Impairment refers to the loss or reduction of normal function in a body part or system, often resulting from injury, disease, or congenital conditions. Understanding the types and causes of impairment is essential for accurate diagnosis and effective treatment. Explore the rest of the article to learn how different impairments impact health and the available management options for your condition.

Table of Comparison

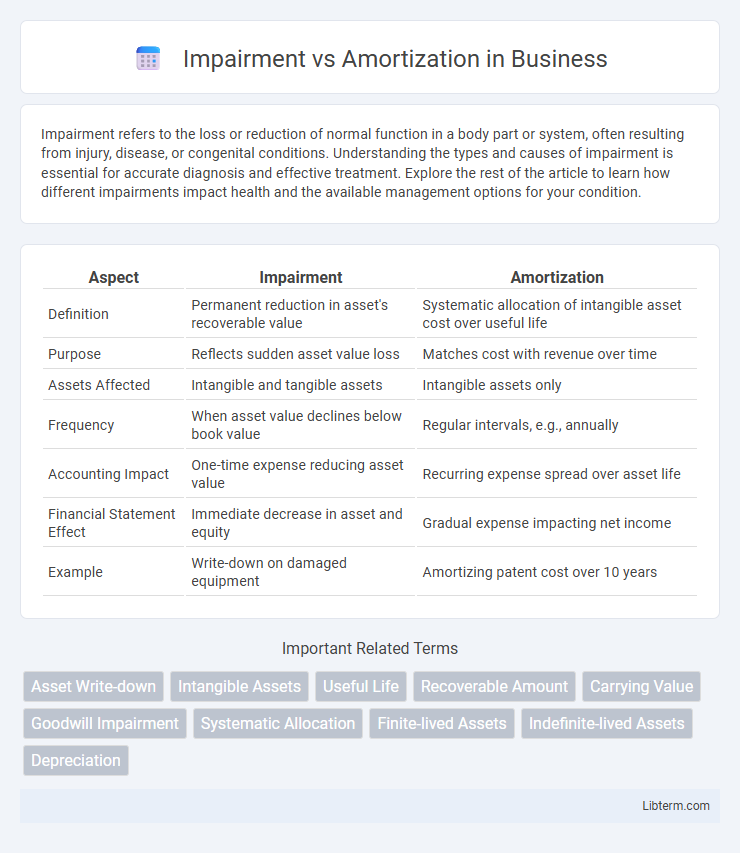

| Aspect | Impairment | Amortization |

|---|---|---|

| Definition | Permanent reduction in asset's recoverable value | Systematic allocation of intangible asset cost over useful life |

| Purpose | Reflects sudden asset value loss | Matches cost with revenue over time |

| Assets Affected | Intangible and tangible assets | Intangible assets only |

| Frequency | When asset value declines below book value | Regular intervals, e.g., annually |

| Accounting Impact | One-time expense reducing asset value | Recurring expense spread over asset life |

| Financial Statement Effect | Immediate decrease in asset and equity | Gradual expense impacting net income |

| Example | Write-down on damaged equipment | Amortizing patent cost over 10 years |

Understanding Impairment and Amortization

Impairment occurs when the carrying amount of an asset exceeds its recoverable amount, requiring a write-down to reflect the loss in value. Amortization systematically allocates the cost of intangible assets over their useful lives, matching expense recognition with revenue generation. Understanding impairment ensures timely recognition of asset value declines, while amortization manages consistent expense reporting for intangible asset consumption.

Key Differences Between Impairment and Amortization

Impairment reflects a sudden, significant decline in an asset's recoverable value, prompting immediate write-downs, whereas amortization refers to the systematic allocation of the cost of intangible assets over their useful life. Impairment losses are recognized when the carrying amount exceeds the recoverable amount, impacting financial statements unpredictably, while amortization expenses are planned, steady charges recorded periodically. Key differences include timing, measurement basis, and financial reporting impact, with impairment addressing unexpected devaluations and amortization representing scheduled cost exhaustion.

