Debt refinancing involves replacing existing debt with a new loan that typically offers better terms, such as lower interest rates or extended repayment periods. This strategy can reduce your monthly payments, improve cash flow, and help manage overall financial obligations more effectively. Explore the rest of this article to learn how debt refinancing can benefit your financial situation and the steps to get started.

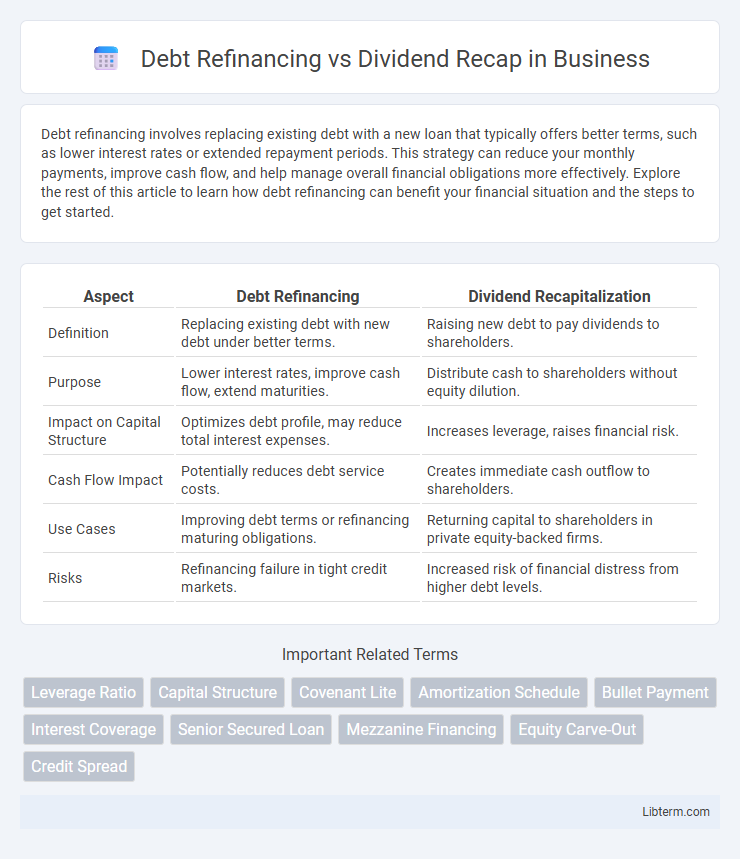

Table of Comparison

| Aspect | Debt Refinancing | Dividend Recapitalization |

|---|---|---|

| Definition | Replacing existing debt with new debt under better terms. | Raising new debt to pay dividends to shareholders. |

| Purpose | Lower interest rates, improve cash flow, extend maturities. | Distribute cash to shareholders without equity dilution. |

| Impact on Capital Structure | Optimizes debt profile, may reduce total interest expenses. | Increases leverage, raises financial risk. |

| Cash Flow Impact | Potentially reduces debt service costs. | Creates immediate cash outflow to shareholders. |

| Use Cases | Improving debt terms or refinancing maturing obligations. | Returning capital to shareholders in private equity-backed firms. |

| Risks | Refinancing failure in tight credit markets. | Increased risk of financial distress from higher debt levels. |

Introduction to Debt Refinancing and Dividend Recap

Debt refinancing involves replacing an existing loan with a new one, typically to secure better interest rates or improve cash flow management, making it a crucial tool for companies aiming to optimize their capital structure. Dividend recapitalization, on the other hand, allows firms--often private equity-owned--to take on additional debt to pay a special dividend to shareholders without selling equity, providing immediate returns while maintaining ownership control. Understanding the distinctions between refinancing existing debt and leveraging new debt for shareholder distribution is essential for strategic financial planning and capital allocation.

Definitions: What is Debt Refinancing?

