A transition bond is a type of fixed-income security designed to support companies undergoing significant changes, such as restructuring or shifts in business models. These bonds provide necessary capital during periods of transformation, often offering higher yields to compensate for increased risk. Explore the rest of the article to understand how transition bonds can impact your investment strategies and market opportunities.

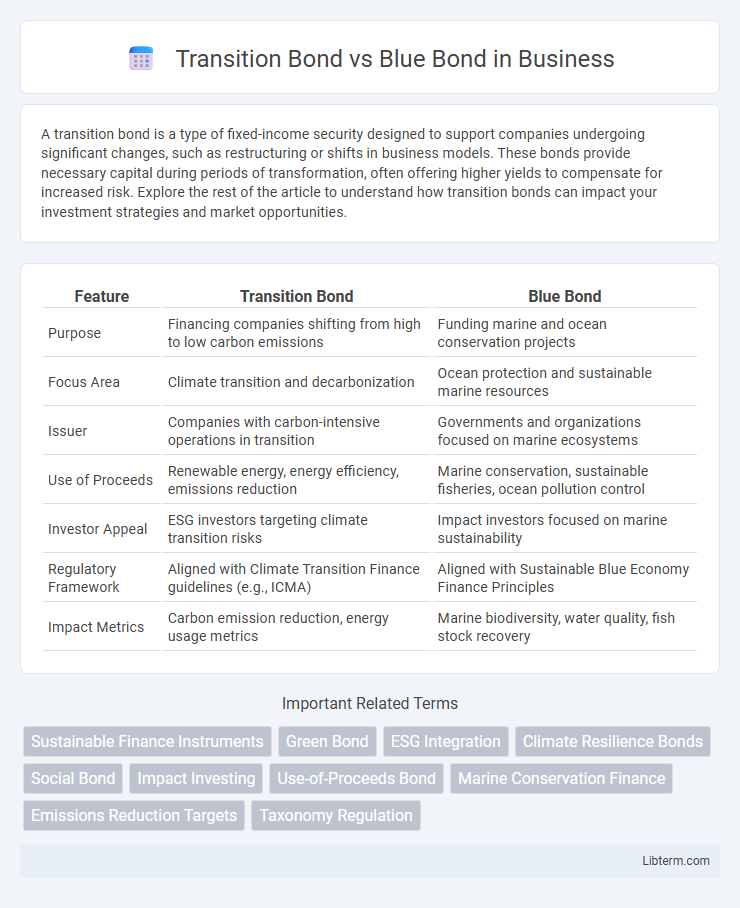

Table of Comparison

| Feature | Transition Bond | Blue Bond |

|---|---|---|

| Purpose | Financing companies shifting from high to low carbon emissions | Funding marine and ocean conservation projects |

| Focus Area | Climate transition and decarbonization | Ocean protection and sustainable marine resources |

| Issuer | Companies with carbon-intensive operations in transition | Governments and organizations focused on marine ecosystems |

| Use of Proceeds | Renewable energy, energy efficiency, emissions reduction | Marine conservation, sustainable fisheries, ocean pollution control |

| Investor Appeal | ESG investors targeting climate transition risks | Impact investors focused on marine sustainability |

| Regulatory Framework | Aligned with Climate Transition Finance guidelines (e.g., ICMA) | Aligned with Sustainable Blue Economy Finance Principles |

| Impact Metrics | Carbon emission reduction, energy usage metrics | Marine biodiversity, water quality, fish stock recovery |

Introduction to Sustainable Bonds

Sustainable bonds encompass various instruments designed to fund projects with positive environmental or social impacts, with Transition Bonds and Blue Bonds representing two distinct categories. Transition Bonds support companies in high-emission sectors aiming to reduce their carbon footprint through clear, credible decarbonization strategies. Blue Bonds specifically finance marine and water-related projects, targeting the conservation of ocean health and sustainable use of aquatic resources.

Defining Transition Bonds

Transition bonds are debt instruments designed to finance companies in high-emission sectors as they shift toward greener operations, aligning with interim climate targets. These bonds prioritize transparent use of proceeds for projects that reduce environmental impact but may not yet be fully sustainable under traditional green bond criteria. Blue bonds, by contrast, specifically fund ocean-related environmental projects, targeting marine conservation and sustainable fisheries.

