Direct equity ownership allows you to hold shares of a company, giving you voting rights and potential dividends that reflect the company's performance. This form of investment offers greater control and transparency compared to indirect methods like mutual funds, making it a preferred choice for investors seeking active participation. Explore the following sections to understand how direct equity ownership can enhance your investment strategy.

Table of Comparison

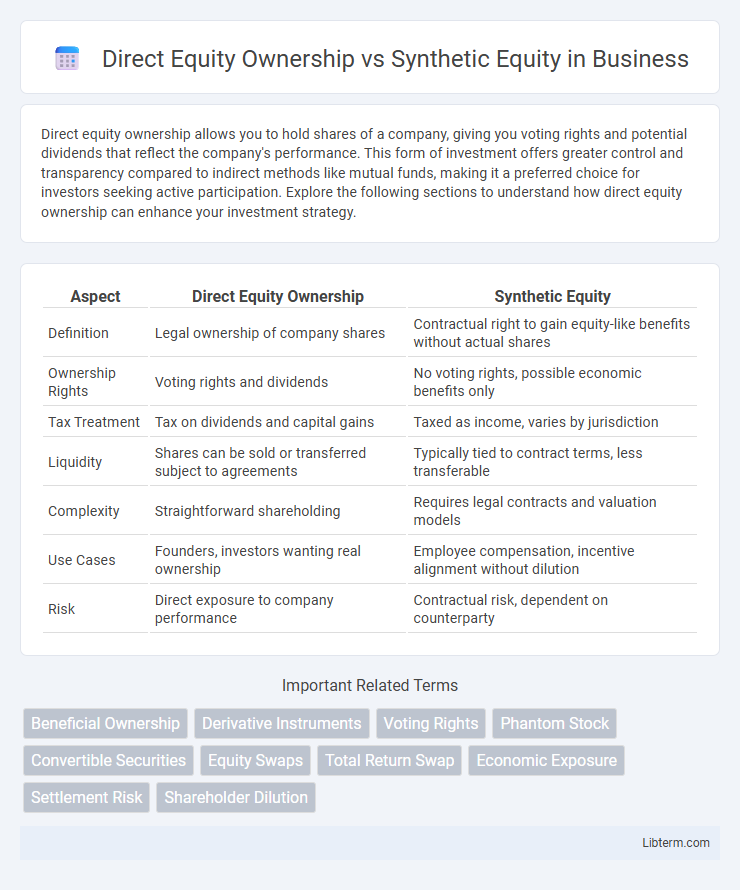

| Aspect | Direct Equity Ownership | Synthetic Equity |

|---|---|---|

| Definition | Legal ownership of company shares | Contractual right to gain equity-like benefits without actual shares |

| Ownership Rights | Voting rights and dividends | No voting rights, possible economic benefits only |

| Tax Treatment | Tax on dividends and capital gains | Taxed as income, varies by jurisdiction |

| Liquidity | Shares can be sold or transferred subject to agreements | Typically tied to contract terms, less transferable |

| Complexity | Straightforward shareholding | Requires legal contracts and valuation models |

| Use Cases | Founders, investors wanting real ownership | Employee compensation, incentive alignment without dilution |

| Risk | Direct exposure to company performance | Contractual risk, dependent on counterparty |

Introduction to Equity Ownership Structures

Direct equity ownership involves holding actual shares in a company, granting shareholders voting rights and entitlement to dividends, which provides tangible control and financial benefits. Synthetic equity, such as stock options or restricted stock units, mimics the economic benefits of owning shares without conferring ownership rights or voting power, aligning employee incentives with company performance. Understanding these equity ownership structures helps businesses design effective compensation plans that balance control, motivation, and financial outcomes.

Defining Direct Equity Ownership

Direct equity ownership refers to holding actual shares or stock certificates in a company, granting shareholders voting rights and direct claims on company assets and profits. Shareholders with direct equity participate in corporate decisions, receive dividends, and benefit from capital appreciation according to their ownership percentage. This form of ownership contrasts with synthetic equity, which mimics equity benefits through financial instruments like stock options or phantom shares without conferring true ownership.

