Selling concessions are incentives offered by sellers to attract buyers and facilitate a smoother transaction, often including price reductions, repair credits, or closing cost assistance. These concessions can significantly enhance your purchasing power by reducing upfront expenses and making homeownership more affordable. Explore the rest of this article to learn how selling concessions can benefit your next real estate deal.

Table of Comparison

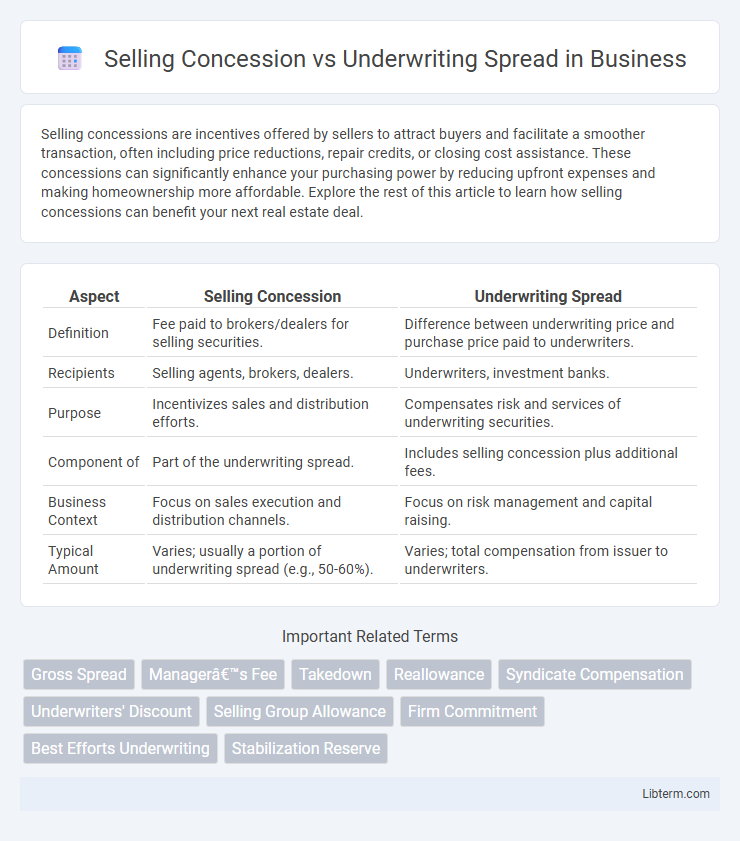

| Aspect | Selling Concession | Underwriting Spread |

|---|---|---|

| Definition | Fee paid to brokers/dealers for selling securities. | Difference between underwriting price and purchase price paid to underwriters. |

| Recipients | Selling agents, brokers, dealers. | Underwriters, investment banks. |

| Purpose | Incentivizes sales and distribution efforts. | Compensates risk and services of underwriting securities. |

| Component of | Part of the underwriting spread. | Includes selling concession plus additional fees. |

| Business Context | Focus on sales execution and distribution channels. | Focus on risk management and capital raising. |

| Typical Amount | Varies; usually a portion of underwriting spread (e.g., 50-60%). | Varies; total compensation from issuer to underwriters. |

Introduction to Selling Concession and Underwriting Spread

Selling concession and underwriting spread are key components in securities underwriting, representing different types of fees earned by underwriters and brokers. The underwriting spread refers to the difference between the price at which underwriters purchase securities from the issuer and the price at which they sell them to the public, covering the underwriter's compensation and risk. Selling concession is a portion of the underwriting spread allocated to brokers or dealers who actively sell the securities to investors, incentivizing distribution efforts in the primary market.

Key Definitions: Selling Concession vs Underwriting Spread

Selling concession refers to the portion of the underwriting spread allocated to broker-dealers as compensation for selling securities to investors, incentivizing brokers to distribute the offering effectively. Underwriting spread denotes the difference between the price at which underwriters purchase securities from the issuer and the price at which these securities are sold to the public, encompassing the total compensation earned by underwriters, including the selling concession, management fee, and underwriting fee. Understanding the distinction between selling concession and underwriting spread is crucial for analyzing the cost structure and fee allocation in securities underwriting transactions.

