Phantom stock is a form of employee compensation that provides cash bonuses tied to the company's stock value without granting actual shares. It aligns employee incentives with company performance while avoiding equity dilution and ownership transfers. Discover how phantom stock plans can benefit your compensation strategy in the rest of this article.

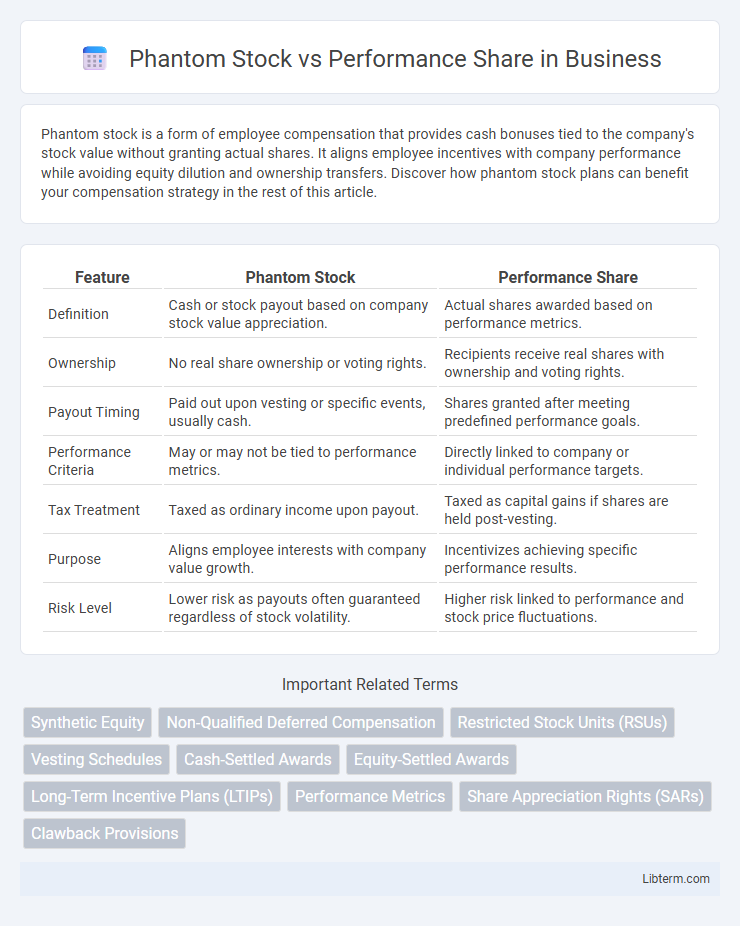

Table of Comparison

| Feature | Phantom Stock | Performance Share |

|---|---|---|

| Definition | Cash or stock payout based on company stock value appreciation. | Actual shares awarded based on performance metrics. |

| Ownership | No real share ownership or voting rights. | Recipients receive real shares with ownership and voting rights. |

| Payout Timing | Paid out upon vesting or specific events, usually cash. | Shares granted after meeting predefined performance goals. |

| Performance Criteria | May or may not be tied to performance metrics. | Directly linked to company or individual performance targets. |

| Tax Treatment | Taxed as ordinary income upon payout. | Taxed as capital gains if shares are held post-vesting. |

| Purpose | Aligns employee interests with company value growth. | Incentivizes achieving specific performance results. |

| Risk Level | Lower risk as payouts often guaranteed regardless of stock volatility. | Higher risk linked to performance and stock price fluctuations. |

Introduction to Phantom Stock and Performance Shares

Phantom Stock is a form of long-term incentive plan that grants employees the monetary value equivalent to company stock appreciation without actual share ownership, aligning employee interests with company performance. Performance Shares are equity-based awards given to employees only when specific financial or operational targets are met, directly linking reward to measurable company success. Both mechanisms serve to motivate and retain talent by tying compensation to company value and performance metrics.

