Crown Jewel represents the most valuable and essential asset within a company, often embodying core technologies, data, or intellectual properties critical to competitive advantage. Protecting these assets requires a strategic approach combining robust cybersecurity measures and careful risk management to prevent loss or exploitation. Explore the rest of this article to learn how you can effectively identify and secure your organization's crown jewels.

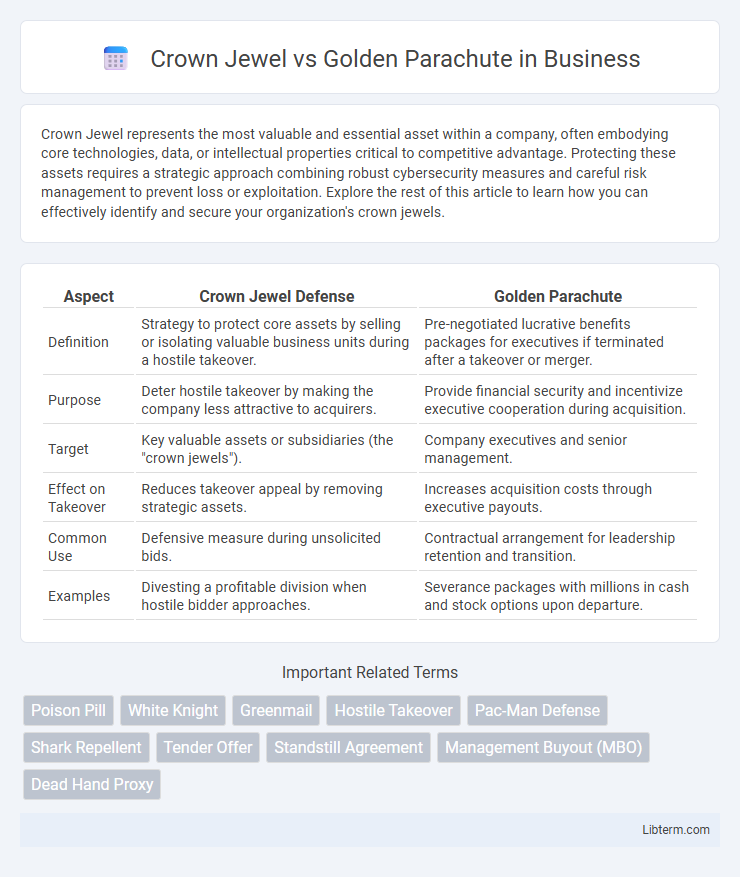

Table of Comparison

| Aspect | Crown Jewel Defense | Golden Parachute |

|---|---|---|

| Definition | Strategy to protect core assets by selling or isolating valuable business units during a hostile takeover. | Pre-negotiated lucrative benefits packages for executives if terminated after a takeover or merger. |

| Purpose | Deter hostile takeover by making the company less attractive to acquirers. | Provide financial security and incentivize executive cooperation during acquisition. |

| Target | Key valuable assets or subsidiaries (the "crown jewels"). | Company executives and senior management. |

| Effect on Takeover | Reduces takeover appeal by removing strategic assets. | Increases acquisition costs through executive payouts. |

| Common Use | Defensive measure during unsolicited bids. | Contractual arrangement for leadership retention and transition. |

| Examples | Divesting a profitable division when hostile bidder approaches. | Severance packages with millions in cash and stock options upon departure. |

Introduction to Crown Jewel and Golden Parachute

Crown Jewel and Golden Parachute are strategic corporate defense mechanisms used during hostile takeovers. Crown Jewel involves a company selling or spinning off its most valuable assets to make itself less attractive to the acquirer. Golden Parachute guarantees lucrative benefits to executives if they are terminated following a takeover, deterring hostile bidders by increasing acquisition costs.

Defining Crown Jewel Defense Strategy

The Crown Jewel defense strategy is a corporate anti-takeover tactic where a company sells or threatens to sell its most valuable assets, known as "crown jewels," to make itself less attractive to a hostile bidder. This strategy contrasts with the Golden Parachute, which offers lucrative severance packages to top executives to deter takeovers by increasing acquisition costs. Crown Jewel defenses directly impact the acquirer's valuation by targeting key assets, whereas Golden Parachutes protect management financially during potential ownership changes.

