Social bonds play a crucial role in building trust and fostering cooperation among individuals and communities. Strong social ties contribute to emotional well-being and create a support network during challenging times. Explore the rest of the article to understand how strengthening your social bonds can enhance your life.

Table of Comparison

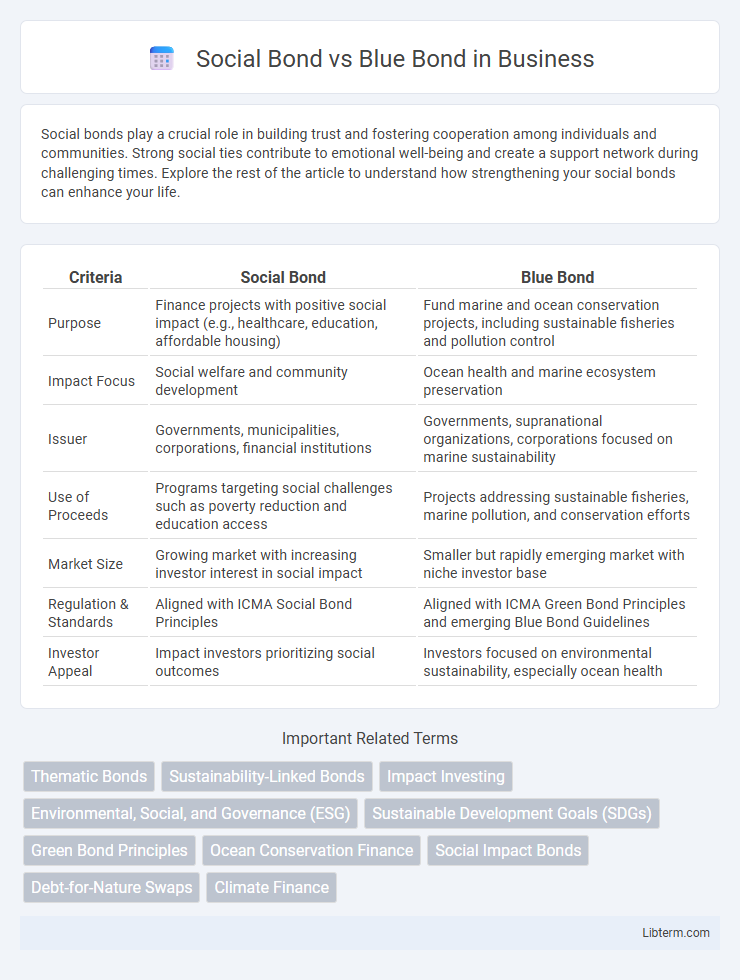

| Criteria | Social Bond | Blue Bond |

|---|---|---|

| Purpose | Finance projects with positive social impact (e.g., healthcare, education, affordable housing) | Fund marine and ocean conservation projects, including sustainable fisheries and pollution control |

| Impact Focus | Social welfare and community development | Ocean health and marine ecosystem preservation |

| Issuer | Governments, municipalities, corporations, financial institutions | Governments, supranational organizations, corporations focused on marine sustainability |

| Use of Proceeds | Programs targeting social challenges such as poverty reduction and education access | Projects addressing sustainable fisheries, marine pollution, and conservation efforts |

| Market Size | Growing market with increasing investor interest in social impact | Smaller but rapidly emerging market with niche investor base |

| Regulation & Standards | Aligned with ICMA Social Bond Principles | Aligned with ICMA Green Bond Principles and emerging Blue Bond Guidelines |

| Investor Appeal | Impact investors prioritizing social outcomes | Investors focused on environmental sustainability, especially ocean health |

Introduction to Social Bonds and Blue Bonds

Social bonds finance projects that generate positive social impacts, targeting issues like affordable housing, education, and healthcare access, while ensuring measurable outcomes align with the United Nations Sustainable Development Goals (SDGs). Blue bonds specifically allocate capital towards ocean-related initiatives such as marine conservation, sustainable fisheries, and coastal resilience, supporting the health of marine ecosystems. Both instruments attract socially responsible investors by combining financial returns with targeted environmental or social benefits.

Defining Social Bonds: Purpose and Impact

Social bonds are debt instruments issued to fund projects that generate positive social outcomes, such as affordable housing, healthcare, and education. Their primary purpose is to address social challenges and improve community well-being by directing capital towards initiatives with measurable social impact. Investors in social bonds seek both financial returns and contributions to social progress, making these bonds integral to sustainable finance strategies.

