Strategic alliances enable businesses to collaborate and combine resources for mutual growth and competitive advantage. By leveraging each other's strengths, companies can enter new markets, share risks, and innovate more effectively. Discover how forming the right strategic alliance can elevate your business by exploring the detailed insights in the rest of this article.

Table of Comparison

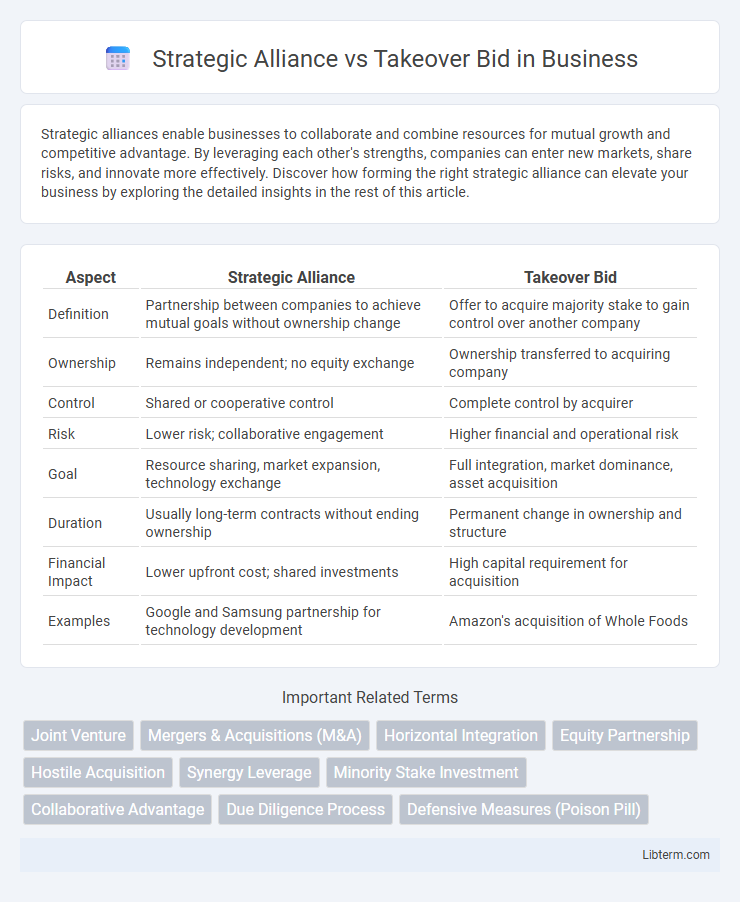

| Aspect | Strategic Alliance | Takeover Bid |

|---|---|---|

| Definition | Partnership between companies to achieve mutual goals without ownership change | Offer to acquire majority stake to gain control over another company |

| Ownership | Remains independent; no equity exchange | Ownership transferred to acquiring company |

| Control | Shared or cooperative control | Complete control by acquirer |

| Risk | Lower risk; collaborative engagement | Higher financial and operational risk |

| Goal | Resource sharing, market expansion, technology exchange | Full integration, market dominance, asset acquisition |

| Duration | Usually long-term contracts without ending ownership | Permanent change in ownership and structure |

| Financial Impact | Lower upfront cost; shared investments | High capital requirement for acquisition |

| Examples | Google and Samsung partnership for technology development | Amazon's acquisition of Whole Foods |

Introduction to Strategic Alliances and Takeover Bids

Strategic alliances involve collaborative agreements between companies to leverage shared resources and capabilities for mutual benefit, enhancing competitive advantage without altering ownership structures. Takeover bids are attempts by an acquiring firm to gain control of a target company by purchasing a majority of its shares, often resulting in full ownership transfer. Both approaches serve different strategic purposes: alliances focus on cooperation and synergy, while takeover bids emphasize consolidation and control.

