EBITDA Margin measures a company's operating profitability by comparing earnings before interest, taxes, depreciation, and amortization to total revenue. This metric helps you evaluate how efficiently a business generates profit from its core operations. Explore the full article to understand how EBITDA Margin impacts financial analysis and decision-making.

Table of Comparison

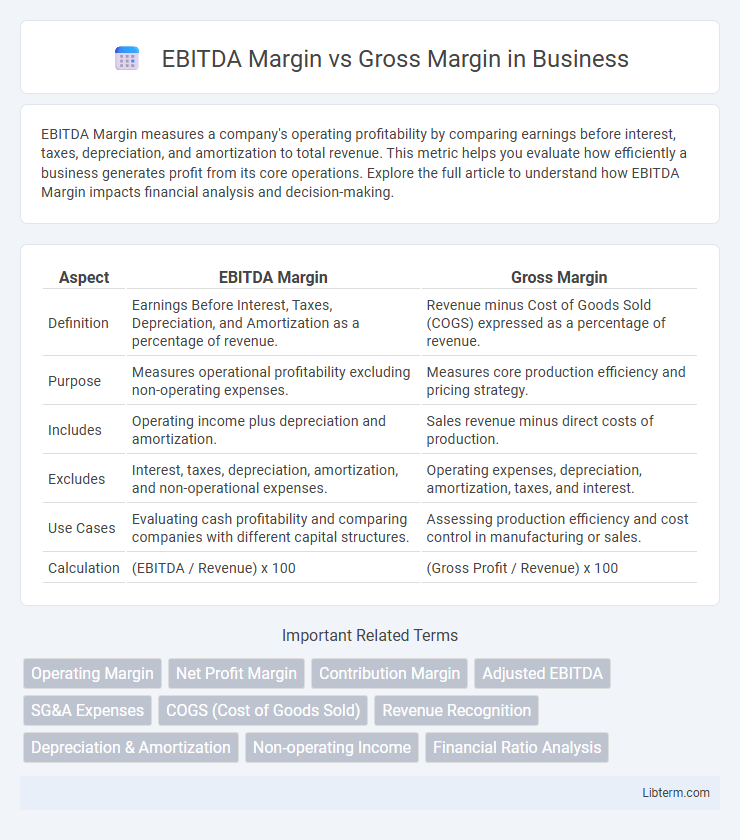

| Aspect | EBITDA Margin | Gross Margin |

|---|---|---|

| Definition | Earnings Before Interest, Taxes, Depreciation, and Amortization as a percentage of revenue. | Revenue minus Cost of Goods Sold (COGS) expressed as a percentage of revenue. |

| Purpose | Measures operational profitability excluding non-operating expenses. | Measures core production efficiency and pricing strategy. |

| Includes | Operating income plus depreciation and amortization. | Sales revenue minus direct costs of production. |

| Excludes | Interest, taxes, depreciation, amortization, and non-operational expenses. | Operating expenses, depreciation, amortization, taxes, and interest. |

| Use Cases | Evaluating cash profitability and comparing companies with different capital structures. | Assessing production efficiency and cost control in manufacturing or sales. |

| Calculation | (EBITDA / Revenue) x 100 | (Gross Profit / Revenue) x 100 |

Understanding EBITDA Margin

EBITDA margin measures a company's operating profitability by expressing earnings before interest, taxes, depreciation, and amortization as a percentage of revenue, highlighting operational efficiency without non-cash expenses. It provides a clearer picture of core business performance compared to gross margin, which only accounts for sales minus cost of goods sold (COGS), excluding operating expenses. Understanding EBITDA margin helps investors and analysts assess cash flow generation potential and compare profitability across companies with varying capital structures and tax environments.

Defining Gross Margin

Gross margin measures a company's profitability by calculating the percentage of revenue remaining after deducting the cost of goods sold (COGS), reflecting the efficiency of production and pricing strategies. Unlike EBITDA margin, which includes operating expenses like SG&A and depreciation, gross margin strictly focuses on direct costs associated with product creation. High gross margins indicate strong control over production costs and pricing power, essential for sustaining competitive advantage and funding operational activities.