What Are Blue Bonds?

Blue bonds are debt instruments specifically designed to finance marine and ocean-based projects that promote sustainable use of ocean resources. They support activities such as marine conservation, sustainable fisheries, and pollution control, aiming to protect aquatic ecosystems while fostering economic growth. Unlike transition bonds, which fund companies shifting to greener practices, blue bonds exclusively target ocean-related environmental sustainability initiatives.

Key Differences Between Transition Bonds and Blue Bonds

Transition bonds primarily finance projects that help companies reduce carbon emissions and move towards sustainability, whereas blue bonds specifically support marine and ocean conservation efforts. Transition bonds target industries with high environmental impact aiming for gradual improvement, while blue bonds fund initiatives like sustainable fisheries, marine habitat restoration, and pollution control. The key difference lies in their thematic focus: transition bonds emphasize decarbonization pathways across various sectors, and blue bonds concentrate solely on protecting aquatic ecosystems.

Objectives and Impact: Transition Bonds vs Blue Bonds

Transition Bonds finance companies shifting from high-carbon to greener operations, aiming to support measurable emission reductions and accelerate the low-carbon transition across industries. Blue Bonds specifically fund marine and ocean-related conservation projects, targeting sustainable fisheries, marine biodiversity protection, and climate resilience in coastal communities. Both bonds drive sustainable development but differ in focus: Transition Bonds address decarbonization in traditional sectors, while Blue Bonds enhance ocean health and water resource sustainability.

Eligible Projects for Transition and Blue Bonds

Transition bonds finance activities aimed at reducing carbon emissions and supporting companies in high-impact sectors like energy, manufacturing, and transportation to achieve climate goals while maintaining economic viability. Blue bonds specifically fund marine and ocean-based projects that promote sustainable fisheries, marine conservation, pollution reduction, and the development of renewable ocean energy sources. Eligible projects for transition bonds include upgrading energy efficiency, adopting cleaner technologies, and decarbonizing industrial processes, whereas blue bonds focus on preserving marine ecosystems and enhancing ocean health through targeted sustainability initiatives.

Market Growth and Investor Interest

Transition bonds have seen rapid market growth as companies commit to intermediate sustainability goals, reflecting increased investor interest in funding environmental improvements beyond traditional green projects. Blue bonds focus specifically on ocean and marine ecosystem conservation, attracting investors eager to support biodiversity and sustainable fisheries within a niche yet expanding segment. Both bond types illustrate the broader trend of growing investor demand for tailored environmental, social, and governance (ESG) instruments, with transition bonds capturing broader industrial decarbonization efforts and blue bonds driving capital toward blue economy initiatives.

Regulatory Frameworks and Standards

Transition bonds and blue bonds operate under distinct regulatory frameworks and standards tailored to their environmental objectives. Transition bonds adhere to guidelines such as the Climate Transition Finance Handbook by the International Capital Market Association (ICMA), ensuring alignment with companies' credible decarbonization pathways. Blue bonds follow frameworks like the Blue Bond Principles developed by ICMA and the Sustainable Blue Economy Finance Principles, emphasizing marine conservation, ocean health, and sustainable fisheries.

Challenges and Risks in Transition and Blue Bond Markets

Transition bonds face challenges related to defining clear eligibility criteria and verifying companies' genuine commitment to decarbonization, which can lead to greenwashing risks and investor skepticism. Blue bonds encounter risks from uncertain regulatory frameworks, ecological impact assessments, and the difficulty of measuring long-term ocean sustainability outcomes, potentially affecting investor confidence. Both markets must address transparency, standardized metrics, and robust monitoring to mitigate financial risks and enhance credibility for sustainable investment portfolios.

Future Outlook for Transition and Blue Bonds

Transition bonds and blue bonds are poised for significant growth as global investors increasingly prioritize sustainability and environmental responsibility in capital markets. Transition bonds support industries shifting towards lower carbon emissions, aligning with net-zero targets, while blue bonds focus on financing ocean conservation and sustainable marine resources, addressing critical environmental challenges. Future outlook indicates strong demand driven by regulatory support, growing ESG awareness, and the urgent need to fund climate resilience and marine ecosystem preservation.

Transition Bond Infographic

libterm.com

libterm.com