Understanding Blue Bonds: Focus and Objectives

Blue bonds specifically target financing projects that support ocean sustainability, including marine conservation, fisheries management, and pollution reduction. Their primary objective is to drive investment towards protecting marine ecosystems and promoting responsible ocean resource use, differentiating them from general social bonds that aim to address a broader range of social issues such as education and healthcare. By channeling capital into blue economy initiatives, blue bonds play a crucial role in advancing environmental resilience and sustainable development in coastal and marine areas.

Key Differences Between Social and Blue Bonds

Social bonds primarily fund projects that address social issues such as affordable housing, education, and healthcare, while blue bonds specifically target marine and ocean-related conservation and sustainable use of marine resources. The defining difference lies in the thematic focus: social bonds aim to improve societal well-being broadly, whereas blue bonds concentrate on preserving aquatic ecosystems and supporting sustainable fisheries. Additionally, blue bonds often involve partnerships with environmental organizations to ensure ecological impact, contrasting with social bonds' alignment with social service providers and community development initiatives.

Issuers and Investors: Who Participates?

Social bonds primarily attract issuers such as governments, municipalities, and corporations aiming to fund projects with positive social outcomes, drawing investors focused on social impact and ethical investing. Blue bonds are typically issued by sovereign entities, development banks, or environmental organizations dedicated to marine and water-related projects, appealing to investors committed to environmental sustainability and ocean conservation. Both bond types engage a growing market of impact-driven investors but differ in project focus and issuer profiles, aligning financial goals with specific social or environmental objectives.

Use of Proceeds: Social vs Blue Bonds

Social bonds primarily finance projects that address social challenges such as affordable housing, healthcare, education, and employment generation. Blue bonds are specifically designed to support marine and ocean-based projects, including sustainable fisheries, marine conservation, pollution reduction, and coastal ecosystem restoration. Both bond types require transparent use of proceeds but diverge in focus: social bonds emphasize social impact metrics, while blue bonds measure environmental outcomes related to ocean health.

Market Trends and Growth for Both Bond Types

Social bonds have gained significant traction in recent years, driven by increasing investor demand for financing projects with positive social impacts like healthcare, education, and affordable housing. Blue bonds, a niche within green bonds targeting marine and ocean conservation, are experiencing rapid growth due to heightened global awareness of ocean sustainability and climate change resilience. Market trends show expanding issuance volumes for both bond types, with social bonds dominating due to their broader appeal, while blue bonds are attracting specialized investors focused on environmental protection and sustainable marine economies.

Regulatory Frameworks and Guidelines

Social bonds operate under regulatory frameworks such as the Social Bond Principles (SBP) established by the International Capital Market Association (ICMA), which emphasize funding projects with positive social outcomes like affordable housing and education. Blue bonds are guided by emerging guidelines like the ICMA's Green Bond Principles and the Sustainable Blue Economy Finance Principles, focusing on marine and freshwater conservation efforts, including fisheries management and ocean pollution control. Both bond types require rigorous reporting and impact assessments to ensure transparency and alignment with sustainable development goals (SDGs).

Case Studies: Success Stories of Each Bond

The Social Bond issued by the International Finance Corporation (IFC) in 2017 successfully financed projects improving education and healthcare in emerging markets, demonstrating measurable social impact with clear reporting metrics. The Blue Bond, exemplified by the Seychelles Blue Bond launched in 2018, generated $15 million aimed at marine conservation and sustainable fisheries, showcasing effective government-private sector collaboration and innovative financing for ocean sustainability. Both bonds highlight the growing trend of targeted green and social finance, with social bonds focusing on community welfare, while blue bonds prioritize ocean ecosystem resilience and sustainable economic growth.

Future Outlook: Evolving Social and Blue Bond Markets

Social bonds and blue bonds are expected to experience significant growth as investors increasingly prioritize environmental, social, and governance (ESG) criteria in their portfolios. The future outlook for social bonds focuses on addressing social challenges such as affordable housing, healthcare, and education, driven by rising global social inequality and pandemic recovery efforts. Blue bonds, targeting ocean conservation and sustainable marine economies, are projected to expand alongside heightened awareness of ocean health and increasing regulatory support for blue economy initiatives.

Social Bond Infographic

libterm.com

libterm.com