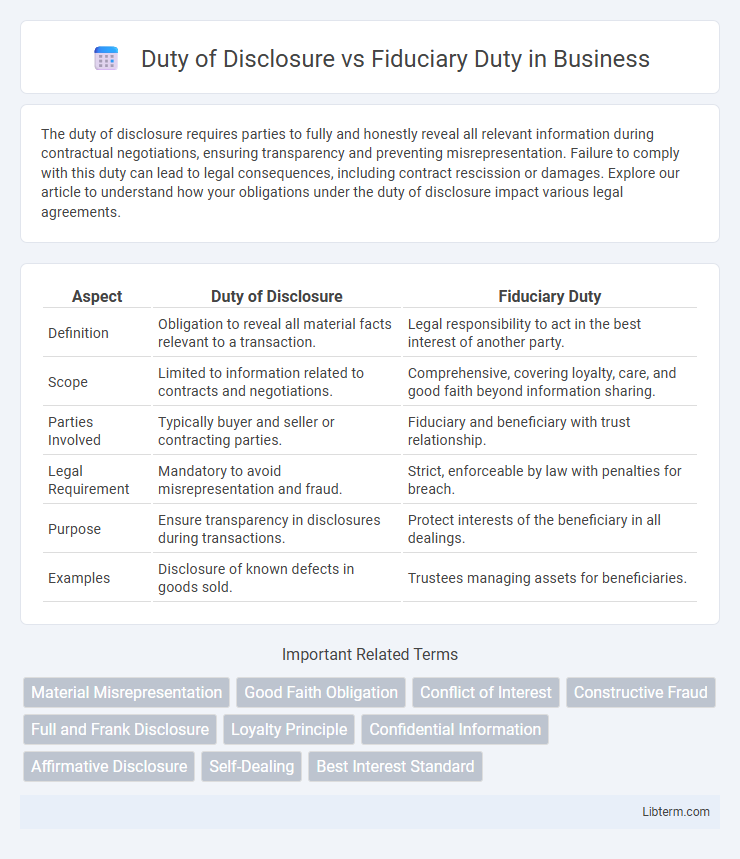

The duty of disclosure requires parties to fully and honestly reveal all relevant information during contractual negotiations, ensuring transparency and preventing misrepresentation. Failure to comply with this duty can lead to legal consequences, including contract rescission or damages. Explore our article to understand how your obligations under the duty of disclosure impact various legal agreements.

Table of Comparison

| Aspect | Duty of Disclosure | Fiduciary Duty |

|---|---|---|

| Definition | Obligation to reveal all material facts relevant to a transaction. | Legal responsibility to act in the best interest of another party. |

| Scope | Limited to information related to contracts and negotiations. | Comprehensive, covering loyalty, care, and good faith beyond information sharing. |

| Parties Involved | Typically buyer and seller or contracting parties. | Fiduciary and beneficiary with trust relationship. |

| Legal Requirement | Mandatory to avoid misrepresentation and fraud. | Strict, enforceable by law with penalties for breach. |

| Purpose | Ensure transparency in disclosures during transactions. | Protect interests of the beneficiary in all dealings. |

| Examples | Disclosure of known defects in goods sold. | Trustees managing assets for beneficiaries. |

Introduction to Duty of Disclosure and Fiduciary Duty

Duty of Disclosure requires parties to reveal all material facts relevant to a transaction, ensuring transparency and fairness in contractual dealings. Fiduciary Duty imposes a legal obligation on one party to act in the best interest of another, prioritizing loyalty and trust over personal gain. Both duties play critical roles in maintaining ethical standards in legal, financial, and corporate environments.

Defining Duty of Disclosure

Duty of Disclosure requires parties in a transaction to reveal all material facts that could influence the other party's decisions, ensuring transparency and preventing fraud. This duty mandates full and honest communication of relevant information, especially in contracts, insurance, and real estate dealings. Unlike Fiduciary Duty, which involves acting in another party's best interest with loyalty and care, Duty of Disclosure centers specifically on the obligation to disclose critical information.