Role in the Securities Offering Process

Selling concessions represent the portion of the underwriting spread allocated to brokers or dealers who sell securities directly to investors, motivating effective distribution during the offering process. The underwriting spread encompasses the total difference between the public offering price and the amount received by the issuer, covering compensation for the underwriters' risk and services. Understanding the allocation between selling concession and underwriting spread is crucial for issuers and underwriters to balance incentives and costs in the securities offering process.

Components and Calculation Methods

Selling concession represents the portion of the underwriting spread paid to the broker-dealer as compensation for selling the securities, typically calculated as a fixed percentage per share sold. The underwriting spread encompasses the total difference between the price paid by underwriters to the issuer and the public offering price, consisting of selling concession, manager's fee, and underwriting fee. Calculation methods involve subtracting these components from the gross proceeds to determine net proceeds to the issuer while accounting for the different fees allocated among underwriters and selling group members.

Distribution of Fees Among Syndicate Members

Selling concessions refer to the portion of the underwriting spread allocated to brokers or dealers who sell the securities directly to investors, incentivizing them to distribute the issue effectively. Underwriting spread encompasses the total difference between the price paid by underwriters to the issuer and the price at which securities are sold to the public, which includes the underwriting fee, selling concession, and management fee. The distribution of fees among syndicate members varies, with managing underwriters receiving the management fee and part of the spread, while syndicate members earn a selling concession based on their sales volume.

Impact on Issuer and Investor Costs

Selling concession directly affects the issuer's net proceeds by reducing the amount received from the bond sale, as a portion of the underwriting spread is allocated to brokers or dealers who sell the securities. The underwriting spread represents the overall discount between the price paid by investors and the price received by the issuer, impacting both issuer costs and investor yield; a wider spread increases issuer expenses while lowering investor returns. Investors face costs influenced by these components, with selling concessions potentially leading to higher purchase prices and reduced yields, highlighting the balance between issuer fundraising goals and investor demand.

Factors Influencing Spread and Concession Amounts

Selling concession and underwriting spread are influenced by factors such as the issuer's credit quality, market volatility, and deal size, which determine the compensation levels for underwriters and sales agents. Higher risk issuers or volatile market conditions typically result in wider underwriting spreads to compensate underwriters for increased risk and effort. The concession amount varies based on the distribution channel and investment bank agreements, balancing between incentivizing brokers and managing overall deal expenses.

Advantages and Disadvantages for Underwriters

Selling concession provides underwriters with a direct incentive to aggressively market securities, enhancing distribution efficiency and potentially increasing demand stability. However, high selling concessions can reduce the overall underwriting spread, limiting the underwriters' profit margin on each transaction. Conversely, a larger underwriting spread ensures more substantial compensation for underwriters, but may decrease the attractiveness to sellers and investors, potentially complicating the placement of securities.

Regulatory Considerations and Compliance

Selling concessions and underwriting spreads must comply with SEC regulations to ensure transparent fee disclosures and prevent conflicts of interest during securities offerings. The Financial Industry Regulatory Authority (FINRA) mandates clear reporting of compensation to maintain investor protection and uphold fair market practices. Firms must implement rigorous compliance frameworks to accurately allocate and disclose these fees in alignment with the Securities Act of 1933 and related regulatory guidelines.

Industry Best Practices in Managing Spreads and Concessions

Industry best practices in managing selling concessions and underwriting spreads emphasize transparent communication between issuers and underwriters to balance cost efficiency and market appeal. Effective negotiation tactics involve setting concession levels that incentivize distribution without eroding issuer proceeds, while underwriting spreads are calibrated to reflect market risk and syndicate capacity. Advanced analytics and benchmarking against comparable deals support optimized pricing strategies, ensuring competitive yet sustainable financial structuring in equity and debt offerings.

Selling Concession Infographic

libterm.com

libterm.com