Defining Strategic Alliances

Strategic alliances involve cooperative agreements between two or more companies to achieve shared objectives while remaining independent entities, emphasizing collaboration and resource sharing. These partnerships enable firms to access new markets, technologies, and expertise without the complexities of ownership changes or hostile takeovers. In contrast, a takeover bid is a formal offer to acquire control of another company, often resulting in full ownership and integration.

Understanding Takeover Bids

Takeover bids involve one company attempting to gain control of another by purchasing a majority of its shares, often resulting in a change of ownership and management. This aggressive acquisition strategy contrasts with strategic alliances, which are collaborative partnerships without transfer of ownership. Understanding takeover bids requires analyzing bid types, such as friendly or hostile, and evaluating shareholder responses and regulatory implications.

Key Differences Between Strategic Alliances and Takeovers

Strategic alliances involve collaborative agreements between companies to share resources and expertise while maintaining independence, whereas takeover bids aim to acquire control over the target company through purchasing a majority of its shares. Strategic alliances typically allow for flexible cooperation with shared risks and benefits, while takeovers result in full integration or ownership and often involve significant financial and operational restructuring. The key difference lies in control and commitment levels: alliances foster mutual benefit without ownership transfer, whereas takeovers seek ownership and direct control.

Benefits of Forming a Strategic Alliance

Forming a strategic alliance enables companies to share resources, expertise, and market access without the complexities of full ownership transfer involved in a takeover bid. Strategic alliances facilitate risk sharing and innovation through collaborative efforts while maintaining operational independence for each party. This partnership approach often results in faster market entry, cost efficiencies, and enhanced competitive positioning across industries such as technology, pharmaceuticals, and automotive sectors.

Advantages and Risks of Takeover Bids

Takeover bids offer advantages such as rapid market expansion, increased control over target companies, and potential cost synergies that enhance competitive positioning. However, risks include high acquisition costs, integration challenges, possible cultural clashes, and resistance from target company management or shareholders. These factors can lead to operational disruptions and may diminish the anticipated value from the takeover bid.

Factors Influencing the Choice: Alliance or Acquisition

Decision-making between strategic alliances and takeover bids is influenced by factors such as the degree of control desired, resource commitment, risk tolerance, and market entry objectives. Strategic alliances offer flexibility and shared risks without full ownership, making them suitable when firms seek collaboration to access new markets or technologies. Takeover bids are preferred when a company aims for complete control, rapid expansion, or elimination of competition, despite higher costs and integration challenges.

Real-World Examples of Strategic Alliances

Strategic alliances enable companies to collaborate while maintaining independence, as demonstrated by Starbucks and PepsiCo's partnership to market ready-to-drink beverages. Unlike takeover bids, which involve acquiring control, strategic alliances focus on shared resources and mutual benefits without ownership changes. Real-world examples include Spotify and Hulu teaming up to offer bundled subscriptions and Boeing partnering with suppliers worldwide for advanced aerospace solutions.

Notable Takeover Bid Case Studies

Notable takeover bid case studies, such as Vodafone's acquisition of Mannesmann in 2000 and Kraft Heinz's bid for Unilever in 2017, demonstrate the complexities and high stakes involved in hostile takeovers, highlighting challenges in valuation, regulatory approval, and shareholder approval. These takeover bids often contrast with strategic alliances, which prioritize collaboration and shared goals without direct ownership transfer, reflecting fundamentally different approaches to growth and market expansion. Examining these high-profile cases provides valuable insights into negotiation tactics, regulatory hurdles, and market reactions throughout the takeover process.

Choosing the Right Growth Strategy for Your Business

Choosing the right growth strategy for your business involves understanding the distinct advantages of a strategic alliance versus a takeover bid. Strategic alliances enable companies to leverage complementary strengths, share resources, and access new markets with lower risk and capital investment compared to takeover bids, which involve acquiring controlling interest in another company, resulting in full integration and potentially higher control but greater financial commitment. Evaluating factors such as company culture compatibility, financial capacity, and long-term business objectives is critical to determining whether a collaborative partnership or an acquisition aligns best with your growth ambitions.

Strategic Alliance Infographic

libterm.com

libterm.com