What Constitutes Fiduciary Duty?

Fiduciary duty constitutes a legal obligation where one party, known as the fiduciary, must act in the best interest of another party, the principal, with loyalty, good faith, and trust. This duty encompasses duties of care, confidentiality, and full disclosure, requiring the fiduciary to avoid conflicts of interest and self-dealing. Unlike the duty of disclosure, fiduciary duty imposes a higher standard of ethical conduct and accountability in managing another's assets or interests.

Key Differences Between Duty of Disclosure and Fiduciary Duty

Duty of Disclosure requires parties to reveal all material information relevant to a transaction, ensuring transparency and honesty in dealings. Fiduciary Duty involves a higher standard of care where one party must act in the best interest of another, maintaining loyalty, confidentiality, and avoiding conflicts of interest. The key difference lies in the scope: Duty of Disclosure centers on providing necessary information, while Fiduciary Duty encompasses a broad obligation to prioritize the beneficiary's interests above all else.

Legal Foundations of Both Duties

The Duty of Disclosure requires parties to reveal material facts relevant to a contract or transaction, grounded in principles of good faith and fair dealing under contract law. Fiduciary Duty, rooted in equity law, mandates trustees, agents, or corporate officers to act with loyalty and care, prioritizing the beneficiary's or principal's interests above their own. Both duties serve vital roles in promoting transparency and trust, with Disclosure emphasizing information sharing and Fiduciary Duty enforcing ethical conduct and prudent management.

Examples of Duty of Disclosure in Practice

Duty of disclosure requires parties to reveal all material facts relevant to a transaction, such as a seller informing a buyer about known property defects in real estate deals. In insurance contracts, applicants must disclose pre-existing conditions to avoid policy voidance. Unlike fiduciary duty, which demands loyalty and acting in another's best interest, duty of disclosure primarily centers on transparency and honesty during negotiations.

Fiduciary Duty: Real-World Applications

Fiduciary duty requires a legal or ethical relationship of trust between parties, often seen in roles such as trustees, corporate directors, or financial advisors where the fiduciary must act in the best interests of the beneficiary. Real-world applications include managing assets prudently, avoiding conflicts of interest, and ensuring full transparency to protect the beneficiary's interests. Unlike the duty of disclosure, which mandates revealing material information, fiduciary duty encompasses a broader obligation to act loyally and with due care in decision-making processes.

Breach of Duty: Consequences and Remedies

Breach of Duty in Duty of Disclosure often results in rescission of contracts, damages, or penalties as consequences, emphasizing the obligation to provide full and honest information in transactions. In contrast, Breach of Fiduciary Duty can lead to more severe remedies such as monetary compensation, account of profits, or equitable compensation due to the high level of trust and loyalty required in fiduciary relationships. Courts impose strict liability in fiduciary breaches to protect beneficiaries, while breaches in disclosure primarily focus on restoring parties to their original positions or penalizing deceit.

Importance in Business and Legal Relationships

Duty of Disclosure requires parties to reveal all relevant information to ensure transparency and prevent fraud in business and legal relationships. Fiduciary Duty imposes a higher standard, obligating one party to act loyally and in the best interest of another, often involving trust and confidence. Both duties are critical for maintaining trust, mitigating risks, and fostering ethical conduct in corporate governance and contractual agreements.

How to Ensure Compliance with Both Duties

Ensuring compliance with both Duty of Disclosure and Fiduciary Duty requires thorough and transparent communication of all material information relevant to stakeholders while prioritizing their best interests. Implement comprehensive internal policies that mandate regular reporting, conflict of interest disclosures, and adherence to regulatory standards such as SEC guidelines for public companies. Utilize training programs and audit mechanisms to monitor, document, and reinforce ethical behavior, legal compliance, and accountability among directors and officers.

Duty of Disclosure Infographic

libterm.com

libterm.com