Understanding Synthetic Equity Explained

Synthetic equity provides employees with benefits similar to direct ownership without granting actual shares, typically through instruments like stock appreciation rights (SARs) or phantom stock. This approach aligns incentives by allowing participants to profit from company growth while avoiding dilution and regulatory complexities associated with issuing real equity. Understanding synthetic equity involves recognizing its role as a flexible, non-dilutive alternative that offers financial rewards tied to the company's valuation increase.

Key Differences Between Direct and Synthetic Equity

Direct equity ownership grants shareholders actual stock, conferring voting rights and dividends tied to company performance, while synthetic equity mimics these benefits through contractual agreements without issuing real shares. Synthetic equity instruments, such as stock options or phantom shares, offer flexibility in compensation and tax treatment but lack direct shareholder privileges. Key differences include actual ownership presence, transferability, and regulatory implications, making direct equity more suited for long-term investment and synthetic equity ideal for incentivizing employees without diluting ownership.

Advantages of Direct Equity Ownership

Direct equity ownership provides shareholders with actual company stock, granting voting rights and entitlement to dividends, which strengthens investor influence and long-term wealth accumulation. This form of ownership offers clear transparency and straightforward valuation, facilitating easier transfer and liquidity compared to synthetic equity instruments. Investors benefit from direct participation in corporate governance and potential capital appreciation tied closely to company performance.

Benefits of Synthetic Equity for Companies and Employees

Synthetic equity offers companies the advantage of rewarding employees without diluting existing shareholders' ownership or issuing actual shares, preserving capital structure integrity. For employees, synthetic equity provides financial upside linked to company performance, aligning interests with shareholders while offering liquidity options and simplified tax treatment compared to direct equity. This mechanism promotes talent retention and motivation by simulating equity benefits without the complexities of stock issuance and regulatory compliance.

Tax Implications: Direct vs Synthetic Equity

Direct equity ownership often triggers immediate tax liabilities on capital gains and dividends, depending on jurisdiction-specific tax codes, while synthetic equity schemes such as stock options or phantom shares typically defer taxation until the exercise or payout event. In many cases, synthetic equity allows for more favorable tax treatment through capital gains rates rather than ordinary income tax rates, providing potential tax efficiency for employees and founders. Understanding local tax regulations and timing of recognition is critical to optimizing the tax impact of direct versus synthetic equity compensation.

Risk and Reward Profiles Compared

Direct equity ownership offers shareholders actual stakes in a company, providing voting rights and potential dividends, but exposes them to market volatility and liquidity risks. Synthetic equity, such as stock options or phantom shares, allows employees to benefit from stock price appreciation with limited downside risk, as there is no upfront investment or ownership dilution. The reward profile of direct equity is tied to long-term company performance and dividend payouts, while synthetic equity emphasizes upside potential without ownership responsibilities or exposure to market declines.

Practical Use Cases: Which to Choose?

Direct equity ownership provides shareholders with voting rights and dividends, making it ideal for startup founders and early investors seeking control and tangible equity stakes. Synthetic equity, such as stock options or phantom shares, suits employees and executives who want economic benefits tied to company performance without direct ownership or dilution. Choosing between the two depends on goals like control, tax implications, liquidity, and alignment with company growth strategies.

Conclusion: Selecting the Best Equity Approach

Selecting the best equity approach depends primarily on the company's goals, investor preferences, and regulatory environment. Direct equity ownership offers tangible asset control and straightforward valuation, while synthetic equity provides flexibility, tax efficiency, and alignment incentives without diluting ownership. Careful analysis of shareholder rights, liquidity needs, and long-term growth strategies ensures an optimal balance between control and financial benefits.

Direct Equity Ownership Infographic

libterm.com

libterm.com