Debt refinancing involves replacing an existing loan with a new one, typically to secure better interest rates or improved repayment terms, thereby reducing the overall cost of debt. This financial strategy allows companies to manage cash flow more effectively by extending loan maturities or consolidating multiple debts. Unlike dividend recapitalization, debt refinancing does not distribute cash to shareholders but focuses solely on optimizing the company's debt structure.

Definitions: What is a Dividend Recapitalization?

A Dividend Recapitalization is a financial strategy where a company takes on new debt to pay a special dividend to shareholders, effectively restructuring its capital by increasing leverage. Unlike traditional debt refinancing, which replaces existing debt with new debt to improve terms or extend maturities, dividend recaps prioritize distributing cash to equity holders while maintaining or growing debt levels. This approach is commonly used by private equity firms to extract value without selling the company or altering ownership stakes.

Key Differences Between Debt Refinancing and Dividend Recap

Debt refinancing involves replacing existing debt with new debt to secure better interest rates or extend repayment terms, optimizing cash flow management. Dividend recapitalization, however, uses new debt to pay a special dividend to shareholders, often increasing leverage and financial risk. The key difference lies in refinancing prioritizing debt structure improvement, while dividend recaps prioritize shareholder returns at the expense of increased leverage.

Benefits of Debt Refinancing for Businesses

Debt refinancing allows businesses to replace existing debt with new loans that often have lower interest rates, improving cash flow and reducing monthly payment burdens. This strategy enhances financial flexibility by extending loan terms or consolidating multiple debts, aiding in better debt management and credit score improvement. Companies leveraging debt refinancing can reinvest saved costs into growth initiatives, driving long-term profitability and operational expansion.

Pros and Cons of Dividend Recapitalization

Dividend recapitalization allows companies to return capital to shareholders without selling assets, providing liquidity while maintaining operational control. However, this strategy increases leverage, raising financial risk and potentially impacting credit ratings and future borrowing capacity. It can boost shareholder returns in the short term but may constrain long-term growth due to higher debt obligations.

Financial Implications: Impact on Balance Sheet

Debt refinancing restructures existing liabilities by replacing old debt with new debt, often to secure better interest rates or extended maturities, which can improve cash flow and reduce interest expenses on the balance sheet. Dividend recapitalization involves taking on new debt specifically to pay dividends to shareholders, increasing leverage and potentially raising financial risk by expanding liabilities without corresponding asset growth. Both strategies alter the debt-to-equity ratio, influencing leverage metrics and investor perception of financial stability.

Strategic Considerations for Choosing Refinancing or Recap

Debt refinancing strategically improves a company's capital structure by replacing existing debt with new debt that typically offers better interest rates, extended maturities, or more favorable covenants, enhancing liquidity and reducing financial risk. Dividend recapitalization involves raising new debt to pay dividends to shareholders, often used by private equity firms to extract value without an equity sale, but it increases leverage and financial risk, potentially impacting credit ratings and future borrowing ability. Choosing between refinancing and dividend recap depends on the company's goals: refinancing prioritizes cost reduction and balance sheet optimization, while dividend recaps focus on shareholder returns and liquidity extraction, requiring careful analysis of market conditions, debt capacity, and long-term strategic impacts.

Risks and Challenges: What Companies Should Know

Debt refinancing involves replacing existing debt with new debt under different terms, presenting risks such as increased interest costs, refinancing risk if market conditions worsen, and potential liquidity constraints. Dividend recapitalization allows companies to pay dividends by taking on new debt, which can strain cash flow, elevate leverage ratios, and increase default risk in volatile markets. Companies must carefully assess credit ratings, covenant restrictions, and market volatility to mitigate financial distress and maintain operational flexibility.

Conclusion: Selecting the Right Financial Strategy

Choosing between debt refinancing and a dividend recap depends on the company's financial health, market conditions, and strategic goals. Debt refinancing is optimal for lowering interest costs and extending loan maturities, enhancing long-term liquidity. A dividend recap suits firms seeking to return value to shareholders without a sale, but it increases leverage and financial risk.

Debt Refinancing Infographic

libterm.com

libterm.com