Key Differences Between Phantom Stock and Performance Share Plans

Phantom stock plans grant employees cash or stock-value payouts tied to company performance without actual equity ownership, while performance shares provide real shares based on achieving predefined performance metrics. Key differences include the nature of benefits--phantom stock offers cash equivalents mimicking stock value, whereas performance shares deliver actual company stock contingent on results. Performance share plans often align employee incentives with shareholder interests more directly, involving voting rights and dividends, unlike phantom stock plans that focus on cash compensation linked to stock price appreciation.

How Phantom Stock Works

Phantom Stock grants employees units that mirror the value of actual company shares without transferring ownership, providing cash or stock equivalent to the stock's value upon vesting or a triggering event. These units accrue value based on the company's stock price performance, creating a direct financial incentive aligned with shareholder interests while avoiding dilution of equity. Typically used to reward long-term performance, Phantom Stock plans offer tax deferral advantages and flexibility in payout timing compared to traditional stock options.

How Performance Shares Operate

Performance shares operate by granting employees a predetermined number of shares contingent on meeting specified performance metrics such as revenue growth, earnings per share, or total shareholder return over a set performance period. Unlike phantom stock, which provides cash or stock equivalents without voting rights, performance shares confer actual equity ownership, including voting rights and dividends once vested. This alignment with company performance incentivizes employees to drive long-term value creation and shareholder wealth.

Eligibility and Participant Criteria

Phantom stock plans typically allow broader eligibility, often extending to key employees, executives, and sometimes consultants without issuing actual shares, providing cash or stock-equivalent payouts based on company valuation. Performance shares are generally restricted to top executives or senior management, contingent upon meeting specific performance criteria tied to company goals such as revenue growth or stock price targets. Eligibility for performance shares is more stringent with a focus on aligning participant incentives to long-term strategic objectives, whereas phantom stock offers flexibility for wider participation across different levels of the organization.

Payout Structures and Vesting Schedules

Phantom stock offers cash payouts based on the company's stock value without actual equity ownership, typically vesting over time with straight-line or cliff vesting schedules to encourage employee retention. Performance shares grant actual company stock, with payouts contingent on meeting specific financial or operational goals, often accompanied by performance-based vesting conditions combined with time-based vesting. Both structures align employee incentives with company performance, but performance shares provide stock ownership and potential dividends, while phantom stock delivers cash equivalents tied to share price appreciation.

Accounting and Tax Implications

Phantom stock creates a liability on the balance sheet as a cash-settled share-based payment, requiring companies to recognize expense and adjust fair value each reporting period under ASC 718 or IFRS 2. Performance shares are equity-settled instruments, impacting equity accounts and recorded as an expense over the vesting period based on grant-date fair value. From a tax perspective, phantom stock is typically taxed as ordinary income upon payment, while performance shares trigger capital gains tax when shares are sold, affecting employee tax timing and employer withholding obligations.

Advantages of Phantom Stock

Phantom stock offers the advantage of aligning employee incentives with company performance without diluting equity or transferring actual shares, making it an ideal choice for private companies seeking to retain control. It provides flexibility in plan design, allowing companies to tailor vesting schedules and payout triggers based on specific performance metrics or time-based criteria. Additionally, phantom stock plans typically involve fewer administrative complexities and legal requirements compared to traditional equity awards, resulting in reduced costs and simpler tax treatment for both employers and recipients.

Benefits of Performance Share Programs

Performance share programs offer employees the potential for substantial financial rewards tied directly to company performance metrics such as earnings per share or total shareholder return. These programs align employee interests with shareholder value creation, fostering long-term commitment and motivation. Unlike phantom stock, performance shares often provide actual equity ownership, enhancing employee engagement and retention through tangible ownership stakes.

Choosing the Right Equity Compensation for Your Organization

Phantom stock offers companies a flexible, cash-settled incentive that mirrors stock value without diluting equity, making it ideal for privately-held firms or those seeking to preserve control. Performance shares directly tie employee rewards to specific company goals and stock price appreciation, boosting motivation and aligning interests with shareholders. Selecting the right equity compensation depends on your organization's growth stage, liquidity preferences, and long-term strategic objectives to maximize employee engagement and retention.

Phantom Stock Infographic

libterm.com

libterm.com