Understanding the Golden Parachute Concept

Golden parachute refers to contractual agreements that provide top executives with significant financial compensation and benefits if they are terminated following a merger or acquisition. These packages typically include severance pay, stock options, bonuses, and other perks designed to protect executives against sudden job loss. Understanding the golden parachute concept is crucial for assessing corporate governance, executive risk management, and shareholder interests during corporate takeovers.

Key Differences Between Crown Jewel and Golden Parachute

Crown Jewel and Golden Parachute are both anti-takeover strategies but differ significantly in purpose and execution. Crown Jewel involves the forced sale of a company's most valuable assets to deter hostile takeovers, while Golden Parachute provides lucrative financial benefits to top executives in the event of a takeover or change in control. The key difference lies in Crown Jewel's defensive asset divestiture versus Golden Parachute's executive compensation arrangements.

Strategic Purpose in Corporate Takeovers

Crown Jewel defenses strategically protect companies by selling or transferring key assets to prevent hostile takeover bidders from gaining valuable resources, thereby deterring unwelcome acquisitions. Golden Parachutes, on the other hand, serve as pre-negotiated executive compensation packages that provide significant financial benefits to top executives if a takeover occurs, aligning management interests with shareholder value and discouraging hostile bids by increasing acquisition costs. Both mechanisms play crucial roles in corporate takeover strategies by influencing bidder behavior and safeguarding existing management control.

Legal and Regulatory Implications

Crown Jewel defenses involve a company selling or threatening to sell its most valuable assets to deter hostile takeovers, often triggering complex regulatory scrutiny under securities laws and antitrust regulations to ensure fair treatment of shareholders. Golden Parachute agreements, which provide lucrative severance packages to executives upon a change of control, must comply with SEC disclosure rules and shareholder approval requirements to prevent excessive compensation and potential conflicts of interest. Both strategies require careful adherence to Corporate Governance standards and relevant federal regulations to avoid legal challenges and protect shareholder value.

Notable Case Studies and Examples

The Crown Jewel defense was notably employed by Gulf Oil in 1984 to prevent a hostile takeover by Chevron, where Gulf Oil attempted to sell off its most valuable assets to make itself less attractive. In contrast, the Golden Parachute strategy was famously highlighted during the 2008 acquisition of Merrill Lynch by Bank of America, providing lucrative severance packages to top executives to secure their support during the merger. Both strategies illustrate different corporate defense mechanisms, with Crown Jewel focusing on asset protection and Golden Parachute targeting executive agreements in M&A scenarios.

Pros and Cons of Each Defense Mechanism

Crown Jewel defense protects a company by divesting its most valuable assets to deter hostile takeovers but risks long-term damage to core capabilities and shareholder value. Golden Parachute offers lucrative severance packages to executives, discouraging hostile bids through financial disincentives but may attract criticism for excessive executive compensation and reduced focus on operational improvements. Both strategies balance deterrence effectiveness with potential negative impacts on corporate governance and stakeholder trust.

Impact on Shareholders and Corporate Governance

Crown Jewels strategies often deter hostile takeovers by selling or encumbering key assets, potentially preserving shareholder value but risking undervaluation of corporate resources. Golden Parachutes provide significant executive compensation upon takeover, aiming to align management's interests with shareholders by ensuring leadership stability, yet may raise concerns about excessive payouts and weaken shareholder influence. Both mechanisms influence corporate governance by shaping board decisions on mergers and acquisitions, balancing control retention and shareholder rights.

Choosing the Right Strategy: Factors to Consider

Choosing between a Crown Jewel defense and a Golden Parachute depends on a company's specific vulnerabilities and shareholder priorities. Crown Jewel strategies protect core assets by divestiture during hostile takeovers, while Golden Parachutes ensure lucrative executive severance to deter aggressive bids. Factors such as industry volatility, regulatory environment, and potential takeover threats shape the optimal choice for safeguarding corporate value.

Crown Jewel Infographic

libterm.com

libterm.com