Definition and Purpose of Impairment

Impairment refers to the permanent reduction in the recoverable amount of a fixed asset below its carrying value on the balance sheet, indicating an asset's diminished economic value due to unforeseen events or changes in market conditions. The primary purpose of impairment is to ensure that asset values are accurately reflected, preventing overstating of asset worth and providing more reliable financial information for decision-making. Amortization, in contrast, systematically allocates the cost of intangible assets over their useful life, reflecting expense recognition rather than loss in asset value.

What Is Amortization?

Amortization refers to the systematic allocation of the cost of an intangible asset over its useful life, reflecting the expense on the income statement. This process helps companies match the asset's cost with the revenue it generates, adhering to the matching principle in accounting. Unlike impairment, which indicates a sudden decrease in asset value, amortization is a planned, gradual expense recognition method applied to intangible assets such as patents, trademarks, and copyrights.

Recognition Criteria for Impairment

Impairment recognition criteria require identifying triggers such as significant declines in asset value, changes in market conditions, or adverse legal factors indicating that the carrying amount of an asset may not be recoverable. An impairment loss is measured when the asset's carrying amount exceeds its recoverable amount, defined as the higher of fair value less costs to sell and value in use. Unlike amortization, which is a systematic allocation of intangible asset cost over its useful life, impairment reflects a sudden, unexpected reduction in asset value based on evidence of recoverable amount impairment.

Methods of Calculating Amortization

Amortization methods primarily include the straight-line method, where an equal expense is allocated over the asset's useful life, and the declining balance method, which accelerates expense recognition by applying a fixed percentage to the asset's reducing book value. Units of production method allocates amortization based on asset usage or output, aligning expense with operational activity. Impairment differs as it involves a one-time write-down when an asset's carrying amount exceeds its recoverable amount, reflecting a permanent decrease in value rather than systematic cost allocation.

Financial Statement Impact: Impairment vs. Amortization

Impairment results in an immediate write-down of an asset's carrying value on the balance sheet, reflecting a permanent decline in its recoverable amount and significantly reducing net income on the income statement. Amortization systematically allocates the cost of intangible assets over their useful lives, producing a consistent expense that gradually decreases net income while maintaining the asset's book value until fully amortized. Both impacts are disclosed in the notes to financial statements, with impairment signals potential asset impairment risks, whereas amortization represents planned allocation of intangible asset costs.

Common Examples: Assets Subject to Impairment and Amortization

Assets subject to impairment include goodwill, trademarks, and long-lived tangible assets such as property, plant, and equipment, which are tested when indicators suggest a decline in value below carrying amount. Amortization typically applies to intangible assets with finite useful lives like patents, copyrights, and software, systematically expensing their cost over expected benefits. Both processes affect asset valuation but impairment results in immediate write-downs while amortization allocates cost over time.

Relevant Accounting Standards and Guidelines

Impairment and amortization are governed by key accounting standards such as IAS 36 for impairment of assets and IAS 38 for intangible assets amortization. Impairment requires entities to assess whether the carrying amount of an asset exceeds its recoverable amount, necessitating a write-down to reflect reduced value. Amortization systematically allocates the cost of intangible assets over their useful life, ensuring expense recognition aligns with revenue generation under prescribed accounting guidelines.

Practical Implications for Businesses and Investors

Impairment reflects a sudden decrease in an asset's recoverable value, often requiring immediate write-downs on financial statements, whereas amortization systematically allocates intangible asset costs over their useful life, impacting earnings gradually. For businesses, recognizing impairment promptly prevents overstated asset values and ensures accurate financial reporting, while amortization aids in forecasting and budgeting by spreading expense recognition. Investors rely on impairment signals to reassess risk and asset quality quickly, while amortization offers insight into ongoing asset consumption and long-term profitability.

Impairment Infographic

libterm.com

libterm.com