Key Differences Between EBITDA Margin and Gross Margin

EBITDA margin measures a company's operating profitability by excluding interest, taxes, depreciation, and amortization, reflecting core business performance before non-operational expenses. Gross margin focuses solely on the relationship between revenue and cost of goods sold (COGS), highlighting production efficiency and pricing strategy impact. The key difference lies in EBITDA margin incorporating operating expenses beyond COGS, offering a broader view of profitability, while gross margin zeroes in on direct production costs.

Importance of EBITDA Margin in Financial Analysis

EBITDA Margin measures a company's operating profitability by excluding non-operating expenses like interest, taxes, depreciation, and amortization, offering a clearer view of core operational performance compared to Gross Margin. While Gross Margin focuses on the direct costs of producing goods, EBITDA Margin includes operating expenses, making it crucial for assessing cash flow potential and operational efficiency. Investors and analysts prioritize EBITDA Margin to evaluate a company's ability to generate sustainable earnings before the impact of capital structure and tax environments.

Significance of Gross Margin for Business Profitability

Gross Margin represents the core profitability by measuring the percentage of revenue remaining after deducting the cost of goods sold, directly indicating how efficiently a company produces its products. The higher the Gross Margin, the more a business retains from sales to cover other operating expenses, highlighting operational efficiency and pricing strategy effectiveness. Unlike EBITDA Margin, which includes operating expenses and non-cash charges, Gross Margin provides a fundamental indicator of production cost control and its impact on overall business profitability.

Calculating EBITDA Margin: Step-by-Step Guide

Calculating EBITDA Margin involves dividing Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) by total revenue, then multiplying by 100 to express it as a percentage. Start by identifying operating income, then add back depreciation and amortization expenses from the income statement to arrive at EBITDA. This metric provides a clear view of a company's operational profitability by excluding non-operating expenses and non-cash charges, differentiating it from Gross Margin, which only considers revenue minus cost of goods sold.

How to Calculate Gross Margin

Gross margin is calculated by subtracting the cost of goods sold (COGS) from total revenue, then dividing the result by total revenue and multiplying by 100 to express it as a percentage. This metric reflects the percentage of revenue that exceeds direct production costs, providing insights into a company's core profitability. Unlike EBITDA margin, which factors in operating expenses, gross margin specifically highlights the efficiency of production and pricing strategies.

Industry Benchmarks: EBITDA Margin vs Gross Margin

EBITDA Margin and Gross Margin are critical financial metrics used to evaluate industry performance, with EBITDA Margin reflecting operating profitability by considering earnings before interest, taxes, depreciation, and amortization, while Gross Margin measures the percentage of revenue remaining after deducting the cost of goods sold. Industry benchmarks reveal that sectors with high capital intensity, like manufacturing, often exhibit lower EBITDA Margins compared to technology companies, which typically demonstrate higher margins due to lower direct costs. Comparing EBITDA Margin versus Gross Margin across industries enables investors and analysts to assess operational efficiency, cost management, and profitability relative to competitors.

When to Use EBITDA Margin vs Gross Margin

EBITDA margin is best used to assess a company's operating profitability by excluding non-operating expenses, taxes, and depreciation, making it ideal for comparing businesses with different capital structures or tax environments. Gross margin, on the other hand, measures the direct profitability of core production activities by focusing on revenue minus the cost of goods sold, providing insight into product pricing and cost control. Use EBITDA margin for evaluating overall operational efficiency and cash flow potential, while gross margin is more appropriate for understanding production-level profitability.

Common Misconceptions About EBITDA and Gross Margins

EBITDA margin and gross margin are often mistaken as interchangeable profitability metrics, but EBITDA margin includes operating expenses such as SG&A and depreciation, while gross margin strictly reflects revenue minus cost of goods sold. A common misconception is that EBITDA margin accounts for all cash flow, yet it excludes interest, taxes, and capital expenditures, which are critical for understanding true cash profitability. Confusing these margins can lead to inaccurate assessments of operational efficiency and financial health, especially in capital-intensive industries.

EBITDA Margin Infographic

libterm.com

libterm.com