Accounts receivable represents the outstanding invoices a company has or the money clients owe for goods or services delivered on credit. Efficient management of accounts receivable is critical for maintaining healthy cash flow and ensuring your business stays liquid. Explore the rest of this article to learn strategies for optimizing your accounts receivable process.

Table of Comparison

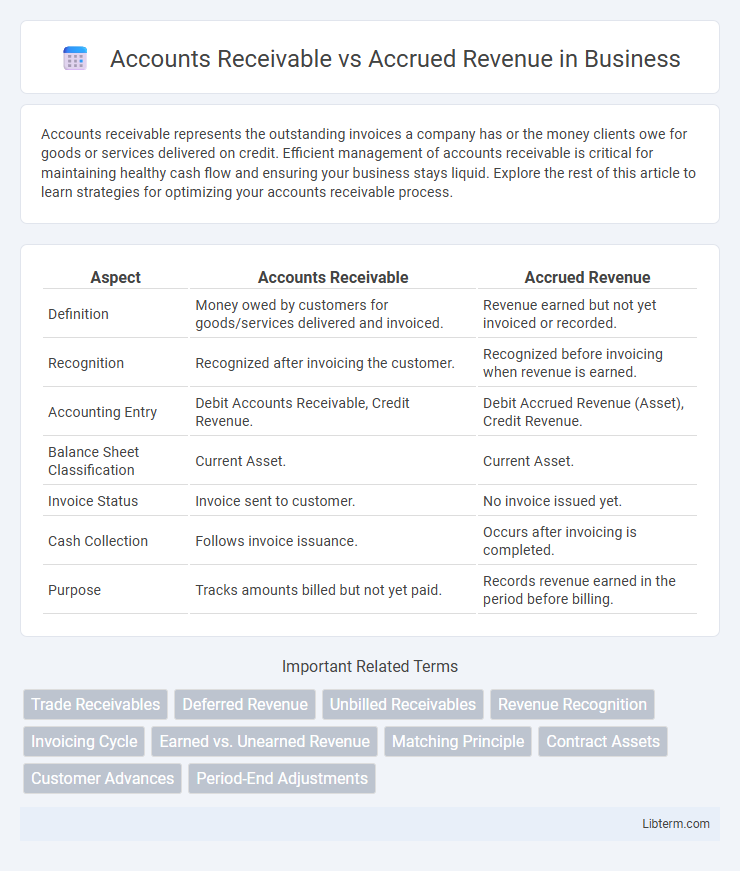

| Aspect | Accounts Receivable | Accrued Revenue |

|---|---|---|

| Definition | Money owed by customers for goods/services delivered and invoiced. | Revenue earned but not yet invoiced or recorded. |

| Recognition | Recognized after invoicing the customer. | Recognized before invoicing when revenue is earned. |

| Accounting Entry | Debit Accounts Receivable, Credit Revenue. | Debit Accrued Revenue (Asset), Credit Revenue. |

| Balance Sheet Classification | Current Asset. | Current Asset. |

| Invoice Status | Invoice sent to customer. | No invoice issued yet. |

| Cash Collection | Follows invoice issuance. | Occurs after invoicing is completed. |

| Purpose | Tracks amounts billed but not yet paid. | Records revenue earned in the period before billing. |

Introduction to Accounts Receivable and Accrued Revenue

Accounts receivable represents the outstanding invoices a company has issued to customers for delivered goods or services, reflecting legally enforceable claims on payment. Accrued revenue, however, accounts for income earned but not yet invoiced or received, typically recorded through adjusting entries under the accrual accounting method. Understanding the distinction enhances accurate financial reporting and cash flow management.

Definitions: Accounts Receivable vs Accrued Revenue

Accounts Receivable refers to the outstanding invoices a company has issued to customers for goods or services delivered but not yet paid. Accrued Revenue represents earnings that have been recognized due to the delivery of goods or services but have not yet been invoiced or received in cash. The key difference lies in timing and documentation: Accounts Receivable involves formal billing, whereas Accrued Revenue is recorded based on earned income before invoicing occurs.

