profits reinvested in the business after dividends are paid. A common misconception is that net income and retained earnings are interchangeable, but retained earnings account for all prior periods' profits minus distributions, not just the current period's net income. Misunderstanding this distinction can lead to inaccurate assessments of a company's financial health and growth potential.

Frequently Asked Questions

Net income represents a company's profit over a specific period, calculated as total revenues minus total expenses, before any distributions to shareholders. Retained earnings reflect the cumulative portion of net income that is reinvested in the company rather than paid out as dividends, appearing on the balance sheet as part of shareholders' equity. Frequently asked questions often clarify the difference between these two financial metrics, their impact on company valuation, and how net income adjustments influence retained earnings over time.

Net Income Infographic

libterm.com

libterm.com