Runway models innovation and creativity, transforming ideas into visual reality through advanced technology and design expertise. Harnessing cutting-edge tools, it streamlines the creative process, enabling professionals to produce stunning, high-quality content efficiently. Discover how Runway can elevate your projects by exploring the full potential in the rest of this article.

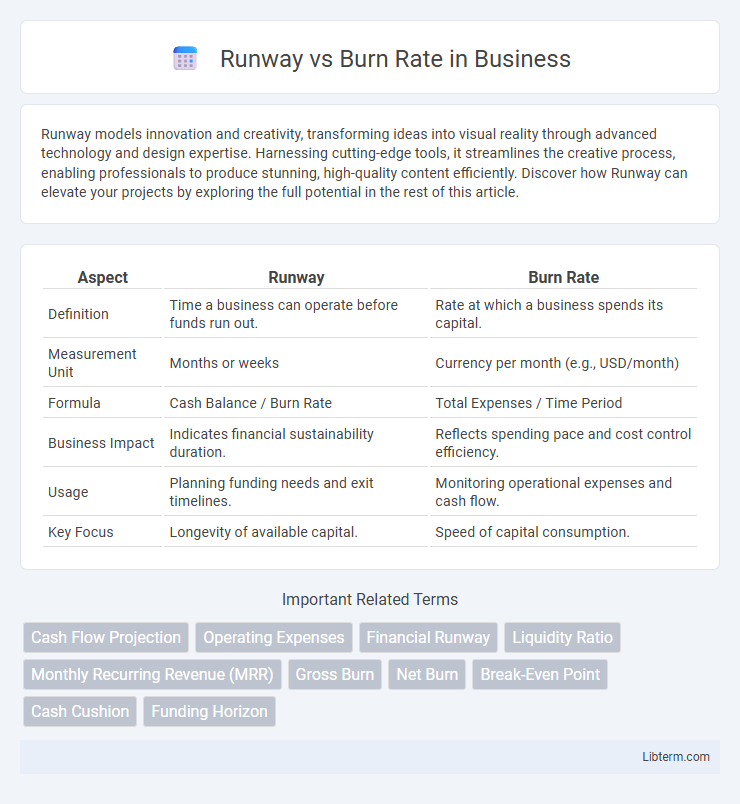

Table of Comparison

| Aspect | Runway | Burn Rate |

|---|---|---|

| Definition | Time a business can operate before funds run out. | Rate at which a business spends its capital. |

| Measurement Unit | Months or weeks | Currency per month (e.g., USD/month) |

| Formula | Cash Balance / Burn Rate | Total Expenses / Time Period |

| Business Impact | Indicates financial sustainability duration. | Reflects spending pace and cost control efficiency. |

| Usage | Planning funding needs and exit timelines. | Monitoring operational expenses and cash flow. |

| Key Focus | Longevity of available capital. | Speed of capital consumption. |

Understanding Runway: Definition and Importance

Runway refers to the amount of time a startup can operate before it runs out of cash, calculated by dividing available cash by the burn rate, which is the monthly cash expenditure. Understanding runway is crucial for founders and investors to assess financial health and plan fundraising or cost-cutting measures effectively. A longer runway provides a buffer for strategic growth and product development, reducing the risk of premature business failure.

What is Burn Rate? Key Concepts

Burn rate is the speed at which a company spends its available capital, typically measured monthly to assess financial health. Key concepts include gross burn, representing total operating expenses, and net burn, reflecting the difference between cash outflows and inflows. Understanding burn rate helps startups determine runway, the time remaining before funds are depleted, crucial for strategic planning and investor communications.

Runway vs Burn Rate: Core Differences

Runway and burn rate are crucial financial metrics for startups assessing cash flow sustainability. Runway measures the time a company can operate before depleting its cash reserves, calculated by dividing available cash by burn rate, while burn rate reflects the monthly cash expenditure. Understanding the interplay between runway and burn rate enables businesses to strategize funding needs and operational adjustments to avoid insolvency.

How to Calculate Startup Runway

Startup runway is calculated by dividing the total cash reserves by the monthly burn rate, providing the number of months a company can operate before funds are depleted. The burn rate refers to the rate at which a startup spends its capital to cover operating expenses, usually expressed as a monthly figure. Understanding runway enables founders to manage cash flow effectively and plan for fundraising or cost-cutting measures to extend operational longevity.

Calculating Burn Rate: Step-by-Step Guide

Calculating burn rate involves tracking total cash expenditure over a specific period, typically monthly, by subtracting ending cash balance from beginning cash balance. Divide the total cash spent by the number of months in the period to determine the average monthly burn rate. Accurately calculating burn rate is essential for assessing financial runway and ensuring sustainable business operations.

Factors Affecting Burn Rate and Runway

Burn rate and runway are influenced by key financial factors such as monthly operating expenses, revenue streams, and capital reserves. Higher fixed costs or unexpected expenditures increase burn rate, thereby reducing runway, while consistent revenue or additional funding can extend the runway by lowering net cash outflow. Monitoring these variables helps startups optimize cash flow management to sustain operations longer before requiring additional investment.

Strategies to Extend Your Financial Runway

Maximizing your financial runway requires precise management of your burn rate by identifying non-essential expenses and implementing cost-cutting measures without sacrificing core operations. Optimizing revenue streams through targeted marketing, diversified income sources, and strategic partnerships can bolster cash flow and extend operational longevity. Regular financial forecasting combined with agile adjustment of spending habits ensures sustained resilience during fluctuating market conditions.

Reducing Burn Rate: Practical Approaches

Reducing burn rate involves strategic cost management, including cutting non-essential expenses and optimizing operational efficiency to extend runway. Implementing automation, renegotiating vendor contracts, and prioritizing revenue-generating activities contribute significantly to lowering monthly cash outflows. Monitoring key financial metrics regularly ensures early detection of overspending, enabling timely adjustments to preserve capital and sustain growth.

Common Mistakes in Managing Runway and Burn Rate

Common mistakes in managing runway and burn rate include underestimating monthly expenses and overestimating revenue projections, leading to inaccurate runway calculations. Founders often fail to adjust burn rate promptly in response to changing market conditions or delayed funding, causing premature cash depletion. Ignoring detailed expense tracking and neglecting contingency planning reduces financial visibility and increases the risk of running out of capital unexpectedly.

Monitoring Runway and Burn Rate for Sustainable Growth

Monitoring runway and burn rate is essential for sustainable growth as it ensures a startup maintains sufficient capital to operate until reaching profitability or the next funding round. Accurate tracking of burn rate--the rate at which cash is spent monthly--helps project runway, indicating how long the company can survive with current funds. Effective management of these financial metrics enables timely strategic decisions, preventing cash shortages and supporting long-term business stability.

Runway Infographic

libterm.com

libterm.com