Key Differences Between Accounts Receivable and Accrued Revenue

Accounts receivable represents amounts billed to customers for goods or services already delivered and recorded as invoices, whereas accrued revenue refers to earned income not yet invoiced or received, typically recognized through adjusting journal entries. Key differences include timing of recognition, with accounts receivable recorded upon invoicing and accrued revenue recognized at the end of an accounting period before billing occurs. Accounts receivable is a formal claim documented in the accounting system, while accrued revenue requires estimation and is often reversed once the invoice is issued.

Recognition Timing in Financial Statements

Accounts Receivable represents amounts billed to customers for goods or services already delivered, recognized when an invoice is issued and recorded as an asset on the balance sheet. Accrued Revenue is revenue earned but not yet invoiced, recognized as a receivable through adjusting entries at period-end to comply with the revenue recognition principle. The critical distinction lies in timing: Accounts Receivable reflects formal billing after delivery, whereas Accrued Revenue captures earned income before invoicing in financial statements.

Impact on Cash Flow Management

Accounts Receivable represents billed amounts awaiting payment, directly affecting immediate cash inflows and liquidity management by forecasting expected collections. Accrued Revenue involves earned but unbilled income, impacting cash flow indirectly as it reflects revenue recognition without current cash receipt, requiring careful monitoring to ensure timely invoicing and payment. Effective cash flow management hinges on distinguishing these concepts to optimize working capital and maintain financial stability.

Journal Entries: Accounts Receivable vs Accrued Revenue

Accounts Receivable journal entries debit Accounts Receivable and credit Revenue once the invoice is issued, reflecting earned revenue with customer billing. Accrued Revenue entries debit Accrued Revenue (or Accounts Receivable) and credit Revenue before invoicing, recognizing revenue earned but not yet billed. Differentiating these entries ensures accurate financial reporting and matching revenue to the period in which it is earned.

Real-World Examples and Scenarios

Accounts Receivable represents money owed by customers for goods or services already delivered, such as a retailer invoicing a client after a completed sale, while Accrued Revenue refers to earned income not yet billed, like a consulting firm providing weekly services and recognizing revenue monthly. In real-world scenarios, a software company might record Accounts Receivable upon sending invoices for subscription renewals, whereas it records Accrued Revenue when delivering services at month-end but invoices clients next quarter. Properly distinguishing between these ensures accurate financial reporting, reflecting timely revenue recognition according to accounting principles like GAAP or IFRS.

Implications for Financial Reporting and Analysis

Accounts Receivable represents amounts billed to customers for goods or services delivered, directly impacting cash flow projections and balance sheet liquidity analysis. Accrued Revenue refers to earned income not yet invoiced, affecting revenue recognition timing and requiring careful adjustment in financial statements to ensure compliance with accrual accounting principles. Accurate differentiation between these accounts ensures precise matching of revenues and expenses, enhancing the reliability of financial reporting and the effectiveness of ratio analysis such as receivables turnover and earnings quality metrics.

Common Challenges and Best Practices

Accounts Receivable often faces challenges with timely collection and accurate invoicing, while Accrued Revenue struggles with precise revenue recognition and estimation. Implementing automated accounting systems improves tracking and reduces errors in both areas, and regular reconciliation ensures financial statements accurately reflect outstanding receivables and earned, but unbilled, revenues. Clear communication between sales, billing, and finance teams enhances accuracy and minimizes disputes, optimizing cash flow management.

Conclusion: Choosing the Right Approach for Your Business

Selecting between accounts receivable and accrued revenue depends on the specific timing and recognition of income within your business model. Accounts receivable records payments after invoicing customers, ideal for businesses with immediate billing cycles, while accrued revenue recognizes earned income before invoicing, suited for companies with ongoing services or long-term contracts. Accurately categorizing these ensures precise financial reporting and better cash flow management aligned with your company's operational practices.

Accounts Receivable Infographic

libterm.com

libterm.com