A subscription model offers businesses a steady stream of recurring revenue by charging customers a regular fee for access to products or services. This approach enhances customer retention and builds long-term relationships, providing predictable cash flow and opportunities for growth. Explore the article to discover how a subscription model can transform your business strategy.

Table of Comparison

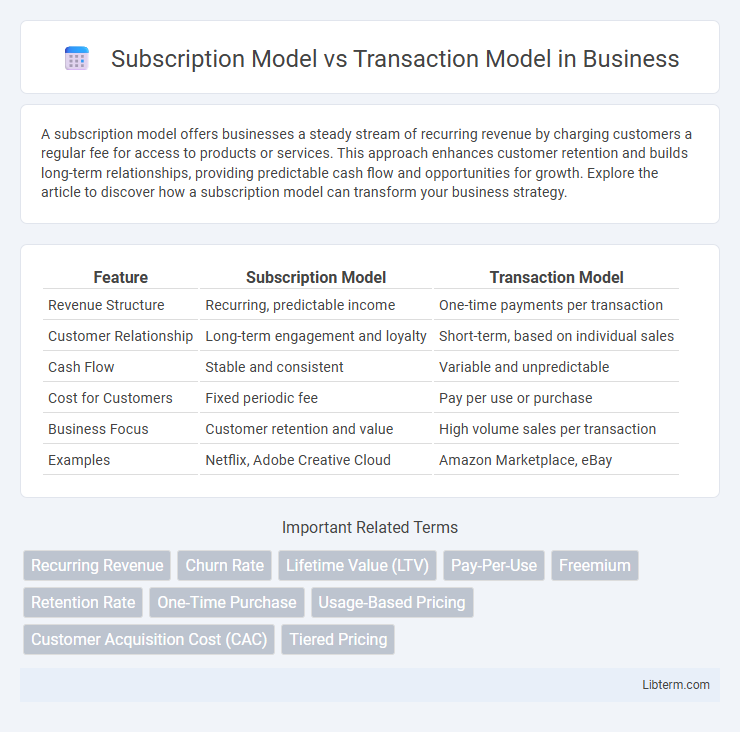

| Feature | Subscription Model | Transaction Model |

|---|---|---|

| Revenue Structure | Recurring, predictable income | One-time payments per transaction |

| Customer Relationship | Long-term engagement and loyalty | Short-term, based on individual sales |

| Cash Flow | Stable and consistent | Variable and unpredictable |

| Cost for Customers | Fixed periodic fee | Pay per use or purchase |

| Business Focus | Customer retention and value | High volume sales per transaction |

| Examples | Netflix, Adobe Creative Cloud | Amazon Marketplace, eBay |

Understanding Subscription and Transaction Models

The subscription model generates recurring revenue by charging customers a fixed fee at regular intervals, providing predictable cash flow and fostering long-term customer relationships. In contrast, the transaction model relies on one-time payments for individual purchases, emphasizing customer acquisition and immediate revenue without ongoing commitments. Understanding these models helps businesses align their pricing strategies with customer behavior and market demands.

Key Differences Between Subscription and Transaction Models

The subscription model generates recurring revenue by charging customers a fixed fee at regular intervals, ensuring predictable cash flow and long-term customer relationships. In contrast, the transaction model relies on one-time payments per purchase, driving revenue based on sales volume and customer acquisition frequency. Key differences include revenue predictability, customer retention strategies, and the impact on cash flow management.

Benefits of the Subscription Model

The subscription model offers predictable and recurring revenue, enhancing cash flow stability and enabling better financial forecasting. It fosters stronger customer loyalty and long-term relationships by providing continuous value and personalized experiences. This model also reduces customer acquisition costs over time and allows businesses to gather continuous data for improving products and services.

Advantages of the Transaction Model

The transaction model offers significant advantages such as immediate revenue generation and enhanced cash flow, making it ideal for businesses requiring quick capital turnover. It enables precise tracking of individual sales, providing valuable data insights for customer behavior analysis and inventory management. This model reduces the risk of long-term commitment for customers, driving higher conversion rates and customer acquisition flexibility.

Revenue Predictability: Subscription vs. Transaction

Subscription models offer consistent revenue streams by securing recurring payments over a fixed period, enhancing financial forecasting accuracy for businesses. Transaction models generate revenue on a per-sale basis, leading to fluctuating income that can complicate cash flow management and revenue predictability. Companies leveraging subscription billing benefit from higher customer lifetime value (CLV) and reduced churn rates, stabilizing long-term financial performance.

Customer Retention and Lifetime Value

The Subscription Model enhances customer retention by providing consistent value and fostering ongoing engagement, leading to predictable revenue streams and higher lifetime value (LTV). In contrast, the Transaction Model relies on one-time purchases, often resulting in lower retention rates and more fluctuating LTV. Businesses leveraging subscription plans benefit from steady customer relationships and increased opportunities for upselling and cross-selling, boosting overall profitability.

Flexibility and Scalability in Each Model

The subscription model offers high scalability through predictable revenue streams and the ability to easily add or remove user tiers, enhancing business growth flexibility. In contrast, the transaction model provides greater flexibility by allowing customers to pay only for individual purchases without long-term commitments, but it may face scalability challenges due to fluctuating demand and inconsistent cash flow. Businesses must weigh the subscription model's scalability benefits against the transaction model's adaptability to varying customer preferences and market conditions.

Impact on User Experience

The subscription model enhances user experience by providing predictable costs and unlimited access to services, fostering long-term engagement and convenience. In contrast, the transaction model offers flexibility and control by allowing users to pay only for what they consume, which can appeal to those seeking short-term or infrequent usage. User satisfaction varies based on preferences for commitment versus pay-per-use, with subscription models driving loyalty and transaction models supporting customization.

Industry Suitability: Which Model Works Best?

The subscription model is ideal for industries with recurring customer needs, such as software as a service (SaaS), streaming platforms, and fitness memberships, where predictable revenue and long-term engagement are crucial. The transaction model suits industries with infrequent or one-time purchases, like retail, luxury goods, and automotive sales, where individual sales volume drives profit. Businesses with variable customer demand or service frequency may blend both models to optimize revenue streams and customer satisfaction.

Choosing the Right Model for Your Business

Selecting the right business model depends on factors such as predictable revenue needs, customer engagement, and product type. Subscription models offer steady cash flow and customer loyalty, making them ideal for services with ongoing value like software or media streaming. Transaction models suit businesses with infrequent purchases or high variability, providing flexibility and reduced commitment for customers.

Subscription Model Infographic

libterm.com

libterm.com